Onchain Highlights

Supply Shocks and Long-Term Market Behavior

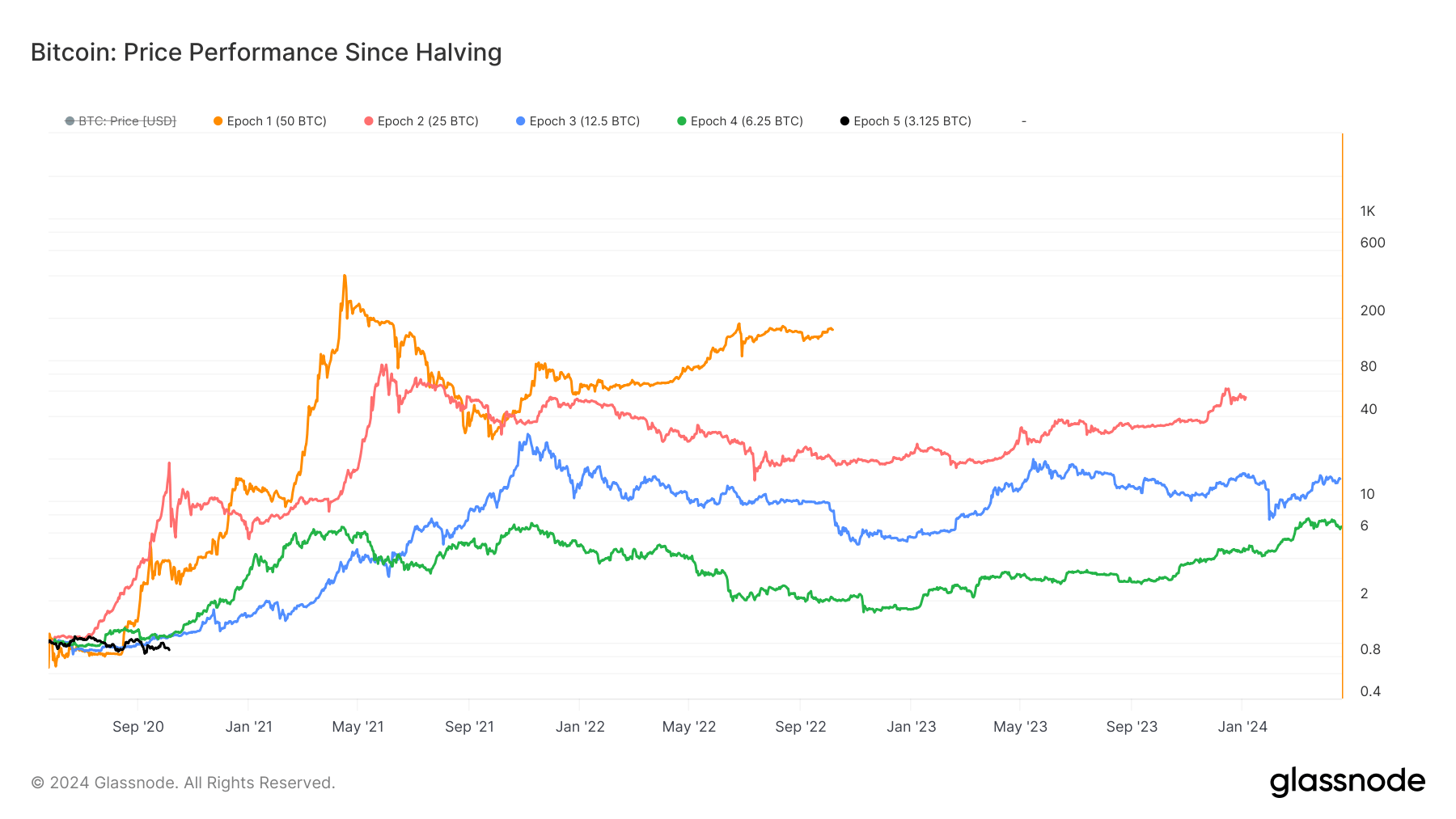

Bitcoin’s price trajectory across its five halving epochs highlights the influence of supply shocks on long-term market behavior.

Epoch 1: Exponential Growth

Epoch 1, where block rewards were 50 BTC, saw exponential growth, setting an early benchmark for the asset’s potential.

Epoch 2 and 3: Significant Rallies

Subsequent epochs, particularly Epoch 2 (25 BTC) and Epoch 3 (12.5 BTC), also experienced significant rallies, peaking at progressively higher levels before entering periods of consolidation.

Epoch 4: Maturing Market

Notably, Epoch 4 (6.25 BTC) displayed more subdued price action, reflecting a maturing market with increased liquidity and institutional participation.

Epoch 5: Stabilizing Prices

As Bitcoin enters Epoch 5 (3.125 BTC), the price appears to be stabilizing within a narrower range compared to previous cycles, suggesting a possible transition to lower volatility.

Historical Patterns and Future Outlook

However, historical patterns indicate that a major price breakout could still be on the horizon as the supply reduction continues to exert upward pressure over time.

The Evolving Nature of Bitcoin’s Market Responses

The comparison of these epochs highlights the evolving nature of Bitcoin’s market responses to its programmed scarcity.

Conclusion

The analysis of Bitcoin’s price performance since halving cycles provides valuable insights into the impact of supply shocks on long-term market behavior. As the asset continues to evolve, it is essential to monitor and understand these trends to make informed investment decisions.

FAQs

Q: What is the significance of the halving cycles in Bitcoin’s price performance?

A: The halving cycles in Bitcoin’s block reward structure have a significant impact on the asset’s price performance, as they reduce the supply of new coins entering the market, leading to upward pressure on prices.

Q: How have previous halving cycles affected Bitcoin’s price?

A: Previous halving cycles have resulted in significant rallies in Bitcoin’s price, with each cycle peaking at progressively higher levels before entering periods of consolidation.

Q: What is the current state of Bitcoin’s market?

A: As Bitcoin enters Epoch 5, the price appears to be stabilizing within a narrower range compared to previous cycles, suggesting a possible transition to lower volatility.

Q: What is the outlook for Bitcoin’s price in the future?

A: Historical patterns indicate that a major price breakout could still be on the horizon as the supply reduction continues to exert upward pressure over time.

Q: How does the comparison of halving cycles provide insights into Bitcoin’s market responses?

A: The comparison of halving cycles highlights the evolving nature of Bitcoin’s market responses to its programmed scarcity, providing valuable insights into the impact of supply shocks on long-term market behavior.