Breakthrough Year for Crypto

2024: A Year of Milestones

2024 was a transformative year for crypto, with the launch of BTC and ETH ETFs, BlackRock’s pioneering efforts in bitcoin adoption, and the election of a pro-crypto president. Additionally, BTC broke its 15-year all-time high. While 2024 was a significant year, the inflection point for crypto still awaits.

Three Predictions for 2025

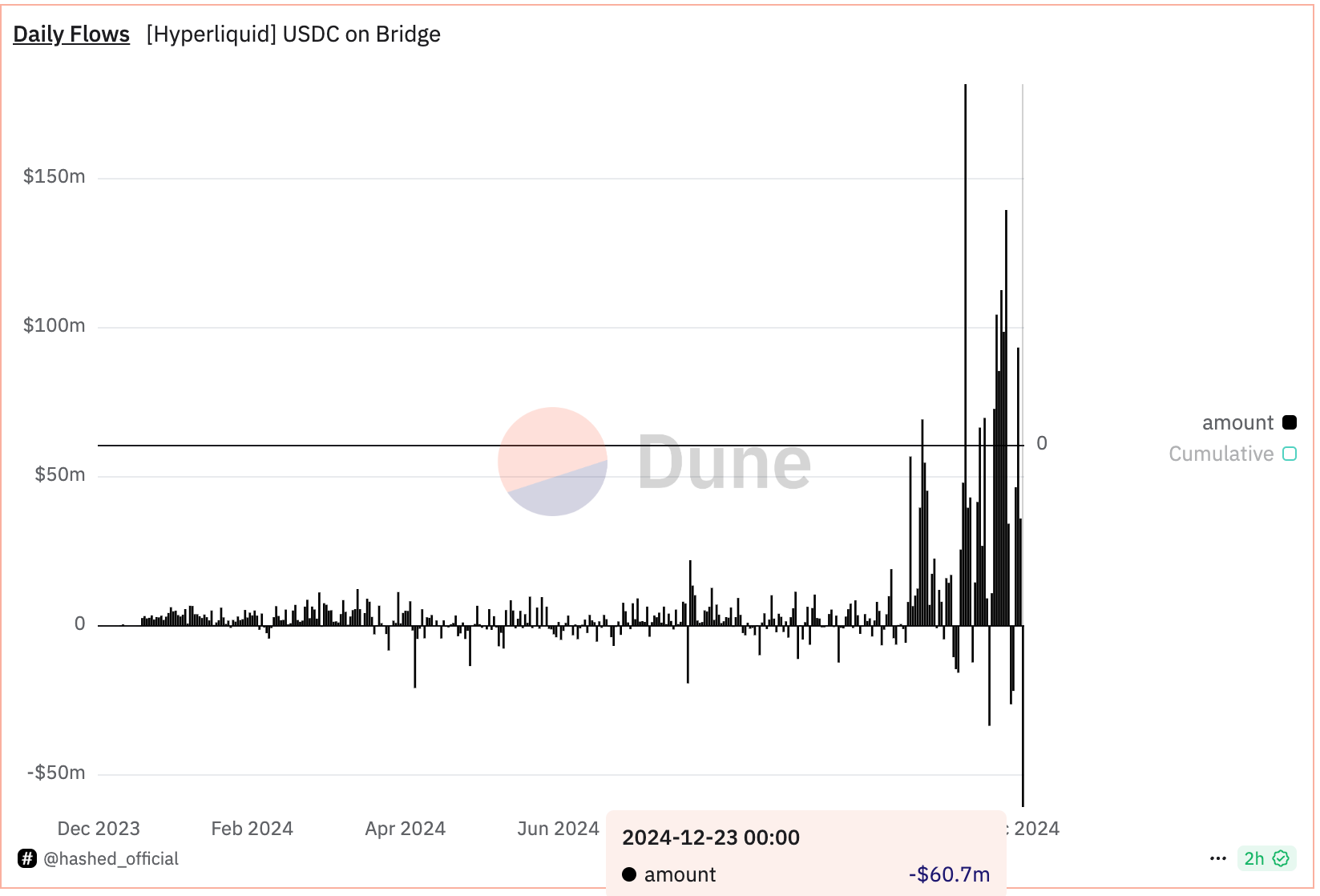

1. DeFi Skyrocketing

DeFi is evolving, with a growing range of products, similar to traditional finance. We’ve already seen the adoption of products like Pendle, Ethena, EtherFi, and Lombard. In 2025, DeFi usage is expected to surge, driven by the adoption of products such as options, swaps, and derivatives like the interest rate swap market, which has a market size of $465.9 trillion in traditional finance. New institutional players are entering the crypto ecosystem, leading to the emergence of a new category: on-chain finance. Securitize and BlackRock are among the companies pushing the frontier in this area.

2. Stablecoins as the Killer Use Case

Stablecoins are poised to become the digital backbone of the global financial system. Tether, the most profitable crypto company, generated $5.2 billion in profit in H1 2024, surpassing BlackRock. The political landscape is shifting in favor of stablecoins, with Operation Choke Point 2.0 coming to an end. This shift is expected to pave the way for major banks and payment companies like Visa and Mastercard to expand their efforts in the sector. The acquisition of stablecoin platform Bridge by Stripe for $1.1 billion (the largest acquisition in crypto history) and rumors of Revolut launching its stablecoin further support this trend.

3. The Race for Retail Adoption

ETFs will be key drivers for new capital entering crypto. BTC ETFs are now available, and Ethereum ETFs are expected to follow. The success of SOL’s growth over the past year has also led to the possibility of a SOL ETF in the first half of 2025 or later. Additionally, major Web3 social platforms are competing with the LensChain mainnet launch and Farcaster’s further expansion. As the pie grows bigger, we can expect to see the emergence of the "Twitter/X and Facebook of crypto" platforms.

Bonus Prediction: MiCA Will Power Crypto Expansion in Europe

Crypto regulations provide the foundation for new projects. They establish clear rules and guidelines for organizational structure. MiCA (Markets in Crypto-Assets Regulation) aims to do just that, with the goal of increasing the importance of EUR-related assets. This could potentially bridge the gap between crypto innovation in the U.S. and Europe.

Conclusion

While 2024 was a significant year for crypto, the inflection point for crypto still awaits. With DeFi expected to surge, stablecoins poised to become the digital backbone of the global financial system, and the race for retail adoption underway, 2025 is shaping up to be an exciting year for crypto.

FAQs

Q: What is the significance of DeFi’s growth?

A: DeFi’s growth is significant because it is expected to drive the adoption of new products and services in the crypto space, similar to traditional finance.

Q: What is the role of stablecoins in the global financial system?

A: Stablecoins are expected to become the digital backbone of the global financial system, providing a stable store of value and facilitating cross-border transactions.

Q: What is the impact of MiCA on crypto expansion in Europe?

A: MiCA aims to increase the importance of EUR-related assets, potentially bridging the gap between crypto innovation in the U.S. and Europe.