Bitcoin’s Long-Term Trajectory Remains Strong Despite Recent Pullback

Market Reaction to Federal Reserve’s Rate Cut

Bitcoin’s price experienced a sharp pullback following the US Federal Reserve’s recent rate cut, but market experts like Bitwise CIO Matt Hougan remain optimistic about the asset’s long-term trajectory.

On December 18, the Federal Reserve announced a 25-basis-point rate cut, scaling back its outlook for 2024 to two cuts instead of the previously expected four.

Also, and perhaps more significantly for Bitcoin, Chair Jerome Powell added that the Fed cannot hold BTC under current regulations while responding to inquiries about President-elect Donald Trump’s strategic reserve plans.

This triggered significant market reactions, with Bitcoin’s price falling to as low as $98,839 before stabilizing at $101,586 earlier today. Similarly, other top digital assets like Ethereum, XRP, and Solana also recorded losses of around 5%, 5.5%, and 3%, respectively.

Market Liquidation and Trader Losses

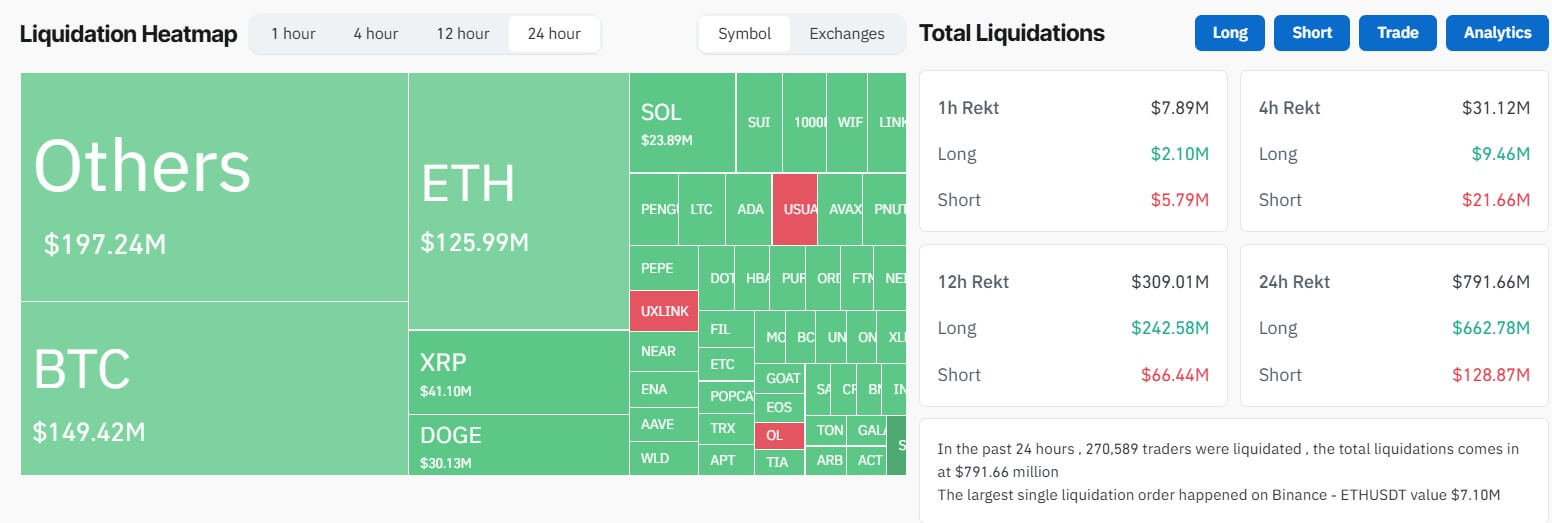

Data from CoinGlass shows that this red market performance led to around $800 million in liquidation, impacting more than 270,000 traders. Traders speculating on upward price movement suffered the most losses, losing $662 million during the last 24 hours.

Traditional Markets and Global Economic Trends

Beyond crypto, traditional markets like the S&P 500 and the Russell 2000 Index experienced 3% and 4.4% declines, respectively.

Bitcoin’s Long-Term Trajectory

Despite this pullback, Hougan reassured investors that Bitcoin’s fundamentals remain strong.

The Bitwise CIO explained that Bitcoin’s recent resilience stems from internal crypto-specific factors, such as growing institutional adoption, pro-crypto shifts in US policy, and government and corporate Bitcoin purchases.

He also highlighted significant blockchain advancements and increasing ETF flows as additional drivers of market strength.

Moreover, Bitcoin’s technical indicators remain favorable, with its 10-day exponential moving average ($102,000) still above the 20-day exponential moving average ($99,000). Hougan views this as a bullish signal, reinforcing his belief that the current dip is a short-term fluctuation rather than the end of the ongoing bull market.

He concluded:

“Crypto’s in a multi-year bull market. 50bps of projected rate cuts won’t change that.”

Conclusion

While the recent market pullback may have caused some short-term volatility, Bitcoin’s long-term trajectory remains strong. As Hougan emphasized, the asset’s fundamentals are supported by growing institutional adoption, pro-crypto shifts in US policy, and government and corporate Bitcoin purchases. As the crypto space continues to evolve, it’s likely that Bitcoin will remain a key player in the global financial landscape.

FAQs

Q: What triggered the recent market pullback?

A: The US Federal Reserve’s rate cut and Chair Jerome Powell’s comments about the Fed’s inability to hold BTC under current regulations.

Q: How did other digital assets perform during the market pullback?

A: Other top digital assets like Ethereum, XRP, and Solana recorded losses of around 5%, 5.5%, and 3%, respectively.

Q: What was the impact of the market pullback on traders?

A: Traders speculating on upward price movement suffered the most losses, losing $662 million during the last 24 hours.

Q: What are the implications of the Federal Reserve’s rate cut for Bitcoin?

A: Hougan believes that the rate cut will not change the overall trajectory of the crypto market, which is expected to continue its multi-year upward trend.