Bitcoin Price Slumps 13% as Long-Term Holders Sell

Long-Term Holders Contribute to Price Decline

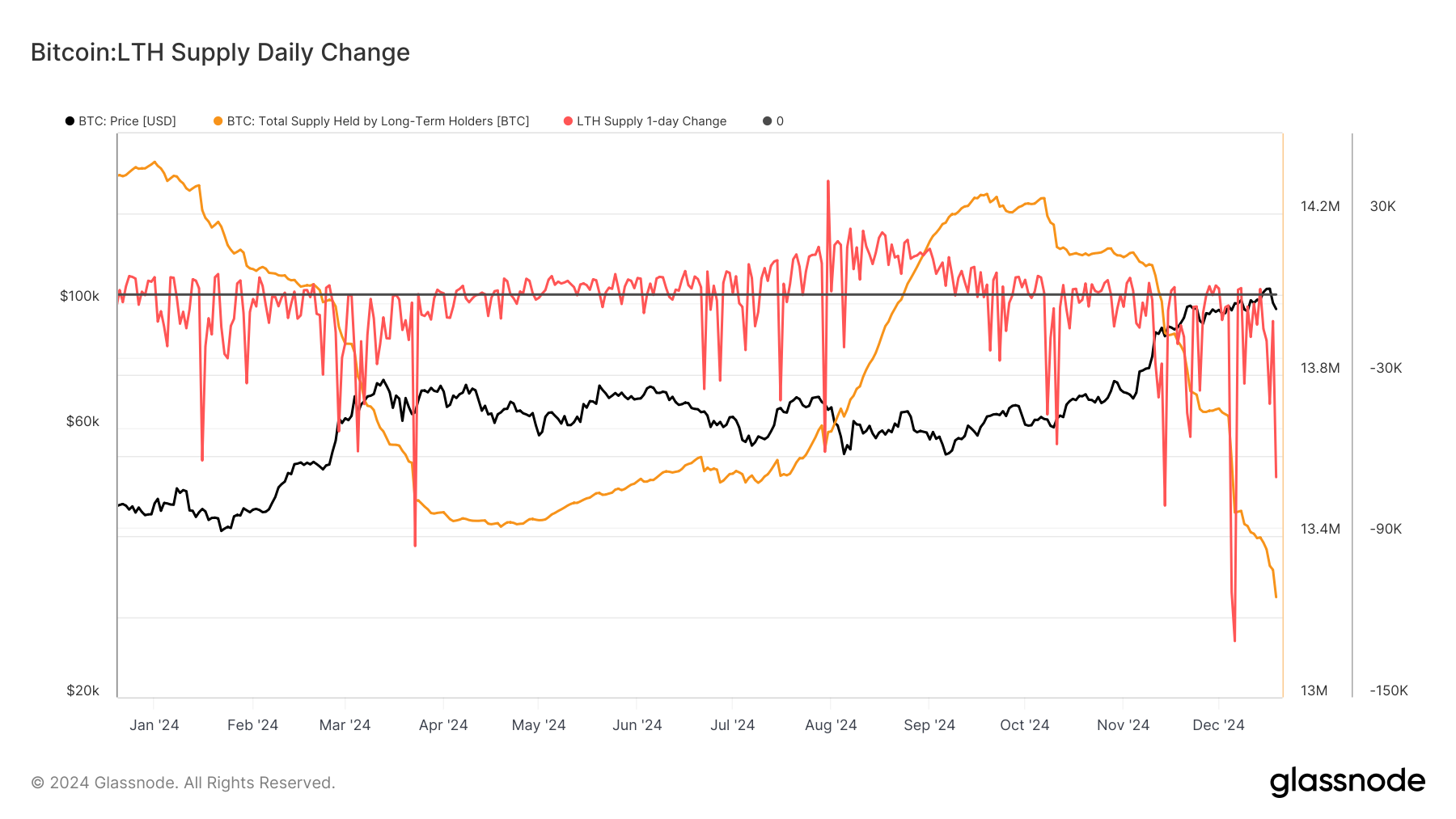

The largest cryptocurrency by market capitalization, Bitcoin (BTC), has experienced a 13% decline in its price, with the majority of the selling pressure originating from long-term holders (LTHs). According to Glassnode, LTHs, who hold their bitcoin for at least 155 days, tend to sell into price strength after accumulating bitcoin when prices are depressed.

Selling Pressure Intensifies

Recent data from CoinDesk research reveals that LTHs were already distributing a significant amount of BTC about a week ago, with their pace of selling increasing since then. In the past few days, LTHs have reduced their total holdings to around 13.2 million BTC, down from approximately 14.2 million in mid-September. On Thursday, they sold nearly 70,000 BTC, the fourth-largest one-day sell-off this year, according to Glassnode data.

Short-Term Holders Step In

For every seller, there must be a buyer. In this case, short-term holders (STHs) have accumulated approximately 1.3 million BTC in the same time period, picking up coins from LTHs and more. However, the narrative has shifted, with LTHs looking to sell more than STHs are willing to buy, contributing to the price decline of around $94,500.

Bitcoin Supply Dynamics

There are currently 19.8 million tokens in circulating supply, with another 2.8 million sitting on exchanges. This balance continues to decline, with around 200,000 bitcoin exiting exchanges in the past few months.

The Road Ahead

The recent price decline has sparked concerns about the future of the cryptocurrency. As LTHs continue to sell, STHs may struggle to absorb the supply, potentially leading to further price fluctuations. The trajectory of the market will largely depend on the actions of these two groups.

Conclusion

In conclusion, the recent price decline of Bitcoin can be attributed to the selling pressure from long-term holders. As the market continues to navigate this period of uncertainty, investors should closely monitor the actions of these two groups to better understand the direction of the market.

FAQs

Q: What is the current state of the Bitcoin market?

A: The market is currently experiencing a decline, with the price of Bitcoin falling 13%.

Q: Who is driving the selling pressure in the market?

A: Long-term holders (LTHs) are the primary sellers, with short-term holders (STHs) attempting to absorb the supply.

Q: What is the current supply of Bitcoin?

A: There are 19.8 million tokens in circulating supply, with an additional 2.8 million sitting on exchanges.

Q: How is the supply of Bitcoin changing?

A: The balance of supply is declining, with around 200,000 bitcoin exiting exchanges in the past few months.

Q: What does the future hold for the Bitcoin market?

A: The market’s trajectory will depend on the actions of LTHs and STHs, with the potential for further price fluctuations.