HyperLiquid’s Perpetual Futures Exchange Experiences Significant USDC Outflow Amid Speculation of North Korean Hacking

Threats to Crypto Protocols

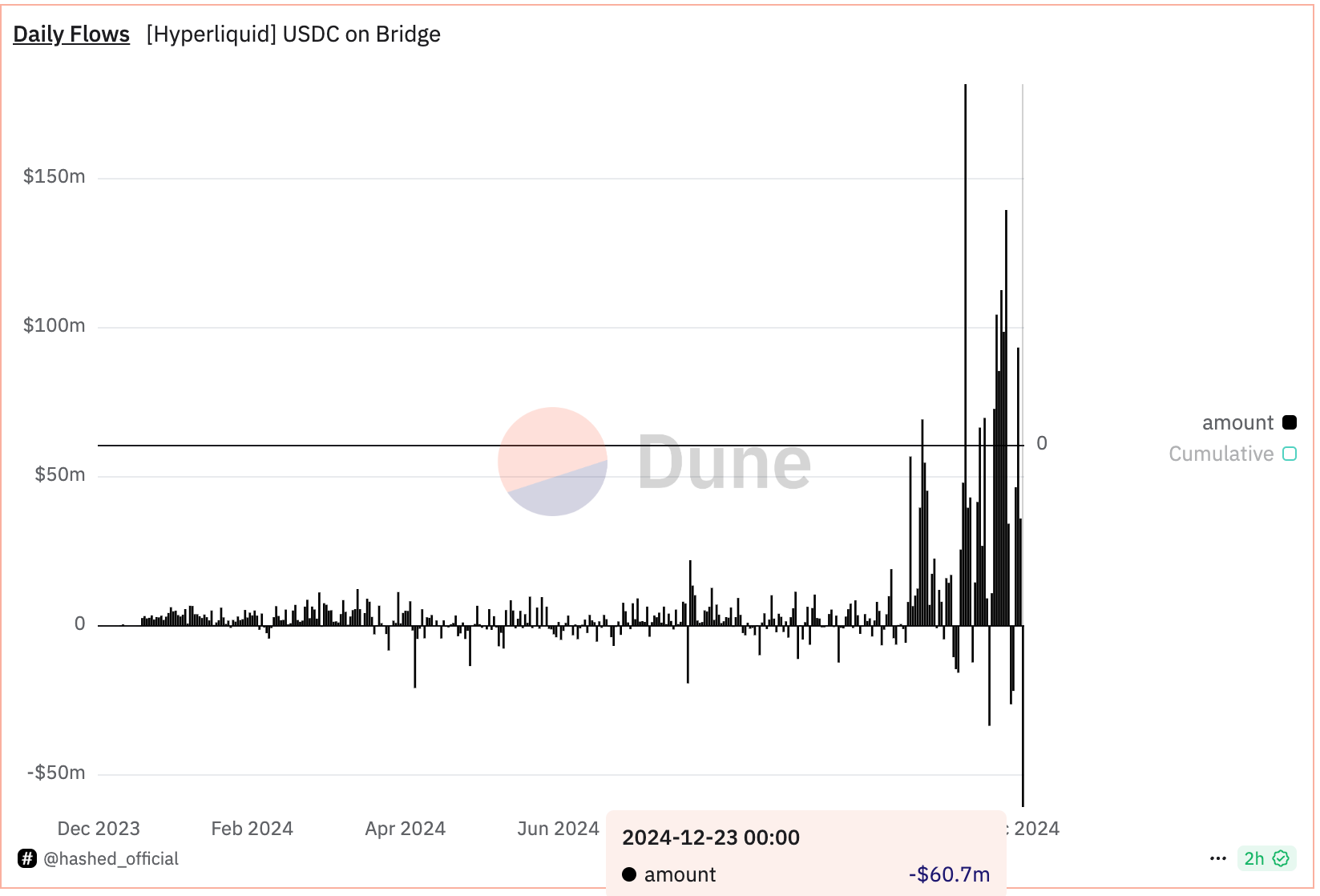

A recent post on X by a pseudonymous observer, Tay, has highlighted the potential involvement of North Korean hackers with the layer-1 blockchain and decentralized exchange for perpetual futures (perps), HyperLiquid. According to Tay, the platform has experienced a notable outflow of the USDC stablecoin, with a record $60 million leaving the exchange by 10:00 UTC on Monday.

USDC Outflow and Its Implications

The USDC stablecoin, the world’s second-largest dollar-pegged stablecoin, is used as collateral on HyperLiquid. The deposit bridge still holds $2.2 billion in USDC. The significant outflow of USDC from the exchange may indicate a lack of confidence in the platform’s security measures, particularly in light of the speculation surrounding North Korean hacking activity.

North Korean Hacking Activity

Tay, known for tracking threats posed by North Korean hackers to crypto protocols, has linked addresses associated with DPRK hackers to losses exceeding $700,000 on HyperLiquid. The transactions suggest that the hackers are familiarizing themselves with the platform’s inner workings, potentially in preparation for a malicious attack.

Tay’s Warning

"DPRK doesn’t trade. DPRK tests," Tay said, emphasizing the potential threat posed by North Korean hackers.

HyperLiquid’s Response

CoinDesk reached out to HyperLiquid for comments on the USDC outflow and potential threat from North Korea. However, no response was received at the time of publication.

Tay’s Offer to Help

Tay claims to have reached out to HyperLiquid two weeks ago, offering assistance in countering the potential threat. "I really want to emphasize that these are the most sophisticated and rapidly evolving of all of the DPRK threat groups. They are very creative and persistent. They also get their hands on 0days (such as the one Chrome patched today," Tay’s message to the platform said.

HyperLiquid’s Dominance in Perpetual Futures Trading

Despite the potential threat, HyperLiquid remains the leading on-chain perpetuals exchange, commanding over 50% of the total on-chain perpetuals trading volume, which tallied $8.6 billion in the past 24 hours. The platform debuted its token, HYPE, on November 29, and since then, it has surged over 600% to $28.6, briefly topping $10 billion in market capitalization. As of writing, HYPE was the 22nd largest digital asset in the world, according to Coingecko.

Conclusion

The recent USDC outflow from HyperLiquid amid speculation of North Korean hacking activity underscores the importance of robust security measures in the cryptocurrency space. As the cryptocurrency market continues to grow, it is crucial that exchanges and platforms prioritize security and transparency to maintain investor trust.

FAQs

Q: What is the purpose of USDC on HyperLiquid?

A: USDC is used as collateral on HyperLiquid.

Q: How much USDC left the exchange in a single day?

A: A record $60 million of USDC left the exchange by 10:00 UTC on Monday.

Q: What is the current market capitalization of HYPE?

A: As of writing, HYPE was the 22nd largest digital asset in the world, with a market capitalization of $10 billion.

Q: What is the total on-chain perpetuals trading volume on HyperLiquid?

A: The platform commands over 50% of the total on-chain perpetuals trading volume, which tallied $8.6 billion in the past 24 hours.