Significant Options Expiry to Shake Up Market

Market Overview

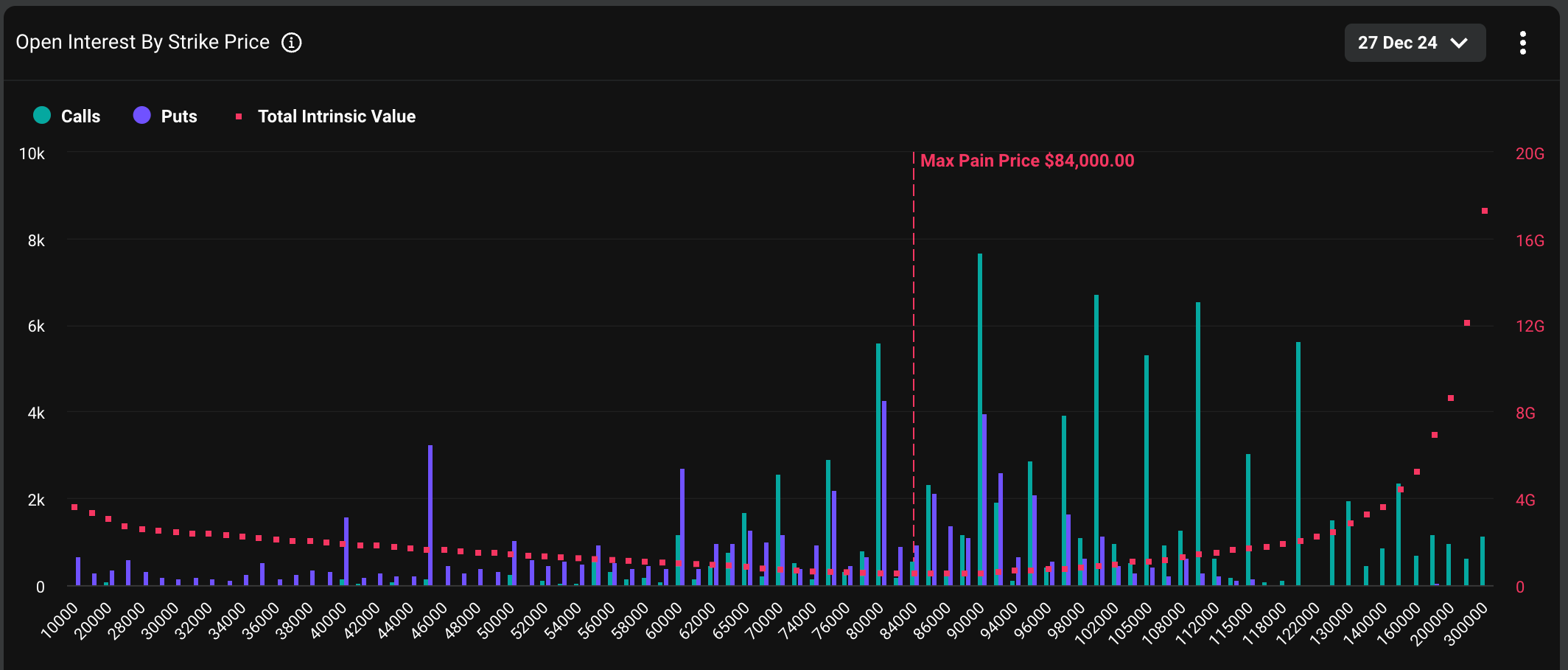

As the year comes to a close, a massive options expiry is set to shake up the market, leaving investors with a mix of uncertainty and excitement. The event, scheduled for Friday at 8:00 UTC, will see 146,000 bitcoin options contracts valued at nearly $14 billion expire on the crypto exchange Deribit, marking the largest expiry event in the platform’s history.

Options Expiry and Its Impact

Options are derivative contracts that give the purchaser the right to buy or sell the underlying asset at a preset price at a later date. A call gives the right to buy, while a put confers the right to sell. As the options expiry approaches, investors are left wondering how the market will react.

Significant Open Interest to Expire ITM

As of writing, Friday’s settlement looks set to see $4 billion worth of BTC options, representing 28% of the total open interest of $14 billion, expire "in the money" (ITM), generating a profit for buyers. These positions may be squared off or rolled over (shifted) to the next expiry, potentially causing market volatility.

Market Sentiment and Outlook

The put-call open interest ratio for Friday’s expiry is 0.69, indicating seven put options are open for every 10 calls outstanding. This suggests that leverage is skewed to the upside. However, the issue is that BTC’s bullish momentum has run out of steam since last Wednesday’s Fed decision, where Chairman Jerome Powell ruled out potential Fed purchases of the cryptocurrency while signaling fewer rate cuts for 2025.

Impact on Market Volatility

The drop in BTC’s price to $95,000 has put traders with leveraged bullish bets at risk of magnified losses. If they decide to exit their positions, it could lead to increased market volatility. "The previously dominant bullish momentum has stalled, leaving the market highly leveraged to the upside. This positioning increases the risk of a rapid snowball effect if a significant downside move occurs," said Deribit’s CEO, Luuk Strijers.

Directional Uncertainty Lingers

Key options-based metrics show a noticeable lack of clarity in the market regarding potential price movements as the record expiry nears. "The much-anticipated annual expiry is poised to conclude a remarkable year for the bulls. However, directional uncertainty lingers, highlighted by heightened volatility of volatility (vol-of-vol)," Strijers added.

Volatility of Volatility (Vol-of-Vol)

The volatility of volatility (vol-of-vol) is a measure of how much the volatility or the degree of price turbulence in an asset fluctuates. If an asset’s volatility changes significantly over time, it has a high vol-of-vol. A high vol-of-vol typically means increased sensitivity to news and economic data, leading to rapid changes in asset prices, necessitating aggressive position adjustment and hedging.

Market More Bearish on ETH

The options due for expiry reveal a more bearish outlook for ETH relative to BTC. "Comparing the vol smiles of the [Friday’s] expiration between today and yesterday, we see that BTC’s smile is almost unmoved, while ETH’s implied vol of calls has dropped significantly," said Andrew Melville, research analyst at Block Scholes.

Conclusion

The upcoming options expiry is set to be a significant event in the market, with over $14 billion in BTC options contracts set to expire. The uncertainty surrounding the event has left investors with a mix of excitement and trepidation. As the market prepares for the event, investors are left wondering how the price of BTC and ETH will react.

FAQs

Q: What is the significance of the options expiry?

A: The options expiry is the largest in Deribit’s history, with 146,000 BTC options contracts valued at nearly $14 billion set to expire on Friday.

Q: What is the put-call open interest ratio for Friday’s expiry?

A: The put-call open interest ratio is 0.69, indicating seven put options are open for every 10 calls outstanding.

Q: What is the current market sentiment?

A: The market is highly leveraged to the upside, with a put-call open interest ratio of 0.69. However, the recent drop in BTC’s price has put traders with leveraged bullish bets at risk of magnified losses.

Q: What is the impact of the options expiry on market volatility?

A: The event is expected to cause market volatility, with the potential for rapid changes in asset prices if a significant downside move occurs.