U.S. Commodity Futures Trading Commission Pursues Stablecoin-Backed Tokenization Pilot Program

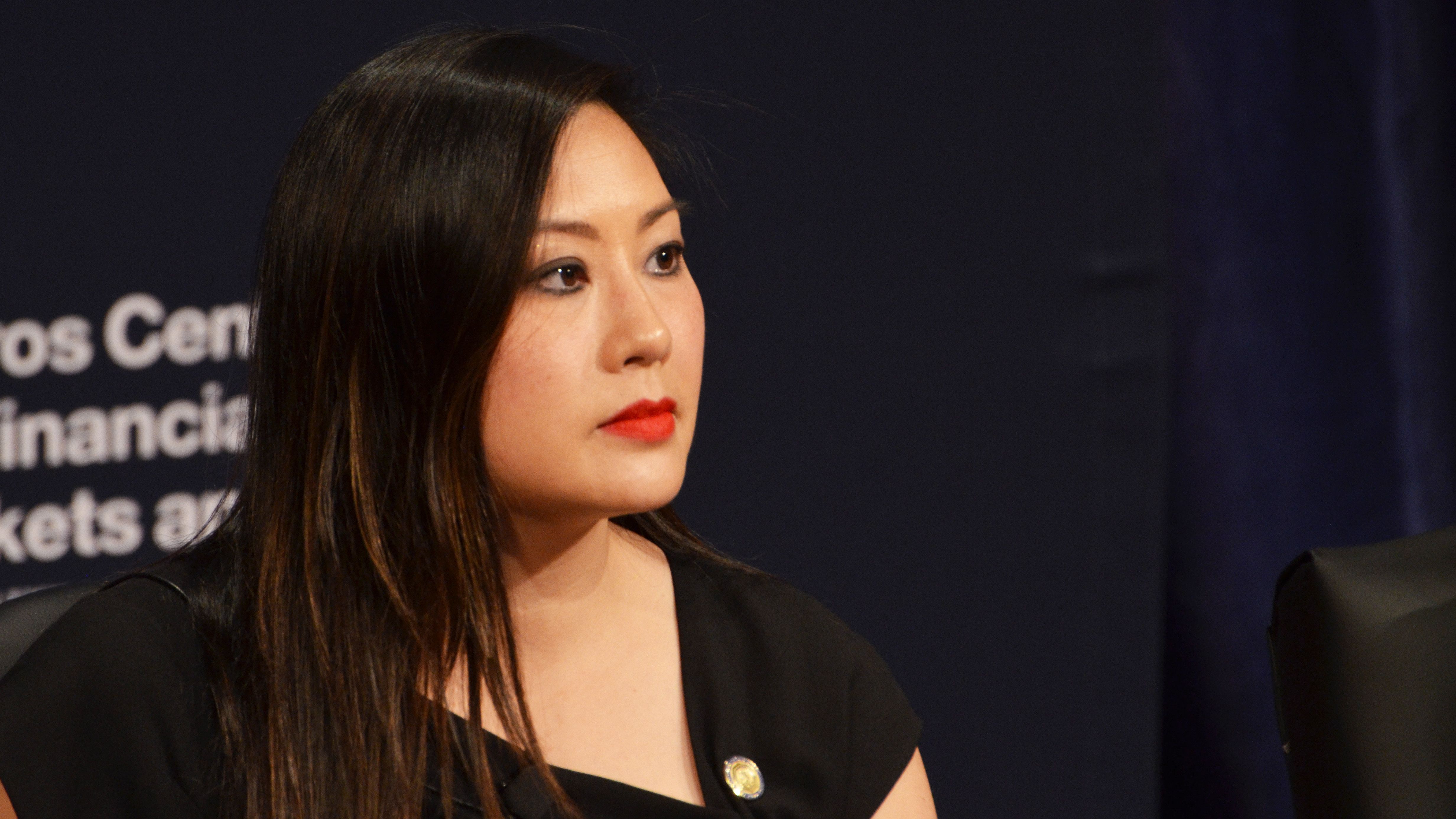

Acting Chairman Caroline Pham Announces Initiative for U.S. Digital Asset Markets

The U.S. Commodity Futures Trading Commission (CFTC) is set to launch a stablecoin-backed tokenization pilot program, with Acting Chairman Caroline Pham announcing the initiative on Friday. The program aims to promote responsible innovation in the digital asset markets, leveraging distributed ledger technology (DLT) to improve operational infrastructure for assets already eligible to serve as regulatory margin.

Pham’s Advisory Committee Recommends Regulatory Sandbox

Pham’s advisory committee, the Global Markets Advisory Committee, had previously suggested the idea for a regulatory sandbox on tokenization in November. The committee’s recommendation anticipated allowing market participants to try out non-traditional collateral, using their existing policies, procedures, practices, and processes to identify, assess, and manage risks.

Acting Chairman Pham’s Statement

“I’m excited to announce this groundbreaking initiative for U.S. digital asset markets,” Acting Chairman Pham said in a statement. “I look forward to engaging with market participants to deliver on the Trump Administration’s promise of ensuring that America leads the way on economic opportunity.”

Key Features of the Pilot Program

The pilot program will focus on the use of non-cash collateral through DLT, with the goal of reducing or eliminating some of the challenges associated with traditional collateral. Market participants will be able to use their existing policies, procedures, practices, and processes to identify, assess, and manage risks.

Forum of Digital Assets CEOs

A date and further details for the forum of digital assets CEOs, which will include the heads of Coinbase, Ripple, Circle, Crypto.com, and other digital assets firms, have not yet been set.

Changes at the CFTC Under Acting Chairman Pham

Acting Chairman Pham has made significant changes at the CFTC since taking over, including a wide-ranging replacement of senior officials at the agency. One personnel matter involving a former human-resource chief sparked an unusually open and detailed response from the CFTC, with the agency arguing that “false allegations” had been made against Pham by “disgruntled individuals” linked to internal misconduct investigations.

Conclusion

The CFTC’s stablecoin-backed tokenization pilot program marks an important step towards promoting responsible innovation in the digital asset markets. The initiative has the potential to improve operational infrastructure for assets already eligible to serve as regulatory margin, while also reducing or eliminating some of the challenges associated with traditional collateral.

FAQs

Q: What is the purpose of the stablecoin-backed tokenization pilot program?

A: The program aims to promote responsible innovation in the digital asset markets, leveraging distributed ledger technology (DLT) to improve operational infrastructure for assets already eligible to serve as regulatory margin.

Q: What is the scope of the pilot program?

A: The program will focus on the use of non-cash collateral through DLT, with the goal of reducing or eliminating some of the challenges associated with traditional collateral.

Q: Who will be participating in the forum of digital assets CEOs?

A: The forum will include the heads of Coinbase, Ripple, Circle, Crypto.com, and other digital assets firms.

Q: What changes has Acting Chairman Pham made at the CFTC?

A: Acting Chairman Pham has made significant changes at the CFTC, including a wide-ranging replacement of senior officials at the agency.