Stablecoin Growth Accelerates, USDC Reaches Record Market Capitalization

Stablecoins: A Key Indicator of Crypto Market Health

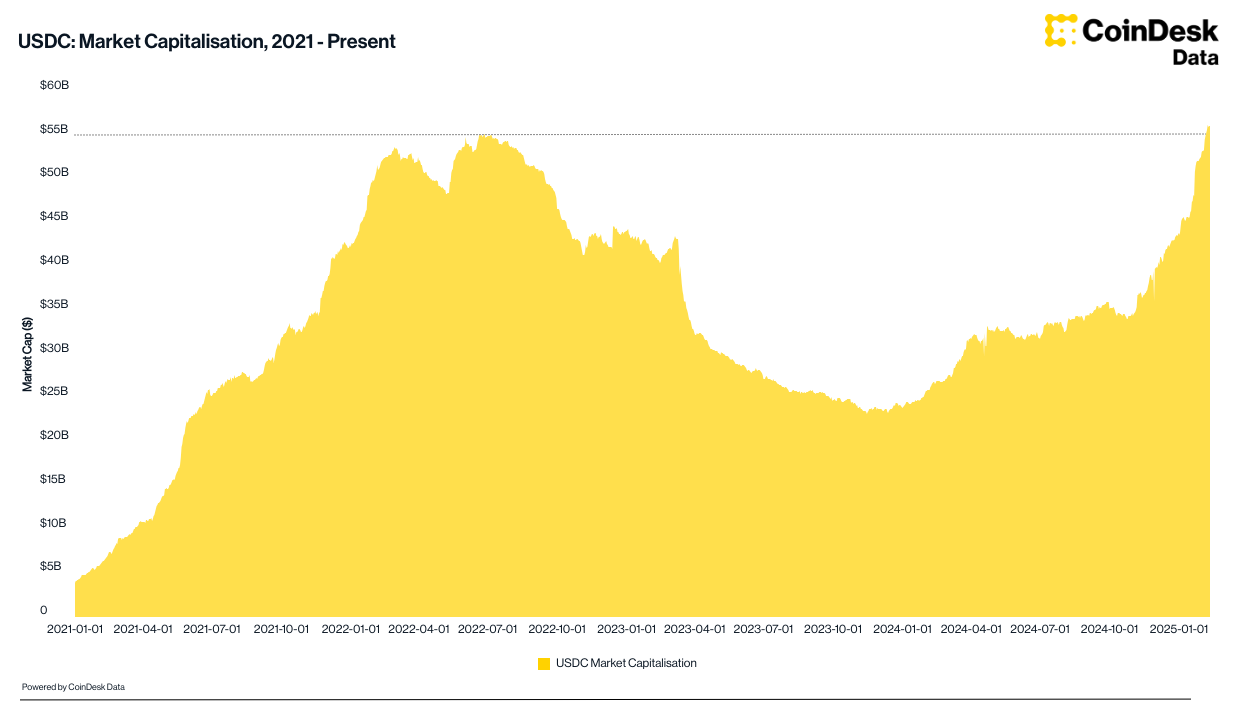

Stablecoins are a type of cryptocurrency with prices anchored to an external asset, predominantly the US dollar. They are widely used for trading on crypto exchanges and serve as a key source of liquidity, making their expanding supply a key indicator of investor demand and overall health of the crypto market. Two of the most popular stablecoins, USDC and USDT, have been gaining traction in recent weeks, with USDC, the second-largest stablecoin, reaching a record market capitalization of over $56 billion.

USDC’s Market Capitalization Surpasses 2022 Peak

According to data from Artemis, USDC has added $10.2 billion to its market capitalization over the past month, driven primarily by rising Solana-based DeFi trading volumes. This growth is more than double the $4.6 billion growth of Tether’s USDT, the largest stablecoin in the market, during the same period. USDT still dominates the stablecoin space with a market capitalization of $142 billion.

The latest growth spurt has enabled USDC to surpass its 2022 peak and fully recover from the 2023 U.S. regional-banking crisis, which dealt a significant blow to the cryptocurrency. At the time, Circle, the issuer of USDC, held part of its stablecoin reserves in bank deposits at Silicon Valley Bank, which suffered a bank run and led to USDC temporarily losing its peg to the U.S. dollar. Many token holders fled to USDT, helping Tether to surpass its 2022 peak market capitalization as early as May 2023.

Stablecoin Growth Accelerates

After a period of tepid action in December and early January, USDT and USDC growth accelerated in the past weeks, data shows. Previous growth spurts, such as between late October and early December and October 2023 to April 2024, coincided with steep rallies in bitcoin (BTC) and altcoin prices.

Combined Market Capitalization of USDT and USDC vs. BTC Price (TradingView)

Conclusion

The acceleration of stablecoin growth, while one of the factors influencing crypto markets, offers a positive signal for the overall market health amid macro headwinds and consolidating prices. As the crypto market continues to evolve, the growth of stablecoins like USDC and USDT will remain a key indicator of investor demand and market sentiment.

FAQs

Q: What is a stablecoin?

A: A stablecoin is a type of cryptocurrency with prices anchored to an external asset, predominantly the US dollar.

Q: What are the most popular stablecoins?

A: USDT (Tether) and USDC (Circle) are the two most popular stablecoins in the market.

Q: What is the current market capitalization of USDC?

A: The current market capitalization of USDC is over $56 billion.

Q: How has USDC’s market capitalization changed over the past month?

A: USDC’s market capitalization has increased by $10.2 billion over the past month, driven primarily by rising Solana-based DeFi trading volumes.