Here is the rewritten content:

Short-Term Bitcoin Holders: A Key Indicator of Market Trends

Accumulation of Bitcoin by Short-Term Holders

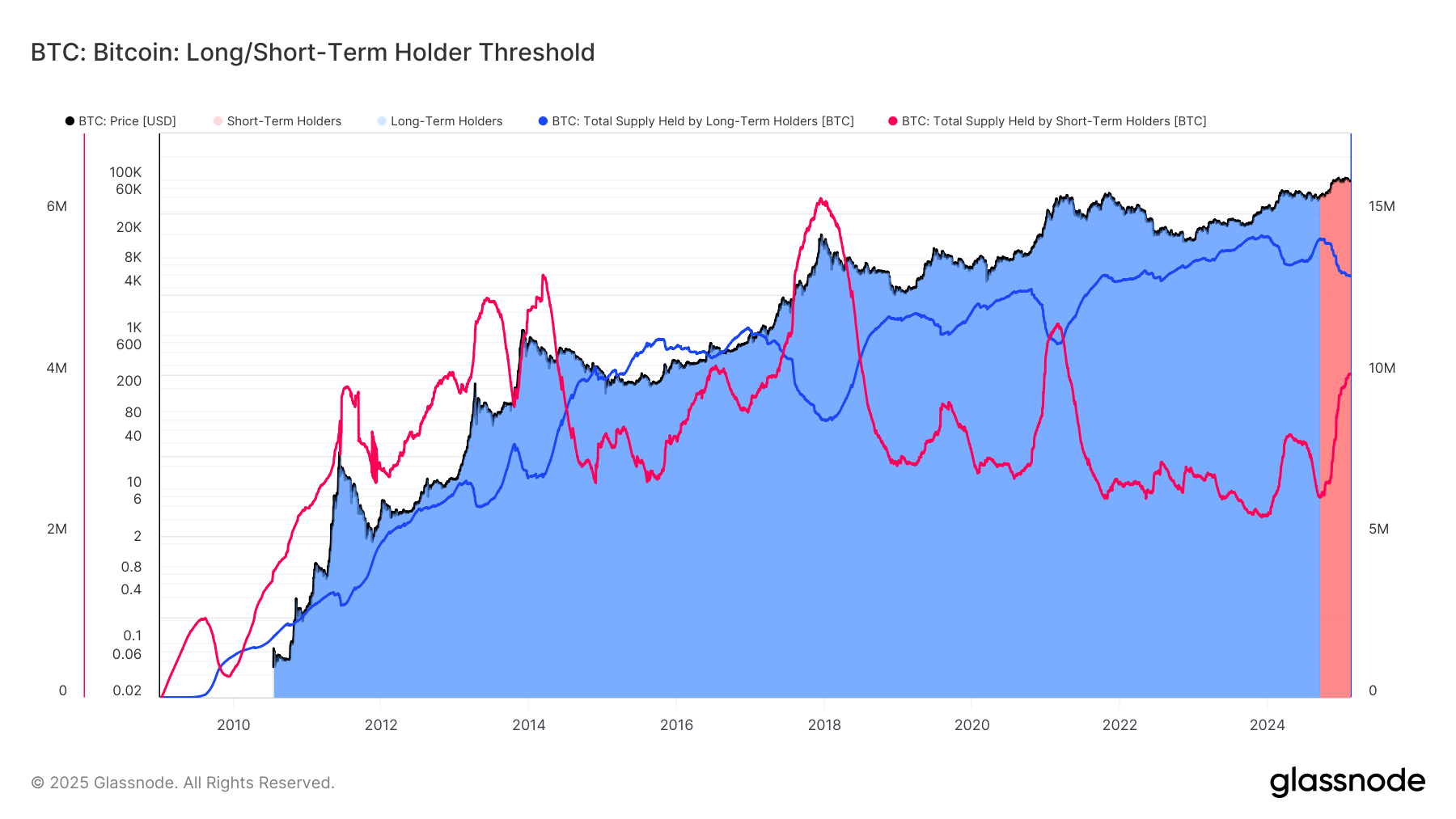

According to Glassnode, short-term bitcoin (STH) holders have added 1.5 million bitcoin (BTC) since September, bringing the total to over 4 million bitcoin. This represents an average accumulation of approximately 300,000 BTC per month. During this period, the price of bitcoin surged from $60,000 to $109,000 before pulling back below $100,000. Glassnode defines STHs as those who have held bitcoin for less than 155 days.

Historical Patterns in Bull Market Cycles

Historically, in previous bull market cycles, bitcoin’s price tends to peak when STHs exhaust their buying momentum, leading to a slowdown in price appreciation. This pattern has played out in 2013, 2017, and 2021. However, STHs held significantly more bitcoin at these cycle peaks: 5 million BTC in 2013, 6.2 million BTC in 2017, and 4.6 million BTC in 2021. Compared to the current 4 million BTC, the current STH holdings are relatively low, suggesting that new market entrants could continue accumulating, meaning the cycle may still have room to grow.

Long-Term Holders: Profits and Distribution

Meanwhile, long-term holders (LTHs) — investors who have held bitcoin for more than 155 days — have distributed 1.2 million BTC during the same period. This indicates significant profit-taking following bitcoin’s strong rally since November. The continued offloading by LTHs has been a major factor in bitcoin’s stalled price action since mid-November.

Conclusion

The accumulation of bitcoin by short-term holders and the distribution of bitcoin by long-term holders are key indicators of market trends. The current STH holdings are relatively low compared to previous bull market cycles, suggesting that new market entrants may continue accumulating, driving the cycle forward. On the other hand, the distribution of bitcoin by LTHs may have contributed to the recent price stagnation. As the market continues to evolve, it will be important to monitor these trends to gain insights into the future direction of the price of bitcoin.

FAQs

Q: What is the current total amount of bitcoin held by short-term holders?

A: According to Glassnode, short-term bitcoin holders currently hold over 4 million bitcoin.

Q: How much bitcoin have long-term holders distributed since September?

A: Long-term holders have distributed 1.2 million bitcoin during the same period.

Q: What is the historical pattern in bull market cycles regarding short-term holders?

A: In previous bull market cycles, bitcoin’s price tends to peak when short-term holders exhaust their buying momentum, leading to a slowdown in price appreciation.

Q: How does the current STH holding compare to previous cycle peaks?

A: The current STH holding of 4 million BTC is relatively low compared to previous cycle peaks, which saw STH holdings of 5 million BTC in 2013, 6.2 million BTC in 2017, and 4.6 million BTC in 2021.