Here is the rewritten content:

Global Markets in a Bearish Mood

By Francisco Rodrigues (All times ET unless indicated otherwise)

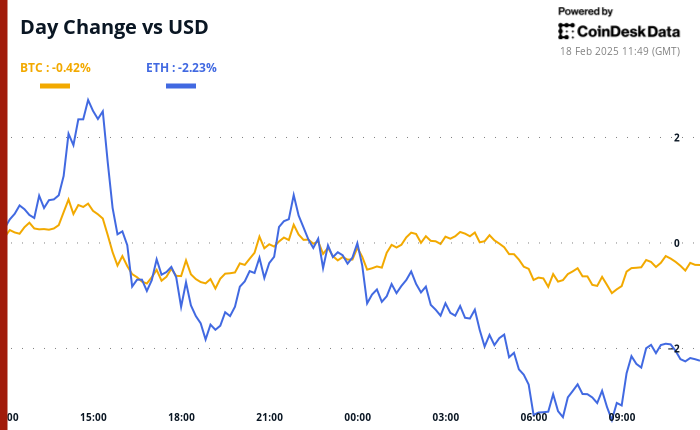

The crypto market is experiencing a bearish sentiment, with the CoinDesk 20 Index down around 2.3% over the past day. The near- to medium-term market movement is heavily influenced by the U.S.-Russia negotiations in Riyadh, which focus on ending the conflict in Ukraine and "normalizing" ties between the countries.

FTX Repayment Program

FTX Digital Markets, the Bahamas-based subsidiary of FTX, is set to start repaying creditors today. The repayment program, valued at around $16 billion, will come in the form of stablecoins. Creditors with claims under $50,000 will receive roughly 119% of their adjudicated claim value, with 9% annual interest accrued since November 2022.

Ethereum’s Pectra Upgrade

Investors have turned their attention to ether, with U.S.-listed spot ETFs offering exposure to the second-largest cryptocurrency by market capitalization seeing a cumulative net inflow of $393 million this month. This comes ahead of Ethereum’s Pectra upgrade, which is entering its testing phase on the Holesky testnet. The Pectra upgrade is expected to bring improvements to scalability and security, and will allow users to pay for gas fees with tokens other than ether.

Individual Investors’ Sentiment

A survey from the American Association of Individual Investors found that bearishness among investors is at a two-year high, according to the Wall Street Journal. This pessimism is often seen as a contrarian indicator, with institutional investors’ risk appetite also dropping this month due to potential trade war fears and reduced interest rate cut expectations.

What to Watch

Crypto:

- The U.S.-Russia negotiations in Riyadh will be closely watched, as they may impact the global markets.

- The FTX repayment program will be closely monitored, with some analysts believing that the amount being repaid is too small to move the needle.

Macro:

- San Francisco Fed President and CEO Mary C. Daly will deliver a speech in Phoenix on February 18 at 10:20 a.m. (live stream link).

- The Fed’s Michael S. Barr, vice chair for supervision, will give a speech titled "Artificial Intelligence in the Economy and Financial Stability" in New York on February 18 at 1:00 p.m. (live stream link).

- The Fed will release minutes of the January 28-29 FOMC meeting on February 19 at 2:00 p.m.

Earnings:

- CoinShares International (CS) will report its financials on February 18, pre-market.

- Semler Scientific (SMLR) will report its financials on February 18, post-market.

- Block (XYZ) will report its financials on February 20, post-market.

- Riot Platforms (RIOT) will report its financials on February 24, post-market.

- Cipher Mining (CIFR) will report its financials on February 25, pre-market.

- MARA Holdings (MARA) will report its financials on February 26, post-market.

Token Events:

- Fast Token (FTN) will unlock 4.66% of its circulating supply worth $78.6 million on February 21.

- Optimism (OP) will unlock 1.92% of its circulating supply worth $34.23 million on February 28.

- Ethena (ENA) will be listed on Arkham on February 18.

- Ronin (RON) will be listed on KuCoin on February 18.

Conferences:

- CoinDesk’s Consensus will take place in Hong Kong on February 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Token Talk

- Donald Trump supporters are set to receive around $50 worth of official TRUMP tokens if they bought merchandise from the websites associated with the U.S. president.

- The token was unveiled just days before Trump took office and have lost more than 70% of their value since then.

Conclusion

The global markets are experiencing a bearish sentiment, driven by the U.S.-Russia negotiations in Riyadh and the FTX repayment program. The crypto market is also seeing a shift in attention to ether, with the Pectra upgrade on the horizon. Individual investors are showing a high level of bearishness, which can be a contrarian indicator. As always, it is essential to stay informed and adapt to the changing market conditions.

FAQs

Q: What is the significance of the U.S.-Russia negotiations in Riyadh?

A: The negotiations are focused on ending the conflict in Ukraine and normalizing ties between the countries, which may impact the global markets.

Q: What is the FTX repayment program, and how does it work?

A: The program is valued at around $16 billion and will be repaid in the form of stablecoins, with creditors with claims under $50,000 receiving roughly 119% of their adjudicated claim value, with 9% annual interest accrued since November 2022.

Q: What is the Pectra upgrade, and how will it impact the Ethereum network?

A: The Pectra upgrade will bring improvements to scalability and security, and will allow users to pay for gas fees with tokens other than ether. It is expected to have a positive impact on the Ethereum network.