Here is the rewritten content in HTML format:

Regulatory Update

Vermont Drops Case Against Coinbase Over Staking Services

Earlier this week, the state of Vermont announced that it would be dropping its case against Coinbase, a major cryptocurrency exchange, over allegations that the company was offering staking services without proper registration. This decision marks a significant victory for Coinbase, which has been fighting legal battles on multiple fronts in recent months.

Coinbase Celebrates the Decision

Coinbase’s Chief Legal Officer, Paul Grewal, welcomed the decision, stating that it was a sign of “progress” in the regulatory landscape for the crypto industry. He emphasized that Coinbase has always maintained that staking services are not securities, and that the company applauds Vermont’s decision to “embrace progress” and provide clarity for its citizens who own digital assets.

Call to Other States to Follow Suit

Grewal went on to urge other states still pursuing similar actions against Coinbase to “take a page from Vermont’s playbook.” He believes that the decision reflects a shift in the regulatory environment for the crypto industry, and that other states should follow suit.

Background on the Legal Dispute

The legal dispute between Coinbase and the state of Vermont dates back to June 2023, when Vermont, along with 10 other states, issued a “show cause order” accusing Coinbase of violating securities laws by offering staking services without proper registration. The 11 states argued that Coinbase’s staking services qualified as unregistered securities, prompting legal action to halt the practice in certain jurisdictions.

History of the Show Cause Order

A “show cause order” is a legal directive requiring a party to explain why a court should not take a specific action, in this case, halting Coinbase’s staking services. The legal actions were launched shortly after the SEC filed its own case against Coinbase, accusing the exchange of operating as an unregistered exchange, broker, and clearing agency.

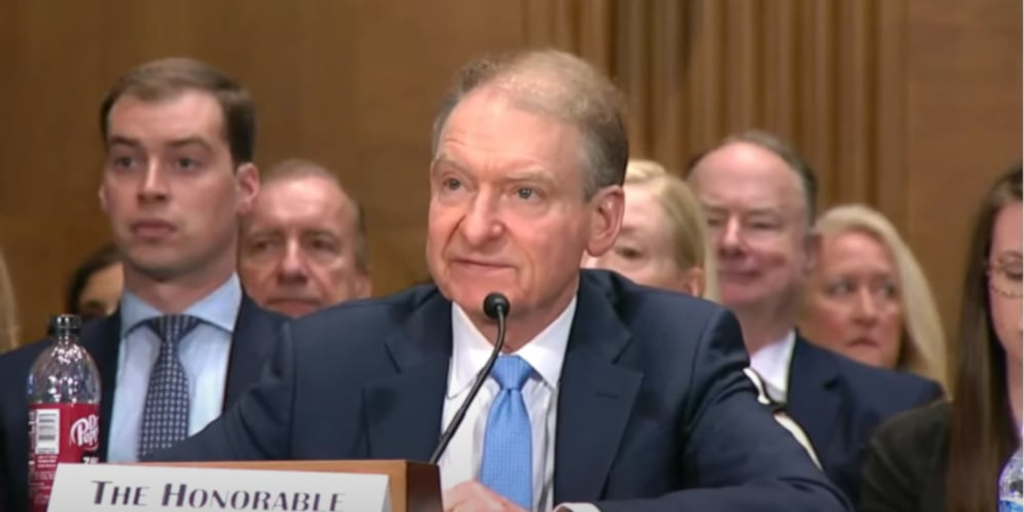

SEC’s Shift in Approach

The SEC, under its new acting chair, Mark Uyeda, has adopted a more lenient stance on enforcement compared to its previous leadership under Gary Gensler. Following the change, the SEC has dropped multiple lawsuits against crypto companies, including Binance, Kraken, and OpenSea, among others.

Conclusion

Coinbase’s victory in the Vermont dispute is a significant milestone in the ongoing regulatory battle for the crypto industry. As the regulatory landscape continues to evolve, it is crucial for companies like Coinbase to work closely with regulatory bodies to ensure that the industry is adequately protected and that investors are confident in the legitimacy of the market. With this decision, Coinbase has demonstrated its commitment to regulatory compliance and has paved the way for other companies to follow suit.

FAQs

What is Staking?

Staking is a process in which cryptocurrency holders lock up their coins in a smart contract, allowing them to validate transactions and earn rewards. It is not considered a security by most regulatory bodies.

What is a Show Cause Order?

A show cause order is a legal directive requiring a party to explain why a court should not take a specific action, in this case, halting Coinbase’s staking services. It is typically issued by regulatory bodies to ensure that companies comply with securities laws and regulations.

What is the SEC’s Role in Regulating Cryptocurrency?

The SEC is the primary regulator of the financial markets in the United States. Its role in regulating cryptocurrency is to ensure that companies comply with securities laws and regulations, and to protect investors from fraudulent activity.

What is the Impact of the Vermont Decision on the Crypto Industry?

The Vermont decision has significant implications for the crypto industry, as it sets a precedent for other states to follow suit. It also sends a clear message that regulatory bodies are willing to work with companies to ensure compliance and provide clarity for investors.

![Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW] Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW]](https://i.ytimg.com/vi/MrMeVsgZJPU/maxresdefault.jpg)