Here is the rewritten content in well-organized HTML format with all tags properly closed:

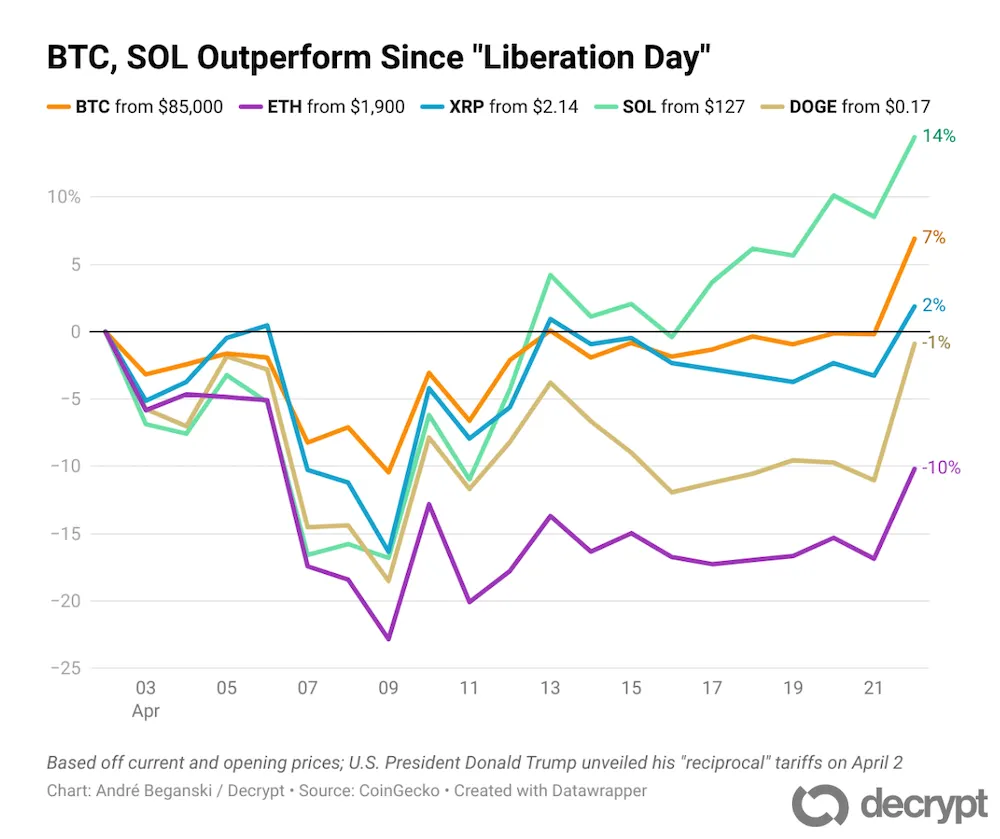

Bitcoin Rallies as Risk-On Assets Surge

Bitcoin was up more than 4% over the past 24 hours, shortly after U.S. equity markets closed, as risk-on assets rallied a day after the U.S. government seemed to avert a shutdown, despite the latest evidence of a brewing recession.

Market Update

The largest cryptocurrency by market capitalization was trading above $84,000, according to crypto data provider CoinGecko. BTC topped $85,000 for the first time in five days earlier in the day before retreating.

Analysis

“Some renewed macro stability is seeing Bitcoin and crypto recover in tandem with other risk assets,” Strahinja Savic, head of data analytics at crypto advisory FRNT Financial, wrote in a Telegram message to Decrypt. “Lower than expected inflation numbers, perception that geopolitical risk is easing, among other factors, are contributing to an easing of macro anxieties and providing a tailwind for Bitcoin.”

Savic noted that some Bitcoin bulls had “certainly used the opportunity to buy the dip…contributing to this recovery.”

Government Shutdown Averted

Bitcoin’s rise came after Senate Minority Leader Chuck Schumer said he would vote for a Republican measure that would fund the government. A shutdown might have further unsettled markets already rocked by mounting evidence that the U.S. economy was headed for stagflation, in which growth slumps while prices rise.

Global Economic Uncertainties

Risk-on assets of all stripes have been swooning for weeks as the country wrestles with the growing prospect of a trade war instigated by U.S. President Trump’s tariffs on its biggest trading partners, controversial government cost-cutting measures, and other macroeconomic uncertainties.

Consumer Sentiment Index

On Friday, the University of Michigan Sentiment Consumer Index, a measure of confidence in the economy, fell to its lowest level since 2022. The same survey showed expectations for inflation also increasing to their highest point in more than two years.

Market Performance

BTC’s rise returned the asset to over its 200-day average just a day after it had fallen below the widely watched measure for the first time in more than six months. The average is a favored indicator among investors to consider Bitcoin’s longer-term prospects.

Other major crypto assets were trading well into positive territory, with Solana and Chainlink recently rising 9% and over 6% from Thursday, respectively, according to CoinGecko. Solana has been buffeted in recent weeks as meme coins favoring the blockchain have plummeted. Ethereum, which has also lost ground in recent weeks, rose more than 3.5%.

Equity Markets

Major equity indexes closed upward, with the tech-heavy Nasdaq and S&P 500 jumping 2.6% and 2.1%, respectively. The S&P had dropped into correction territory the previous day, meaning it had dipped at least 10% from its previous high. Gold, a traditional risk-off asset, spiked above $3,000 for the first time in its history before sinking below the threshold later Friday.

Conclusion

In conclusion, Bitcoin’s rise is a reflection of the current market sentiment, which is driven by a mix of factors, including the averted government shutdown, lower than expected inflation numbers, and easing of geopolitical tensions. While there are still concerns about the global economy, the recent rally in risk-on assets suggests that investors are becoming more optimistic about the future.

FAQs

Q: What caused the recent surge in Bitcoin’s value?

A: The recent surge in Bitcoin’s value is attributed to a combination of factors, including the averted government shutdown, lower than expected inflation numbers, and easing of geopolitical tensions.

Q: What is the current market sentiment like?

A: The current market sentiment is risk-on, with investors becoming more optimistic about the future.

Q: What is the current market performance like?

A: The current market performance is mixed, with some assets, such as Bitcoin and other cryptocurrencies, rising, while others, such as gold, are experiencing a decline.

Q: What is the outlook for the global economy?

A: The outlook for the global economy is uncertain, with concerns about the potential for a trade war and the impact of government policies on the economy.

![Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW] Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW]](https://i.ytimg.com/vi/MrMeVsgZJPU/maxresdefault.jpg)