US Congress Crypto Disclosures: A Comparison of Rep. Byron Donalds’ Bill and Sen. Cynthia Lummis’ Bitcoin Act

Introduction

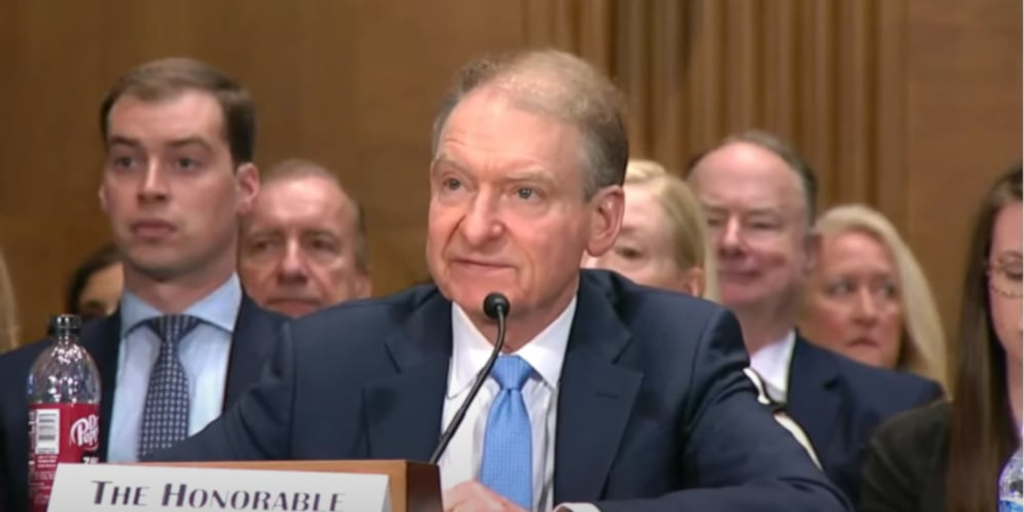

On Friday, Rep. Byron Donalds (R-FL) introduced a bill in the House of Representatives that would enshrine into law President Donald Trump’s proposed Strategic Bitcoin Reserve. This legislation is crucially different from the bill introduced in the Senate earlier this week.

Key Differences between the Two Bills

Unlike the Bitcoin Act put forth by Sen. Cynthia Lummis (R-WY) on Tuesday, which would commit the U.S. government to buying up $80 billion worth of Bitcoin, Donald’s Reserve and Stockpile Act does not call for the purchase of a predetermined sum of BTC. Instead, the proposed legislation would only codify into federal law Trump’s recent executive order that called for the creation of a Bitcoin Strategic Reserve and separate Digital Asset Stockpile.

The Donalds’ Reserve and Stockpile Act

The bill, which is barely more than a page in length, would only codify into federal law Trump’s executive order that called for the creation of a Bitcoin Strategic Reserve and separate Digital Asset Stockpile. The proposed legislation would also authorize the U.S. Treasury Secretary and Commerce Secretary to add more Bitcoin to the federal reserve if such acquisitions were "budget neutral."

Quotes from Rep. Byron Donalds

"For years, the Democrats waged war on crypto. Now is the time for Congressional Republicans to decisively end this war," said Rep. Byron Donalds in a statement.

The White House’s Stance on Bitcoin

In recent days, White House officials have used similar language to color any potential purchases of Bitcoin by the federal government. The White House is estimated to already possess nearly 200,000 BTC from civil and criminal forfeitures.

The Lummis’ Bitcoin Act: Budget Neutrality

It is debatable whether Sen. Lummis’ ambitious Bitcoin Act is budget neutral. The bill would, if signed into law, see the U.S. government purchase tens of billions of dollars worth of BTC, mainly by forcing the Federal Reserve to reevaluate its Nixon-era gold certificates at current prices, and using the proceeds from that mark-up to buy more of the world’s top cryptocurrency.

The White House’s Support for the Lummis’ Bitcoin Act

Earlier this week at a closed-door roundtable, the executive director of the Presidential Working Group on Digital Assets, Bo Hines, told crypto leaders that the Trump administration wants to acquire as much Bitcoin as possible. During the same meeting, Hines told Sen. Lummis that the White House plans to support legislation that puts a Strategic Bitcoin Reserve into law and will apply pressure to make sure it passes Congress, according to meeting attendees.

Conclusion

The proposed legislation by Rep. Byron Donalds could offer the White House a less contentious avenue to codify its Bitcoin reserve into law. It might not compel the U.S. government to begin buying up tens of billions of dollars worth of BTC, but given the current state of discourse over government spending, that simplicity could make the legislation more attractive.

FAQs

Q: What is the main difference between the two bills?

A: The main difference is that the Donalds’ Reserve and Stockpile Act does not call for the purchase of a predetermined sum of BTC, whereas the Lummis’ Bitcoin Act does.

Q: What is the purpose of the Donalds’ Reserve and Stockpile Act?

A: The purpose of the bill is to codify into federal law Trump’s recent executive order that called for the creation of a Bitcoin Strategic Reserve and separate Digital Asset Stockpile.

Q: What is the White House’s stance on Bitcoin?

A: The White House has used similar language to color any potential purchases of Bitcoin by the federal government, stating that it wants to acquire as much Bitcoin as possible.

Q: Is the Lummis’ Bitcoin Act budget neutral?

A: It is debatable whether the Lummis’ Bitcoin Act is budget neutral, as it would require the Federal Reserve to reevaluate its Nixon-era gold certificates at current prices and use the proceeds to buy more of the world’s top cryptocurrency.

![Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW] Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW]](https://i.ytimg.com/vi/MrMeVsgZJPU/maxresdefault.jpg)