SoftBank to Acquire Ampere for $6.5 Billion to Boost AI Infrastructure Investments

SoftBank has announced plans to acquire the chip startup Ampere for $6.5 billion in an all-cash deal that broadens its AI infrastructure investments. For the last eight years, Ampere has been designing high-performance processors tailored for cloud computing, AI workloads, and data centers.

Ampere’s lead investors, private equity firm Carlyle and IT giant Oracle, will sell their shares, which equate to 59.65% and 32.27% stakes in the company, respectively, according to SoftBank. The Japanese telco will retain Ampere as an independent subsidiary based in Santa Clara, once the deal closes in the second half of 2025.

Ampere’s Goal of Expanding Its AI Offerings and Investments

SoftBank has been aiming to bolster its AI offerings for a while. The company was reportedly considering acquiring a minority stake in Ampere in 2021, according to Bloomberg, but no deal materialized.

In 2016, SoftBank acquired Arm Holdings, a semiconductor design company that licenses its blueprints out to tech giants for implementation and manufacturing, for $31 billion. Arm went public in 2023, but SoftBank retains a majority stake. The chip designer recently announced that it may start selling its own CPUs, which will soon turn it into a fierce competitor to the likes of Nvidia and Qualcomm.

SoftBank is an initial equity funder in the Stargate Project, which will contribute $500 billion in total to generative AI infrastructure, like data centers, in the U.S. over four years. It has also partnered with OpenAI on the development of “Cristal intelligence,” a custom enterprise AI service, and recently bought an old Sharp factory in Japan to build an AI data center.

How Ampere Will Help Accelerate SoftBank’s AI Vision

According to SoftBank, Ampere currently employs about 1,000 semiconductor engineers. Recently, the company’s focus has been developing energy-efficient chips for AI workloads, and its CEO Renée James is the former president of Intel.

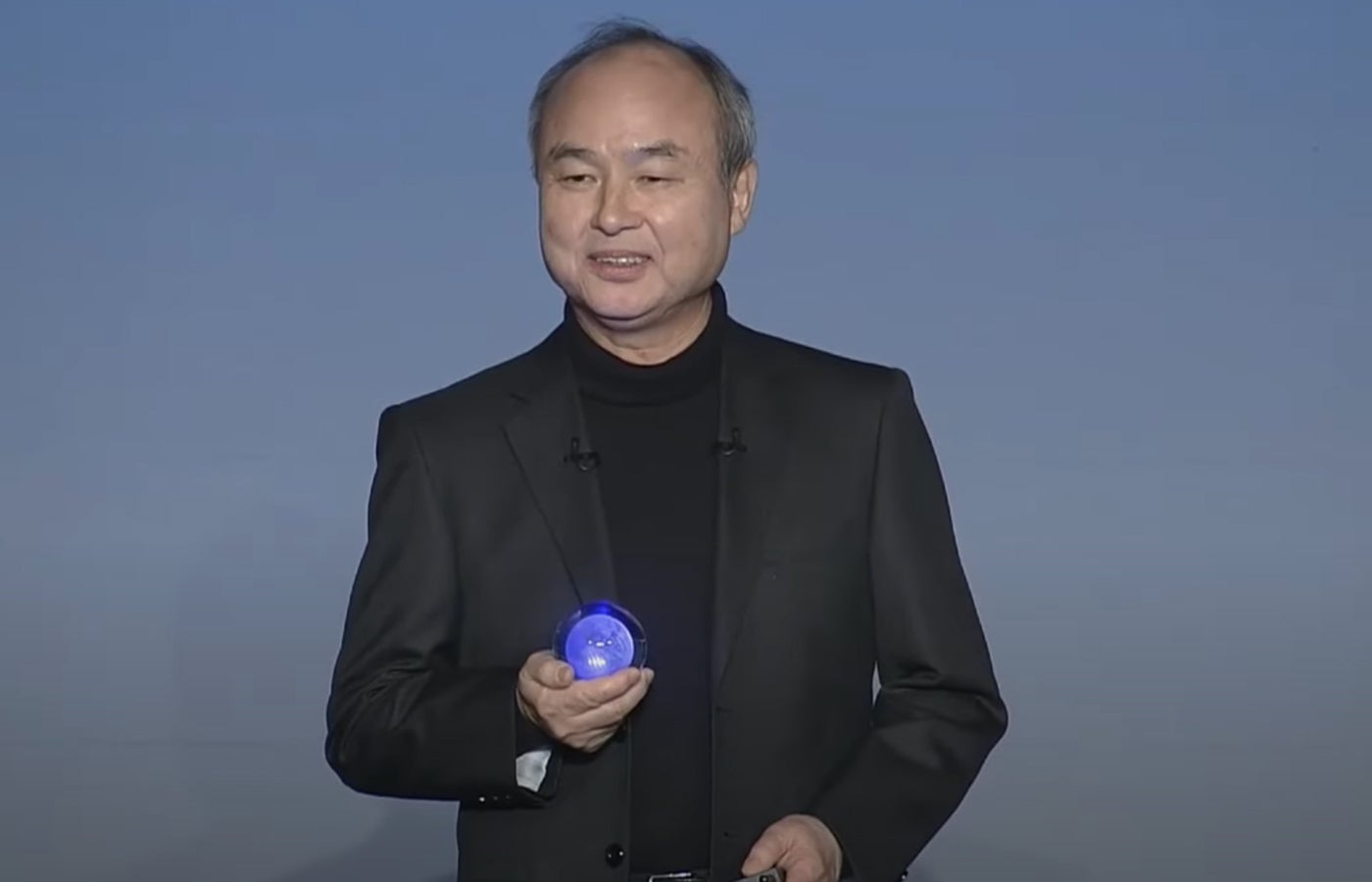

“The future of Artificial Super Intelligence requires breakthrough computing power,” said Masayoshi Son, chairman and chief executive officer of SoftBank Group, in a statement. “Ampere’s expertise in semiconductors and high-performance computing will help accelerate this vision, and deepen our commitment to AI innovation in the United States.”

Ampere’s James added, “This is a fantastic outcome for our team, and we are excited to drive forward our AmpereOne roadmap for high-performance Arm processors and AI.”

Conclusion

The acquisition of Ampere by SoftBank is a significant move that will help the company accelerate its AI vision and expand its AI infrastructure investments. With Ampere’s expertise in semiconductors and high-performance computing, SoftBank will be able to deepen its commitment to AI innovation in the United States.

FAQs

Q: What is the acquisition price of Ampere by SoftBank?

A: The acquisition price is $6.5 billion in an all-cash deal.

Q: What is the current focus of Ampere’s chip design?

A: Ampere’s current focus is on developing energy-efficient chips for AI workloads.

Q: What is SoftBank’s goal with the acquisition of Ampere?

A: SoftBank aims to accelerate its AI vision and expand its AI infrastructure investments.

Q: What is the timeline for the acquisition to close?

A: The deal is expected to close in the second half of 2025.

Q: What is SoftBank’s current stake in Arm Holdings?

A: SoftBank retains a majority stake in Arm Holdings, which it acquired in 2016 for $31 billion.

Q: What is the Stargate Project?

A: The Stargate Project is an initiative that will contribute $500 billion in total to generative AI infrastructure, like data centers, in the U.S. over four years, with SoftBank as an initial equity funder.