Here is the rewritten content in HTML format:

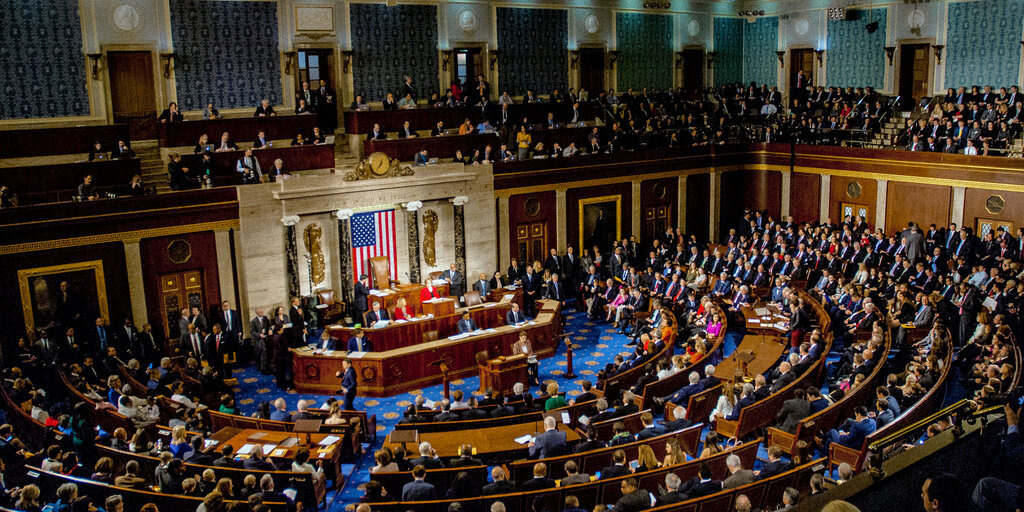

Crypto Tax Resolution Passes Senate with 70-28 Vote

The United States Senate has voted 70-28 in support of a resolution to repeal a Biden-era rule that would have required decentralized finance (DeFi) platforms to collect and report taxpayer information.

Critics argued that the rule was “fundamentally unworkable” because DeFi platforms operate through automated code on blockchains without human intervention or visibility into user identities.

Efforts to repeal and revise the IRS ruling emerged in January, with the U.S. House of Representatives signaling consideration by February.

A week later, the Trump administration threw its weight behind those efforts, leading to a move from the Senate to overturn it on March 4.

However, readings of the Congressional were restarted due to a “blue slip” issue where the House cited constitutional concerns over how budget matters are handled, arguing that the repeal should have started with the House.

Critical Concerns

Earlier this month, U.S. Treasury Secretary Scott Bessent said that his office is looking to work closely with the IRS and Office of the Comptroller of the Currency (OCC) to “rescind and amend” related crypto tax rules that impacted how crypto and digital asset firms do business in the country.

Concerns over the IRS broker rule point to its language about “DeFi brokers” as “front-end service providers” for digital asset transactions.

Issues over how the rule unnecessarily extended these definitions were condemned by Commissioner Hester Pierce in February last year as something that would be “harming” market participants who have unwittingly found themselves “transformed into dealers.”

Conclusion

The passage of the crypto tax resolution is a significant development in the ongoing debate over the regulation of DeFi platforms. As the industry continues to evolve, it is crucial that policymakers and regulators work together to create a framework that balances the need for transparency and accountability with the need for innovation and flexibility.

FAQs

Q: What is the crypto tax resolution?

A: The crypto tax resolution is a bill that would repeal a Biden-era rule requiring DeFi platforms to collect and report taxpayer information.

Q: Why is the IRS proposing this rule?

A: The IRS is proposing this rule to ensure that DeFi platforms are transparent and accountable, and to prevent tax evasion and money laundering.

Q: What are the concerns about the rule?

A: Critics argue that the rule is “fundamentally unworkable” because DeFi platforms operate through automated code on blockchains without human intervention or visibility into user identities.

Q: What is the current status of the crypto tax resolution?

A: The crypto tax resolution has passed the Senate with a 70-28 vote and is now making its way to the White House for President Donald Trump’s signature.

Q: What is next for the crypto industry?

A: The passage of the crypto tax resolution is just one step in the ongoing debate over the regulation of DeFi platforms. The industry is likely to continue to evolve, with new innovations and technologies emerging, and policymakers and regulators working to create a framework that balances transparency, accountability, and innovation.

Related Stories

ConstitutionDAO But for the Apocalypse: Solana NFT Project Aims to Buy Nuclear Bunker

rewrite this content Remember when ConstitutionDAO tried (and failed) to buy a copy of the U.S. Constitution? Well, now there’s...

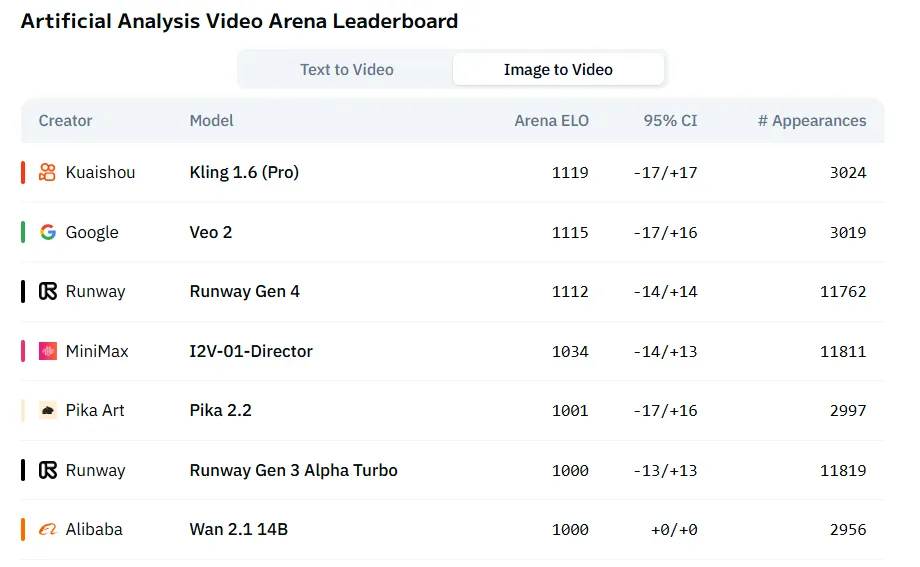

Kling 2.0 Review: State of the Art AI Video Quality

rewrite this content Kling 2.0, a major upgrade to the state-of-the-art AI video generator released by the Chinese tech firm...

This Week in Crypto Games: Solana Game Pass, ‘Ponzi’ Games Pop, SEC and CyberKongz

rewrite this content The crypto gaming space is ever expanding, and with prominent games releasing, token airdrops piling up, and...

What Is ‘Idle Mine’? This Free iOS and Android Game Pays Real Bitcoin

rewrite this content In brief Idle Mine is a mobile game that lets you earn real Bitcoin rewards. The game...

![Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW] Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW]](https://i.ytimg.com/vi/MrMeVsgZJPU/maxresdefault.jpg)