In brief

- Hayes has accumulated about $995,000 worth of ENA in the past two days, according to Arkham Intelligence.

- Ethena, backed by BlackRock, has pledged to route 95% of USDH revenue to Hyperliquid and cover migration costs.

- Native Markets leads the race with 90% odds, while Paxos revised its proposal and secured a Kraken listing offer.

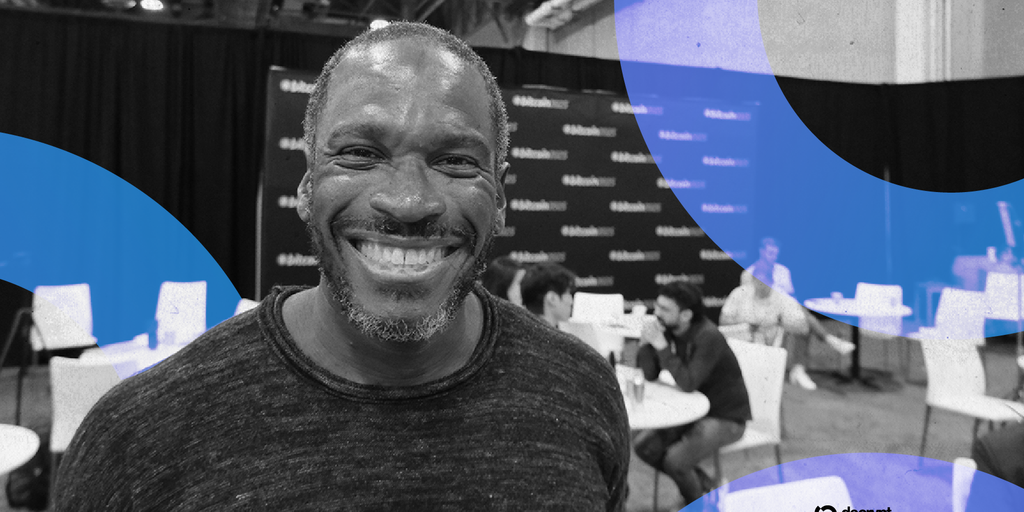

Arthur Hayes, co-founder of crypto investment fund Maelstrom, bought the Ethena token this week, tying his latest move to a project vying for control of the USDH stablecoin ticker as Hyperliquid validators head into a decisive vote on Sunday.

Hayes has accumulated multiple tranches of Ethena’s ENA token over the past two days, including 578,956 tokens worth about $473,000 on Wednesday and two earlier purchases totaling roughly 672,800 ENA, or $521,000, according to data tracked by Arkham Intelligence.

The total, including those from Monday, amounts to roughly $995,000 worth of Ethena tokens within a 48-hour window.

Hayes’ purchases come as Ethena remains a contender in the USDH stablecoin race, with Hyperliquid validators set to decide the ticker on Sunday.

Ethena’s proposal, backed by BlackRock, would use its USDtb stablecoin to collateralize USDH via BlackRock’s BUIDL fund, with 95% of revenue pledged to Hyperliquid and costs covered for shifting trading pairs from USDC.

Ethena’s proposal is a “strong bid from one of crypto’s fastest-growing and most impressive ecosystems,” David Lawant, head of research at FalconX, wrote in a blog post published Wednesday.

Lawant pointed to USDe’s market cap of more than $13 billion and Ethena having processed $23 billion in cumulative mints and redemptions without security incidents or downtime.

Still, Hayes’ buy “reads as personal positioning, rather than putting a backing behind Ethena specifically for the USDH votes,” Kirby Ong, founder of HypurrCollective, a grassroots collective for founders, builders, traders, and power users on the Hyperliquid ecosystem, told Decrypt.

“With the $USDH proposal, the deciding factors will likely come down to validator alignments with their current stakers, whether prediction market sentiment translates into actual on-chain votes,” Ong said.

Other contenders

Paxos, backed by PayPal, is also a top contender, according to Lawant. It revised its proposal on Wednesday, expanding from an emphasis on regulatory pedigree to pledging a larger share of reserve yield to Hyperliquid’s Assistance Fund and deferring any issuer take until the product scales past $1 billion.

On Wednesday evening, Paxos announced it had received an offer from Kraken to list USDH and HYPE from day one, with free USD on- and off-ramps, pending the exchange’s standard review.

Meanwhile, Native Markets remains front and center.

Despite being a newly formed company, Native Markets remains the top contender, with 90% odds in its favor, according to live data on Myriad Markets.

Disclosure: Myriad is a prediction market developed by Decrypt’s parent company DASTAN.

Native Markets pitched a GENIUS-compliant USDH managed through Bridge, Stripe’s stablecoin issuer, with reserves in cash and Treasuries overseen by BlackRock off-chain and Superstate on-chain.

Its plan splits yield evenly between Hyperliquid’s Assistance Fund and ecosystem growth, and promises a HyperEVM launch with seamless interoperability.

Ong explained that while prediction markets “help set expectations,” validator support “determines the valid candidates,” and that “ultimately, anyone can help to decide and set the direction for USDH by staking their weight and making their votes known by delegating to the validator that best matches their vote.”

Ong added: “The final outcome on Sunday may depend on which team gains the most trust and perceived long-term value for the ecosystem.”

Decrypt has reached out to Hayes, Paxos, and Ethena for comment. A separate request was sent to Native Markets through an ecosystem operator (Max Feige).

Other contenders include Sky, the issuer of USDS (formerly MakerDAO’s DAI), Frax Finance with a bank-partnered bid, and Agora, which has warned against Native Markets’ reliance on Stripe-owned Bridge while pledging to channel all net revenue back into Hyperliquid.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.