Rewrite the

Ethereum is trading at critical price levels after a sharp 10% decline from the $4,750 mark, reflecting growing uncertainty across the broader crypto market. The recent correction has pushed ETH toward the $4,300 support zone, a level that bulls are now fiercely defending to prevent a deeper retracement. Despite the pullback, on-chain data suggests that large holders remain confident, signaling that this dip may be part of a healthy market reset rather than the start of a downtrend.

Related Reading

According to recent data, Bitmine continues its aggressive accumulation of ETH, adding to its holdings even as prices fluctuate. This steady inflow from institutional players highlights strong conviction in Ethereum’s long-term fundamentals, particularly as the network maintains dominance in DeFi and smart contract activity.

Still, sentiment among retail traders remains mixed. Some fear that sustained weakness below $4,300 could trigger another wave of selling pressure, while others see this as a potential accumulation opportunity before the next major move. As Ethereum stabilizes at these levels, the coming days will be crucial to determine whether the market resumes its bullish momentum or enters a prolonged consolidation phase amid heightened volatility.

Ethereum Accumulation Continues As Bitmine Strengthens Its Position

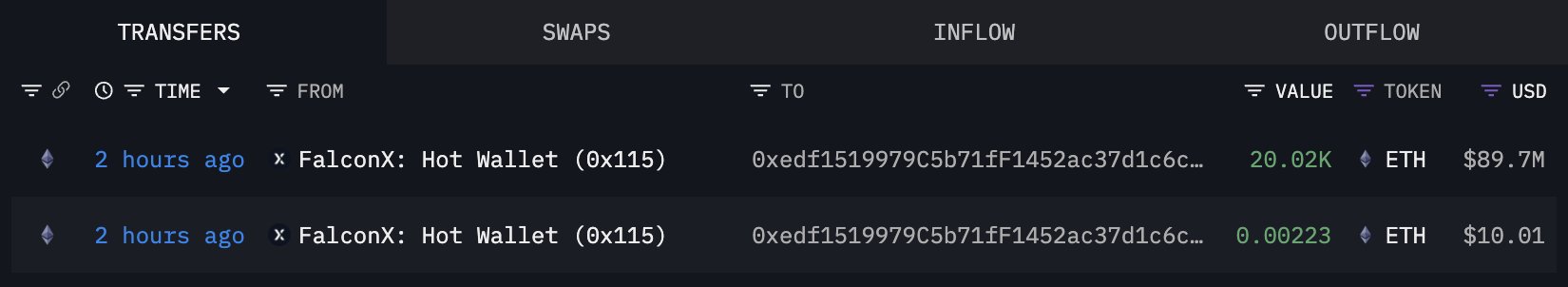

According to data shared by Lookonchain, institutional accumulation around Ethereum remains strong despite recent market volatility. Just a few hours ago, Bitmine received another 23,823 ETH (worth $103.68 million) from BitGo, marking yet another significant inflow of capital. This move comes only two days after Bitmine acquired 20,020 ETH ($89.7 million) via FalconX, underscoring their consistent strategy of building exposure during price dips rather than chasing rallies.

Such accumulation patterns are often seen as a sign of confidence in Ethereum’s long-term fundamentals, particularly from institutional investors who view ETH as a core asset within the broader digital economy. While short-term sentiment remains cautious after the recent correction, these inflows suggest that smart money continues to see value around current prices.

The coming days will be critical for Ethereum’s technical structure. Bulls must defend the $4,300 support zone to maintain momentum and set up a potential recovery toward the $4,600–$4,750 resistance area. A strong defense here could pave the way for a new all-time high, confirming renewed investor confidence and establishing $4,300 as a key accumulation level.

Related Reading

Bulls Defend $4,300 Support

Ethereum (ETH) is currently trading near $4,325, showing signs of consolidation after a 10% decline from its recent high of $4,750. The 12-hour chart reveals that ETH has fallen below the 50-day moving average (blue line), signaling short-term weakness, while the 100-day (green) and 200-day (red) moving averages are still trending upward — a sign that the broader uptrend remains intact.

The $4,300 level now acts as a key support zone, with bulls attempting to establish a base and prevent further downside pressure. If this level holds, the next target would be a retest of $4,500–$4,600, where sellers are likely to reappear. However, a break below $4,250 could expose Ethereum to a deeper pullback toward the $4,000 psychological level, an area that previously served as a strong accumulation zone in late September.

Related Reading

Momentum indicators suggest that selling pressure is easing, aligning with the recent on-chain data showing continued accumulation from large entities such as Bitmine. This reinforces the idea that institutional confidence remains strong, even amid volatility. For now, holding above $4,300 is critical — a successful defense could mark the foundation for Ethereum’s next push toward new highs.

Featured image from ChatGPT, chart from TradingView.com

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.