In brief

- Binance has received regulatory approval to take majority control of GOPAX after prolonged scrutiny.

- GOPAX says the move marks progress toward resolving GOFi repayments tied to Genesis Global Capital.

- Analysts say the decision reconciles with regulators but does not mean immediate disruption in a crypto market still dominated by Upbit and Bithumb.

South Korea’s Financial Intelligence Unit has approved Binance’s majority stake acquisition of GOPAX, ending a regulatory impasse that had stifled its return to the Korean market for over two years.

The approval allows Binance to take majority control of GOPAX, restart operations in Korea, honor repayment pledges to users, and position itself to compete with dominant local exchanges.

The decision was confirmed on Wednesday and first disclosed on Thursday through local press outlet MK.

On Thursday, GOPAX announced that its “board change report” had been accepted by regulators, calling it a part of “the process of enhancing management stability and meeting necessary regulatory requirements,” according to a translation of the post.

GOPAX added that it is closely working with Binance, its major shareholder, to “continue operating with greater prudence and responsibility” and help resolve issues with users affected by the collapse of its GOFi lending product linked to Genesis Global Capital. Binance announced its investment in GOPAX in 2023.

Decrypt reached out to Binance, the Financial Services Commission, the Korea Financial Intelligence Unit, and GOPAX for comment, but did not immediately receive a response.

The move reopens a key Asian market that Binance left in 2021 after tighter enforcement of real-name banking and anti-money-laundering rules.

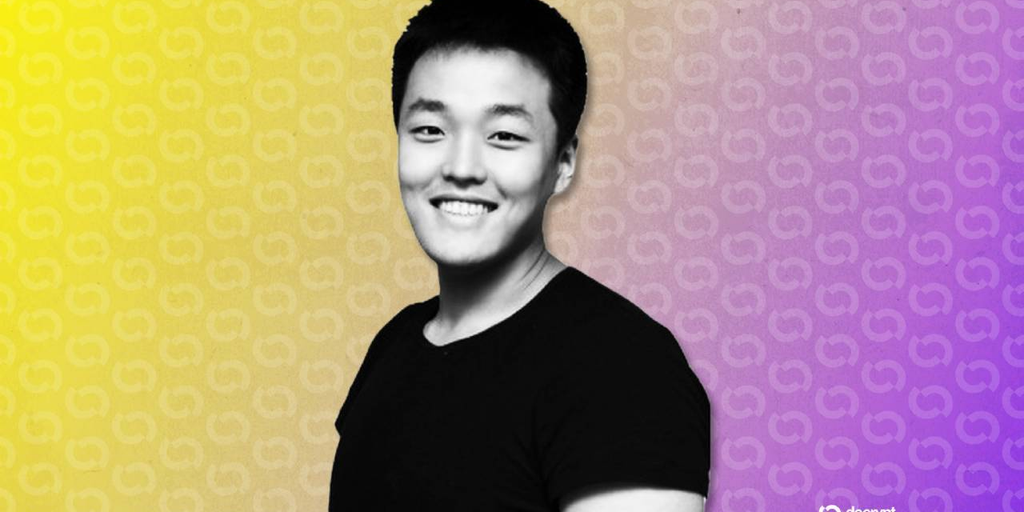

GOPAX’s request for leadership changes had been pending since March 2023, delayed amid concerns over Binance’s compliance history and the criminal conviction of its founder, Changpeng Zhao.

Zhao had served a four-month sentence handed down last year for money laundering violations, part of a $4.3 billion settlement with the U.S. DOJ that restructured Binance’s governance.

Binance’s entry to Korea brings its liquidity, technology, and cost advantages, but faces a market dominated by two local exchanges. Upbit holds roughly 72%, while Bithumb accounts for around 24%, according to a late 2024 report from Kaiko Research.

Analysts said the decision marks regulatory closure rather than market disruption, with structural limits likely to constrain Binance’s immediate impact.

The approval “is structurally about GOPAX’s major shareholder change review, not Binance’s independent market entry,” Ryan Yoon, senior analyst at Seoul-based crypto and digital asset analytics firm Tiger Research, told Decrypt.

“Korean regulators assessed whether Binance meets fitness standards for controlling a licensed exchange, and the two-year process suggests past issues were remediated within regulatory requirements,” he added.

Upon entry, Binance’s presence in Korea won’t immediately lead to retail migration, Yoon noted.

“Lower fees alone haven’t historically shifted market dynamics, and orderbook sharing with Binance Global likely conflicts with Korean regulatory requirements around trade surveillance and capital controls,” he said.

Short-term exchange rankings “look stable given Upbit’s early entrenched effects,” he said.

Longer-term prospects would depend on “whether GOPAX can adapt Binance’s operational advantages—listing speed, liquidity relationships—within Korean regulatory constraints,” he added.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.