Here is the rewritten content in well-organized HTML format with all tags properly closed:

Bitcoin’s Coinbase Premium Indicator Flips Negative

Traders Turn Cautious Ahead of US CPI Release

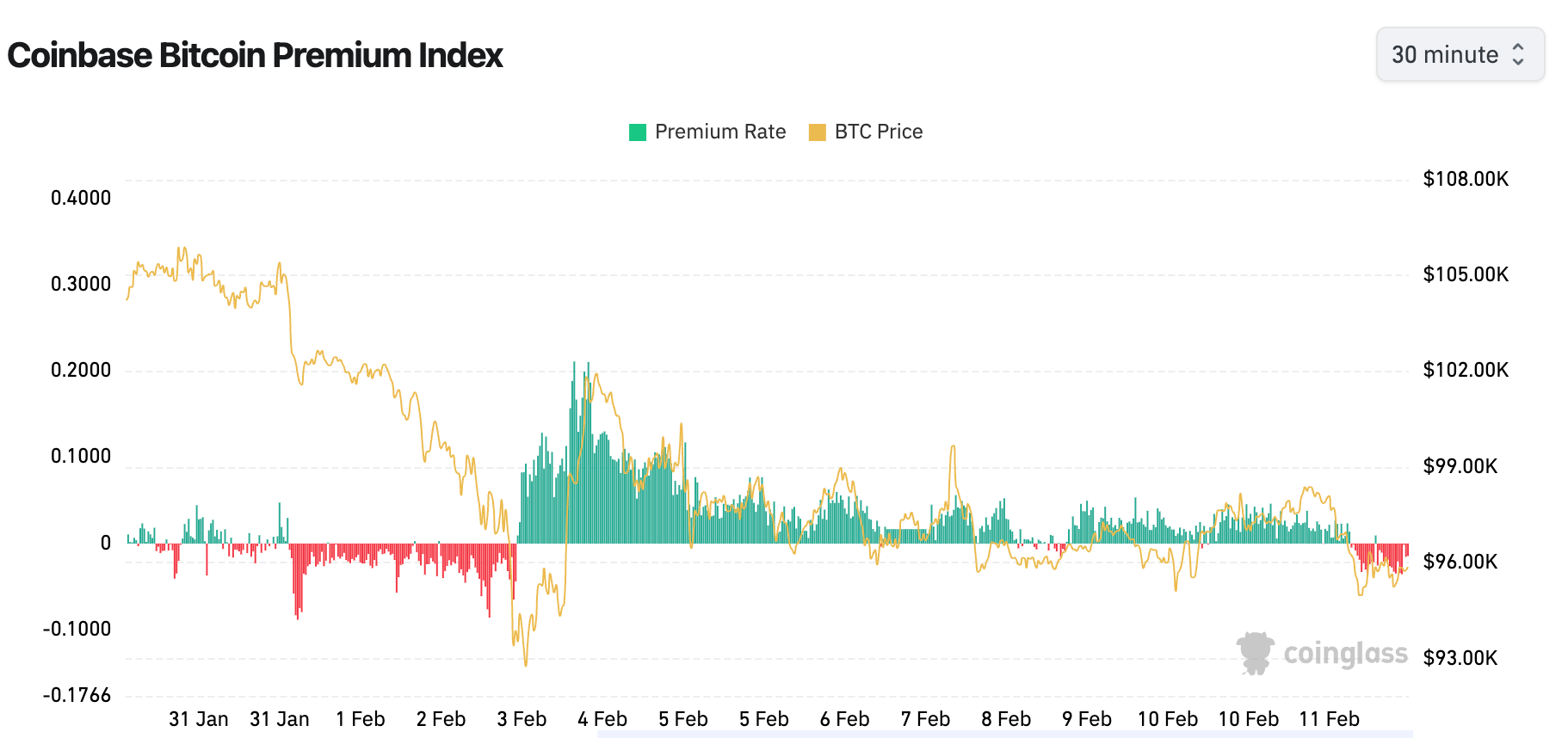

Bitcoin’s (BTC) Coinbase premium indicator, which measures the spread between BTC’s dollar-denominated price on the Coinbase exchange and tether-denominated price on Binance, has flipped negative for the first time since the Feb. 3 crash, according to data source Coinglass.

It’s a sign that traders over the Nasdaq-listed exchange have turned cautious ahead of Wednesday’s U.S. CPI release, and their offshore counterparts have led the price recovery from overnight lows near $94,900 to $96,000.

Historical Context

Historically, bull runs have been marked by prices trading at a premium on Coinbase, indicating strong leadership from U.S. investors. The premium soared to two-month highs in early November as BTC rose into its then-uncharted territory above $70,000.

Technical Analysis

The flip to a negative premium indicates a shift in sentiment, with traders increasingly uncertain about the direction of the market. This could be a sign of a potentially bearish trend, as investors become more cautious ahead of the CPI release.

Implications for Traders

For traders, this could be a signal to take profits or reduce positions in the short term. A negative premium may indicate a lack of conviction in the market, making it a good opportunity for traders to reassess their positions and adjust their strategies accordingly.

Conclusion

In conclusion, the Coinbase premium indicator has flipped negative, indicating a shift in sentiment among traders. This could be a sign of a potentially bearish trend, and traders should be cautious ahead of the U.S. CPI release. It’s essential to closely monitor market developments and adjust trading strategies accordingly.

FAQs

Q: What is the Coinbase premium indicator?

A: The Coinbase premium indicator measures the spread between BTC’s dollar-denominated price on the Coinbase exchange and tether-denominated price on Binance.

Q: Why has the premium turned negative?

A: The premium has turned negative as traders over the Nasdaq-listed exchange have turned cautious ahead of Wednesday’s U.S. CPI release, while their offshore counterparts have led the price recovery from overnight lows.

Q: What does this mean for traders?

A: A negative premium could indicate a lack of conviction in the market, making it a good opportunity for traders to reassess their positions and adjust their strategies accordingly. It may also be a signal to take profits or reduce positions in the short term.