US-Based Bitcoin ETFs Report Substantial Net Inflow on August 26

According to SoSo Value data, US-based Bitcoin ETFs witnessed a net inflow of $202.6 million on August 26. This notable influx of capital into the sector marks a significant milestone in the market.

Breakdown of the Net Inflow

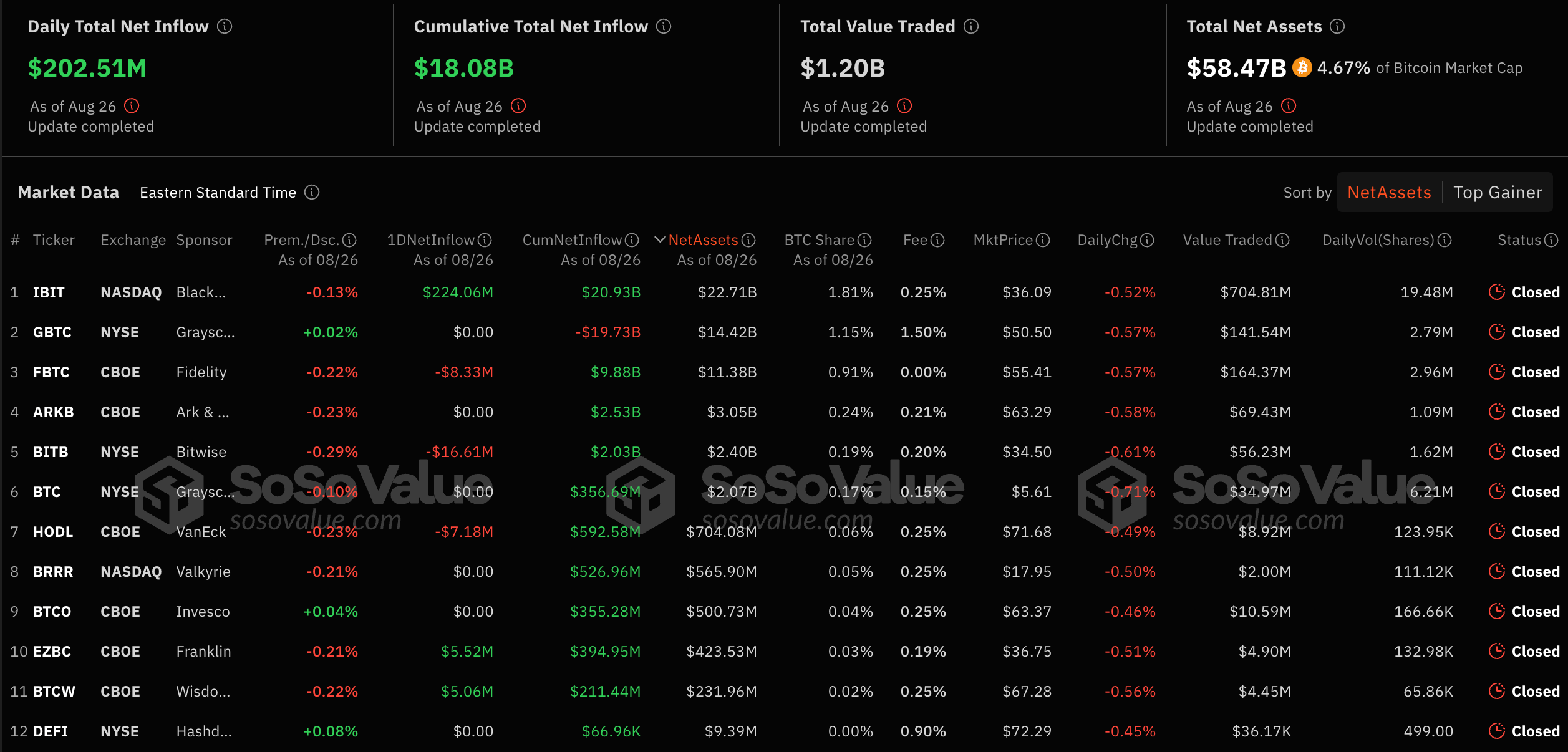

The table below provides a breakdown of the net inflow into each of the participating Bitcoin ETFs:

| Ticker | Sponsor | Prem./Dsc. | Aug. 26 Inflow | Net Inflow | BTC Share | Value Traded |

|---|---|---|---|---|---|---|

| IBIT | BlackRock | -0.13% | $224.06M | $20.93B | 1.81% | $704.81M |

| GBTC | Grayscale | +0.02% | $0.00 | -19.73B | 1.15% | $141.54M |

| FBTC | Fidelity | -0.22% | -8.33M | $9.88B | 0.91% | $164.37M |

| ARKB | Ark | -0.23% | $0.00 | $2.53B | 0.24% | $69.43M |

| BITB | Bitwise | -0.29% | -16.61M | $2.03B | 0.19% | $56.23M |

| BTC | Grayscale | -0.10% | $0.00 | $356.69M | 0.17% | $34.97M |

| HODL | VanEck | -0.23% | -7.18M | $592.58M | 0.06% | $8.92M |

| BRRR | Valkyrie | -0.21% | $0.00 | $526.96M | 0.05% | $2.00M |

| BTCO | Invesco | +0.04% | $0.00 | $355.28M | 0.04% | $10.59M |

| EZBC | Franklin | -0.21% | $5.52M | $394.95M | 0.03% | $4.90M |

| BTCW | WisdomTree | -0.22% | $5.06M | $211.44M | 0.02% | $4.45M |

IBIT and Grayscale Dominate the Market

IBIT, managed by BlackRock, led the pack with a substantial net inflow of $224.06 million on August 26. This significant influx of capital adds to its cumulative net inflow, which now stands at $20.93 billion. The fund trades at a slight discount of 0.13% relative to its net asset value (NAV), holding a 1.81% share of Bitcoin. With a trading volume of $704.81 million, IBIT continues to demonstrate its dominance in the Bitcoin ETF market, reflecting strong investor confidence and significant capital commitment.

Grayscale, on the other hand, has maintained a neutral stance on August 26, with GBTC experiencing no change in its net inflow. Despite this, the fund has accumulated significant outflows over time, evident from its cumulative net outflow of -$19.73 billion. GBTC trades at a slight premium of 0.02% and holds a 1.15% share of Bitcoin. Its trading volume on this day was $141.54 million, indicating continued interest in the fund despite prolonged outflows.

Conclusion

In conclusion, the net inflow into US-based Bitcoin ETFs on August 26 represents a significant milestone in the sector. The dominance of IBIT and Grayscale is evident, with both funds leading the pack in terms of capital inflows and market share. The trend reflects strong investor confidence and capital commitment, which is likely to drive the market forward in the coming months.

FAQs

What is the current state of the US-based Bitcoin ETF market?

The US-based Bitcoin ETF market has witnessed a net inflow of $202.6 million on August 26, reflecting strong investor confidence and significant capital commitment.

Which ETFs have recorded the highest net inflows?

IBIT, managed by BlackRock, has recorded the highest net inflow of $224.06 million on August 26, followed by other top-performing ETFs such as FBTC and ARKB.

What is the cumulative net inflow for the top-performing ETFs?

The cumulative net inflow for IBIT is $20.93 billion, while the cumulative net inflow for FBTC is $9.88 billion.

How does the premium or discount affect the ETF’s market value?

The premium or discount of an ETF relative to its NAV affects the ETF’s market value. A premium indicates that the market value is higher than the NAV, while a discount indicates that the market value is lower than the NAV.

What is the current market share of BlackRock and Grayscale in the Bitcoin ETF market?

BlackRock and Grayscale combined hold a significant 2.96% share of the Bitcoin circulating supply.