China’s Central Bank Cuts Interest Rates to Stimulate Economic Growth

Background

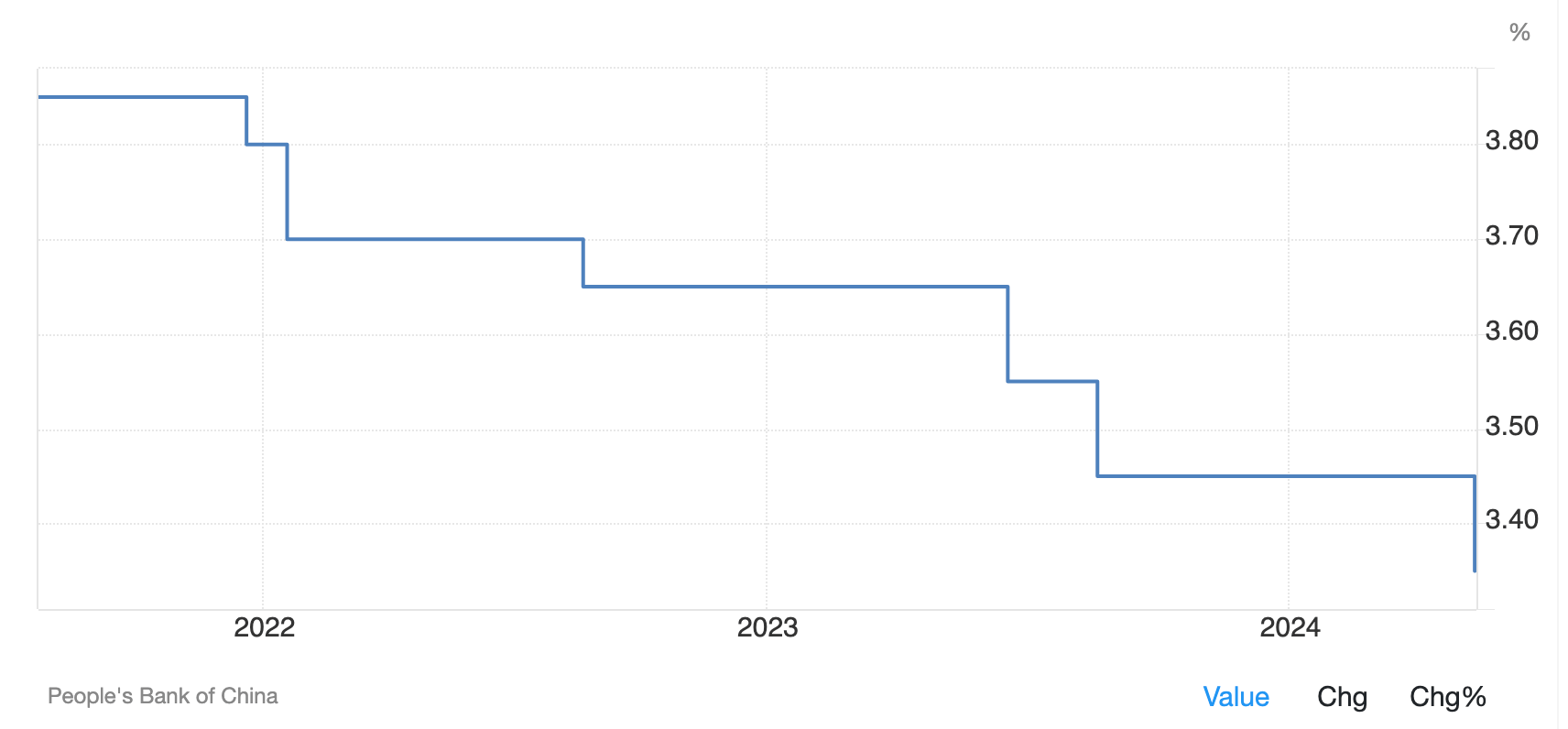

The People’s Bank of China (PBOC), China’s central bank, has taken steps to stimulate economic growth by cutting key interest rates. This move aims to address challenges in the property sector and the broader economy.

Interest Rate Cuts

The PBOC has reduced the seven-day reverse repo rate from 1.8% to 1.7%, the one-year loan prime rate (LPR) from 3.45% to 3.35%, and the five-year LPR from 3.95% to 3.85%. These cuts are intended to increase borrowing and spending, ultimately boosting economic growth.

Economic Challenges

China’s economy has been facing challenges, including weaker-than-expected second-quarter GDP growth of 4.7%. The property sector remains troubled, with major developers facing financial difficulties. Weak consumer demand and deflationary pressures are also concerns.

Market Reactions

The interest rate cuts have been met with mixed reactions in the markets. Chinese stock markets have shown muted responses, while Hong Kong’s Hang Seng index has seen some positive movement.

Impact on Cryptocurrencies

Following the news of the interest rate cuts, Bitcoin’s price rose around 0.5% but has since declined around 1% to $67,400 as of press time.

Uncertainty and Future Policy Actions

The effectiveness of the rate cuts remains uncertain, and further policy actions may be necessary for sustained economic recovery.

Conclusion

In conclusion, China’s central bank has taken steps to stimulate economic growth by cutting key interest rates. While the impact of these cuts is uncertain, they aim to address challenges in the property sector and the broader economy. Further policy actions may be necessary to achieve sustained economic recovery.

FAQs

Q: What is the purpose of the interest rate cuts?

A: The interest rate cuts aim to stimulate economic growth by increasing borrowing and spending.

Q: What are the challenges facing China’s economy?

A: China’s economy is facing challenges such as weaker-than-expected second-quarter GDP growth, troubled property sector, weak consumer demand, and deflationary pressures.

Q: How have the markets reacted to the interest rate cuts?

A: The markets have shown mixed reactions, with Chinese stock markets showing muted responses and Hong Kong’s Hang Seng index seeing some positive movement.

Q: What is the impact of the interest rate cuts on cryptocurrencies?

A: Bitcoin’s price rose around 0.5% initially but has since declined around 1% to $67,400 as of press time.

Q: Are the interest rate cuts effective?

A: The effectiveness of the rate cuts remains uncertain, and further policy actions may be necessary for sustained economic recovery.