rewrite this content

Crypto projects captured $2.67 billion in investments last month and is equivalent to 85% of money raised during the entire second quarter.

DefiLlama data shows that the funding amount in July is 6% larger than June, when crypto startups surpassed $2.5 billion by a small margin.

Additionally, July was the second-largest month in funding, bested only by March’s $3.5 billion. Pump.fun’s pre-sales contributed heavily to July’s numbers, as it attracted nearly $1 billion before its token generation event.

Treasuries shine

DefiLlama tracked investments into crypto-related companies under the category “Investments,” which received $512 million in funding.

BitMine raised $250 million to add Ethereum to its treasury, representing the largest amount in the “investments” category. Meanwhile, Upexi’s $200 million funding was the second-largest capital raise in the category, which was destined to add Solana to its holdings.

Together, both companies represented 88% of all funding in the “investments” category in July.

“Stablecoin infrastructure” also received significant attention from investors, with $352.5 million directed to projects in the segement.

Hong Kong-based OSL Group dominated the funding, gathering $300 million to boost its global expansion.

RD Technologies is another project from Hong Kong, which received $40 million to create regulated systems for stablecoins ranging from issuance to distribution.

DeFi strong even without Pump.fun

Despite Pump.fun adding a considerable amount to the “DeFi” category, projects developing products for the decentralized finance ecosystem raised $107 million. The amount is relatively substantial compared to other sectors.

Kuru received $11.6 million to develop a central limit order book (CLOB) based on the Monad infrastructure. At the same time, GAIB captured $10 million to create a decentralized economic layer to tokenize GPUs and their revenue stream.

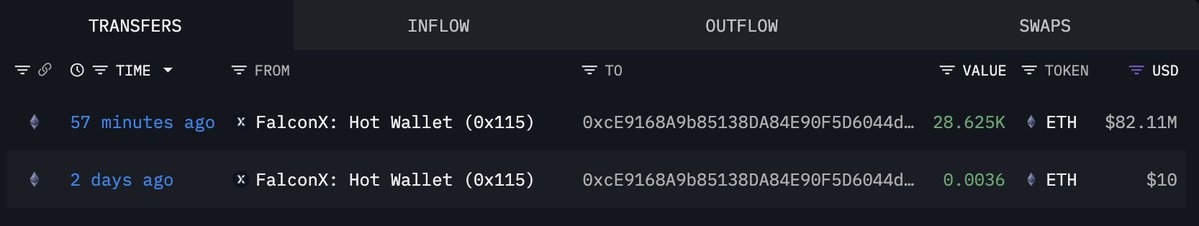

Falcon Finance also received a two-digit funding, as World Liberty Financial backed the project with $10 million to build an overcolateralized stablecoin.

The last of the sectors that got at least $100 million in funding is “infrastructure.” Bitzero raised $25 million in a Series B funding round to support its mining operations.

Furthermore, xTAO received $22.8 million to continue its work of supporting and scaling the Bittensor ecosystem.

Soluna secured a two-digit investment, capturing $20 million to enhance operations, including Bitcoin mining with green energy.

Mentioned in this article

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.