rewrite this content

In brief

- Crypto.com filed an application with the Office of the Currency Comptroller (OCC) for a national bank trust charter.

- The firm joins a growing list of crypto companies seeking the charter, like Coinbase, Circle, and the Stripe-owned Bridge.

- National banks can now custody crypto, and more crypto-friendly regulation may be on the way—like access to expedited “skinny” master accounts.

Crypto exchange Crypto.com has filed a national trust bank charter application with the Office of the Currency Comptroller (OCC), the firm announced on Friday.

The application puts the firm on a growing list of crypto companies—like USDC issuer Circle, crypto exchange Coinbase, and Bridge, the stablecoin arm of private payments company Stripe—which have also sought the national bank charter.

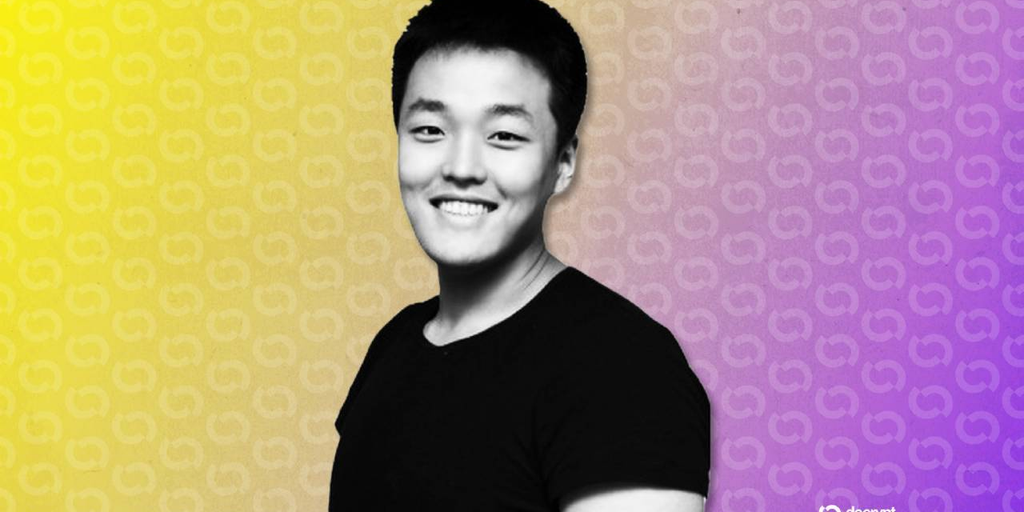

“Building the Crypto.com product and service portfolio through regulated and secure offerings has been our focus since day one,” said Crypto.com co-founder and CEO Kris Marszalek, in a statement. “We are excited to take this next step by filing for a national trust bank charter and look forward to continuing to pursue opportunities to provide customers with the trusted services they require.”

If approved, the charter would strengthen Crypto.com’s case as the “custody service destination of choice,” the firm said.

Crypto firms have been filing for national trust bank charters since earlier this year, when the OCC gave banks approval to buy, sell, and manage crypto assets in their custody. This month, the Peter Thiel-backed crypto bank Erebor became the first to earn a conditional federal charter, making it the second to ever do so after Anchorage Digital.

Further crypto-friendly banking developments were detailed this week when Federal Reserve Governor Christopher Waller said the Fed is exploring the issuance of “skinny master accounts” on an expedited timeline to firms that haven’t been able to secure a full one.

Master accounts, which are managed by federally chartered banks, provide access to the Fed and allow for direct payments. Historically, crypto institutions have tried, but ultimately failed to earn them.

The so-called “skinny” master accounts would come with some limitations, like not including the privileges of interest payments on account balances or overdraft protection.

Earlier this year, Crypto.com relaunched its institutional exchange amid renewed crypto regulatory optimism in the U.S. with the return of the Trump administration. The firm is also making a play in prediction markets, though it was hit with a regulatory setback earlier this month when a Nevada judge ruled against an injunction request.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.