Here is the rewritten content:

Global Cryptocurrency Exchange-Traded Products Suffer Largest Weekly Outflow on Record

Investors Pull $2.9 Billion from Crypto ETPs, Marking a Shift in Sentiment

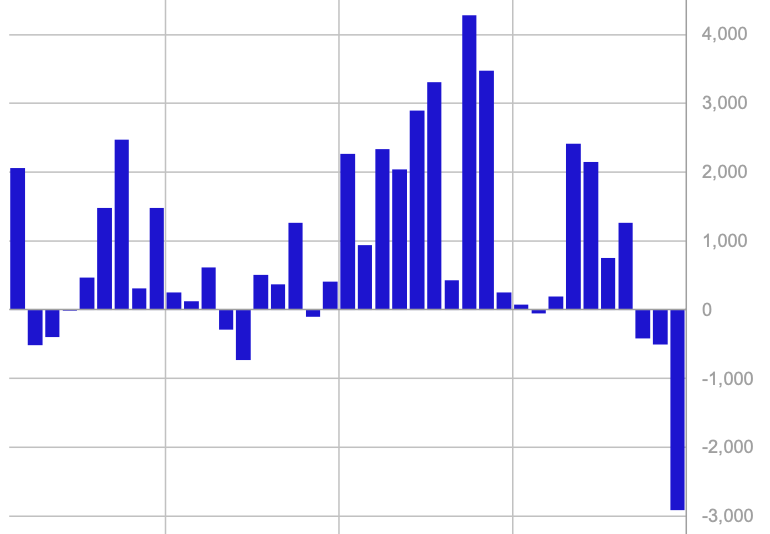

A recent report by CoinShares reveals that cryptocurrency exchange-traded products (ETPs) experienced their largest weekly outflow on record, with investors withdrawing approximately $2.9 billion from these funds. This significant shift in sentiment marks a departure from the prolonged period of steady investment into digital asset products.

A Three-Week Streak of Outflows Totals $3.8 Billion

This latest wave of withdrawals is part of a three-week streak of outflows, with a cumulative total of $3.8 billion. According to James Butterfill, a research analyst at CoinShares, several factors are likely driving the sell-off, including mounting investor concerns following the recent $1.5 billion hack on crypto exchange Bybit and the Federal Reserve’s increasingly hawkish stance on monetary policy.

Bitcoin Takes the Brunt of the Outflows

Bitcoin, the largest cryptocurrency by market capitalization, was particularly hard hit, losing $2.6 billion over the past week. In contrast, funds that bet against Bitcoin, known as short Bitcoin ETPs, saw only a modest inflow of $2.3 million, indicating that bearish sentiment has not yet fully taken hold.

A Few Assets Buck the Trend

While most assets struggled, a few bucked the trend. Sui (SUI) emerged as the top performer, attracting $15.5 million in inflows, followed by XRP (XRP), which also drew fresh investment.

Spot Bitcoin ETFs Face a Tough Week

Spot Bitcoin ETFs faced one of their toughest weeks yet, with investors pulling significant capital from these funds. BlackRock’s iShares Bitcoin Trust (IBIT), the largest of its kind, recorded a staggering $1.3 billion in outflows, the highest weekly withdrawal since its launch.

Institutional Positioning Shifts

CME Bitcoin futures open interest dropped sharply over the past two weeks, falling from 170,000 BTC to 140,000 BTC, signaling a potential shift in institutional positioning. The three-month futures annualized rolling basis is yielding 7%, only slightly higher than the 4% yield offered by short-term U.S. Treasuries, making the trade less attractive for investors.

Hedge Funds Unwind Basis Trade

"This tells me the hedge funds are starting to unwind their basis trade position, which is a net-neutral position," said James Van Straten, analyst at CoinDesk. "With a narrowing spread between futures yields and risk-free returns, traders may be reallocating capital away from bitcoin derivatives in favor of safer, more liquid assets."

Conclusion

The recent outflow from cryptocurrency ETPs is a significant shift in sentiment, indicating that investors are reevaluating their exposure to these assets. As the market navigates this new landscape, it will be essential for investors to stay informed about the latest developments and trends.

Frequently Asked Questions

Q: What is the cause of the recent outflow from cryptocurrency ETPs?

A: The outflow is attributed to mounting investor concerns following the recent $1.5 billion hack on crypto exchange Bybit and the Federal Reserve’s increasingly hawkish stance on monetary policy.

Q: How much did investors withdraw from cryptocurrency ETPs?

A: Investors withdrew approximately $2.9 billion from cryptocurrency ETPs over the past week.

Q: What was the total amount withdrawn over the past three weeks?

A: The total amount withdrawn over the past three weeks is $3.8 billion.

Q: How did Bitcoin perform during this period?

A: Bitcoin lost $2.6 billion over the past week, taking the brunt of the outflows.