Here is the rewritten content in well-organized HTML format with all tags properly closed:

DWF Labs Launches $250 Million Liquid Fund to Accelerate Web3 Adoption

Dubai-based crypto market maker and investor DWF Labs has announced the launch of a $250 million Liquid Fund aimed at expanding blockchain projects of different sizes.

According to a press release shared with CryptoPotato, the fund will provide investments ranging from $10 million to $50 million per project, with a focus on accelerating Web3 adoption.

“DWF Labs, the new generation crypto market maker and investor, is excited to announce the launch of their Liquid Fund aimed at accelerating the adoption and expansion of mid and large-cap crypto projects,”

The Liquid Fund

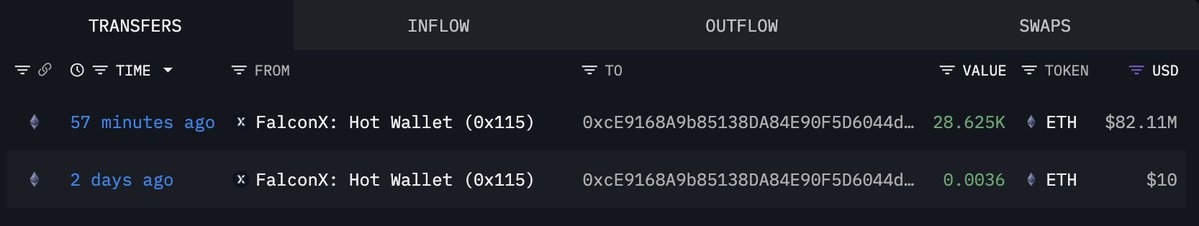

Known for its active role in the crypto investment space, the market maker has already allocated over $11 million to blockchain initiatives in the last two weeks alone. As part of this action, it is preparing to finalize two investment agreements, one for $25 million and another for $10 million, with further announcements expected soon.

The initiative is designed to provide both financial support and ecosystem development for blockchain projects that drive broader adoption. Each investment will include a tailored strategy, covering stablecoin TVL and ecosystem expansion to enhance liquidity and decentralized finance (DeFi) activity for Layer 1 and Layer 2 networks.

It will also support lending market development to strengthen financial infrastructure, PR, and brand amplification to increase visibility, as well as a go-to-market strategy to attract traders and grow tokenholder participation.

“Through this fund, we are doubling down on our mission to accelerate Web3 innovation and adoption,” said Andrei Grachev, Managing Partner at DWF Labs. “We believe that strategic capital, coupled with hands-on ecosystem development, is the key to unlocking the next wave of growth for the industry,” he added.

DWF Labs’s History

DWF Labs has been a key player in scaling blockchain ecosystems, having supported several other industry-leading ventures.

The company has partnered with over 700 projects, providing liquidity and market-making services across 60 centralized and decentralized exchanges. This includes investing in tokens ranging from meme coins to blue-chip cryptocurrencies. The $250 million fund will mark the next phase of its commitment to creating long-term value creation in the crypto space.

The development comes over a month after the 0G Foundation launched an $88 million ecosystem fund to accelerate projects creating AI-powered DeFi applications and autonomous agents, also known as DeFAI agents. The project has received backing from strategic investors, including Hack VC, Delphi Ventures, Bankless Ventures, and OKX Ventures.

Conclusion

In conclusion, DWF Labs’ $250 million Liquid Fund is a significant development in the crypto space, aimed at accelerating Web3 adoption and expansion of blockchain projects. With a focus on providing strategic capital and hands-on ecosystem development, the fund has the potential to unlock the next wave of growth for the industry.

FAQs

Q: What is the purpose of the $250 million Liquid Fund?

A: The fund is designed to provide strategic capital and ecosystem development for blockchain projects that drive broader adoption.

Q: What is the investment range for each project?

A: The fund will provide investments ranging from $10 million to $50 million per project.

Q: What is the focus of the fund?

A: The fund is focused on accelerating Web3 adoption and expansion of blockchain projects, with a focus on stablecoin TVL and ecosystem expansion to enhance liquidity and decentralized finance (DeFi) activity.

Q: What is DWF Labs’ history in the crypto space?

A: DWF Labs has been a key player in scaling blockchain ecosystems, having supported several other industry-leading ventures and partnered with over 700 projects, providing liquidity and market-making services across 60 centralized and decentralized exchanges.