rewrite this content

Ethereum (ETH) approached within 3.9% of its all-time high as altcoins demonstrated broad strength.

Leverage across major alternative cryptocurrencies reached a record $47 billion according to Glassnode data.

Ethereum traded at $4,738.94 as of press time, up by 3.1% in the past 24 hours and just 2.7% away from its all-time high registered in November 2021.

The rally coincided with widespread altcoin gains, with seven-day returns showing Ethereum and Dogecoin both up 25.5%, XRP gaining 16.2%, and Solana advancing 13.6%.

Bitfinex head of derivatives Jag Kooner attributed Ethereum’s momentum to “strong ETF inflows, institutional accumulation, and a favourable macro backdrop after softer CPI data boosted rate-cut expectations.”

The combination has driven traders back into risk assets, with both Bitcoin and Ethereum seeing renewed long positioning.

Options activity signals breakout expectations

Ethereum options open interest climbed to a year-to-date high of approximately $16.1 billion alongside the spot price rally, according to Glassnode.

The elevated open interest signals strong demand for optionality around the potential breakout above previous highs.

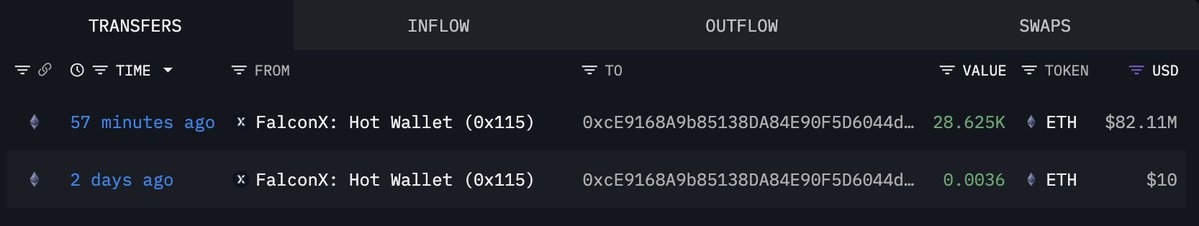

Call premium activity confirms bullish positioning, with traders paying approximately $82 million on Aug. 8 and $31.5 million on Aug. 11, consistently outpacing put premium.

Glassnode data indicated traders are paying premiums for upside convexity as Ethereum approaches record levels.

Options data shows low implied volatility despite the open interest buildup, suggesting markets expect a sharp move ahead while hedging downside risk.

Kooner, from Bitfinex, noted that compressed volatility indicates any macro shock could trigger significant price swings.

Altcoin sector shows statistical outperformance

Market-cap-weighted seven-day returns across top altcoins breached the line in a standard deviation band three times since April, marking statistically significant outperformance periods.

The magnitude and frequency highlight sustained capital rotation from Bitcoin into the altcoin sector.

The leverage buildup creates conditions where price movements can trigger cascading effects across multiple assets.

Glassnode highlighted that the broad altcoin strength reflects “an intensifying speculative bid and a market-wide appetite for higher beta exposures as momentum builds outside Bitcoin.”

Ethereum Market Data

At the time of press 10:41 pm UTC on Aug. 13, 2025, Ethereum is ranked #2 by market cap and the price is up 3.46% over the past 24 hours. Ethereum has a market capitalization of $574.2 billion with a 24-hour trading volume of $63.35 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 10:41 pm UTC on Aug. 13, 2025, the total crypto market is valued at at $4.16 trillion with a 24-hour volume of $241.62 billion. Bitcoin dominance is currently at 58.78%. Learn more about the crypto market ›

Mentioned in this article

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.