Rewrite the

Ethereum is showing early signs of recovery after a dramatic sell-off on Friday that sent prices plunging to $3,450. The drop came amid what analysts describe as the largest liquidation event in crypto market history, wiping out billions in leveraged positions across major exchanges. While bulls briefly lost control during the panic, ETH has since begun to stabilize, with renewed buying interest emerging near key demand zones.

Related Reading

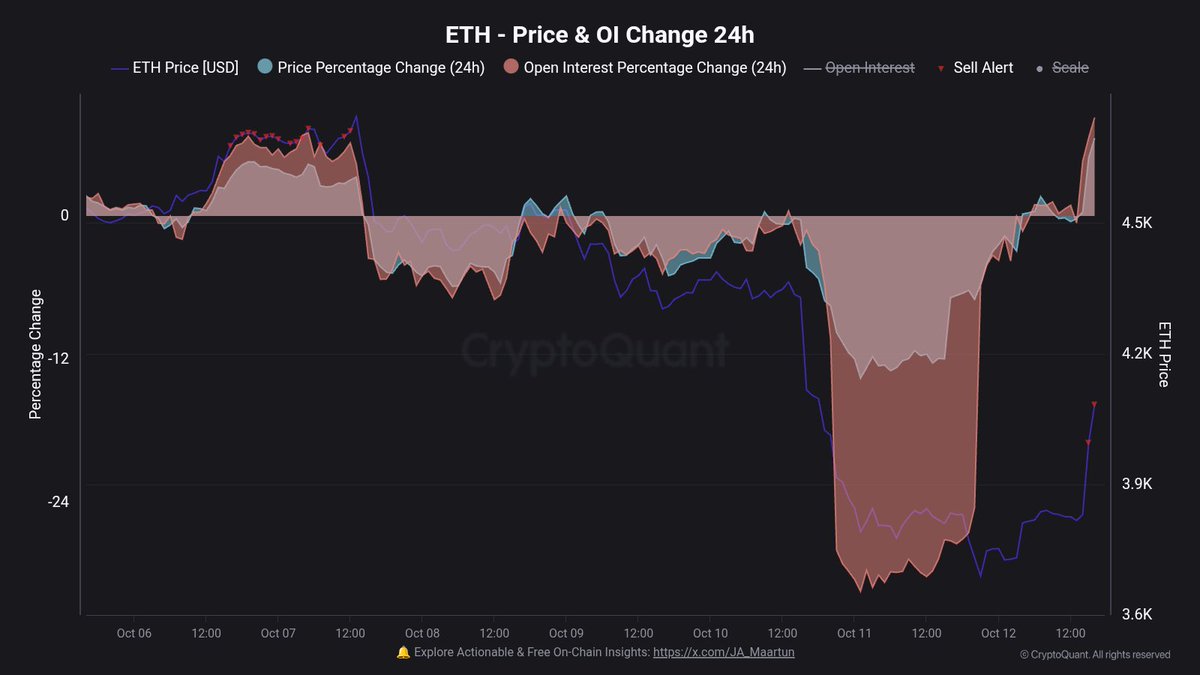

Onchain analyst Maartunn highlighted that leverage is once again building up on Ethereum, signaling that traders are returning to the market following the reset. According to his data, open interest on ETH surged significantly over the past 24 hours — a sign that speculative activity is resuming as volatility cools. This renewed leverage could set the stage for another decisive move, either fueling a short-term relief rally or inviting further liquidations if momentum fades.

The coming days will be crucial for Ethereum, as bulls attempt to reclaim the $4,000 level to confirm a sustainable recovery. Market sentiment remains cautious but optimistic, with onchain data showing large holders and institutions continuing to accumulate ETH despite recent turbulence — a potential signal of long-term confidence in the asset’s resilience.

Leverage Returns to Ethereum: A Risky Revival In Market Activity

According to Maartunn, Ethereum’s Open Interest has surged by +8.2% within the past 24 hours — a clear sign that leverage is flowing back into the market. This rapid rise comes just days after the largest liquidation event in crypto history, where overleveraged traders were wiped out during the sudden crash. Now, it seems many are trying to “trade their money back,” reigniting short-term volatility and speculation across exchanges.

Maartunn notes that while these so-called “revenge pumps” often create strong intraday rallies, they rarely sustain long-term momentum. Historically, around 75% of similar leverage-driven recoveries tend to revert, leading to renewed pullbacks once liquidity and funding rates normalize. Only about 25% manage to extend into lasting uptrends, typically when supported by fresh spot buying or renewed institutional inflows.

This data underscores the precarious balance Ethereum currently faces. The jump in Open Interest signals revived market participation, but also introduces the risk of another wave of forced liquidations if traders overextend their positions. For now, ETH’s short-term recovery remains largely fueled by derivatives activity rather than spot demand.

The next few days will be pivotal in determining Ethereum’s direction. If price holds above the $4,000 region with sustained volume, it could confirm that bulls are regaining control. However, a sudden drop in Open Interest or sharp funding spikes could signal that the rally is overextended — setting the stage for another correction.

Related Reading

Ethereum Rebounds, But Resistance Looms Ahead

Ethereum is showing a solid recovery after last week’s dramatic sell-off that drove prices down to the $3,450 level. The daily chart shows that ETH quickly rebounded from the 200-day moving average (red line), confirming it as a major area of demand. Price is now consolidating near $4,150, attempting to build momentum after a strong bullish candle on high volume — a potential sign that buyers are regaining control.

However, ETH faces immediate resistance near the $4,250–$4,300 zone, which coincides with the 50-day moving average (blue line). This area previously acted as strong support, and reclaiming it would be essential for confirming a shift back into bullish structure. The 100-day moving average (green line) is now flattening, reflecting the market’s cautious sentiment following the massive liquidation event.

Related Reading

If bulls manage to sustain price action above $4,000, the next targets lie near $4,500 and eventually $4,750. Conversely, failure to hold the 200-day MA could open the door to a deeper retest of $3,600 or lower. For now, Ethereum’s recovery remains technically constructive, but it must overcome these resistance levels to confirm that the recent rebound is more than just a short-term reaction to oversold conditions.

Featured image from ChatGPT, chart from TradingView.com

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.