Rewrite the

Ethereum (ETH) has been on an uptrend since September 28, surging from around $3,800 to the mid $4,000 range at the time of writing. According to recent data from Binance, ETH went through a “reset” during the second half of September and early October, and may now be eyeing the $5,000 price level.

Ethereum Reset Over, New Highs Soon?

According to a CryptoQuant Quicktake post by contributor Arab Chain, ETH underwent a healthy reset over the past few weeks. While the digital asset initially dropped to $3,800 – $3,900 range, it is now trading in the mid $4,000 level.

Related Reading

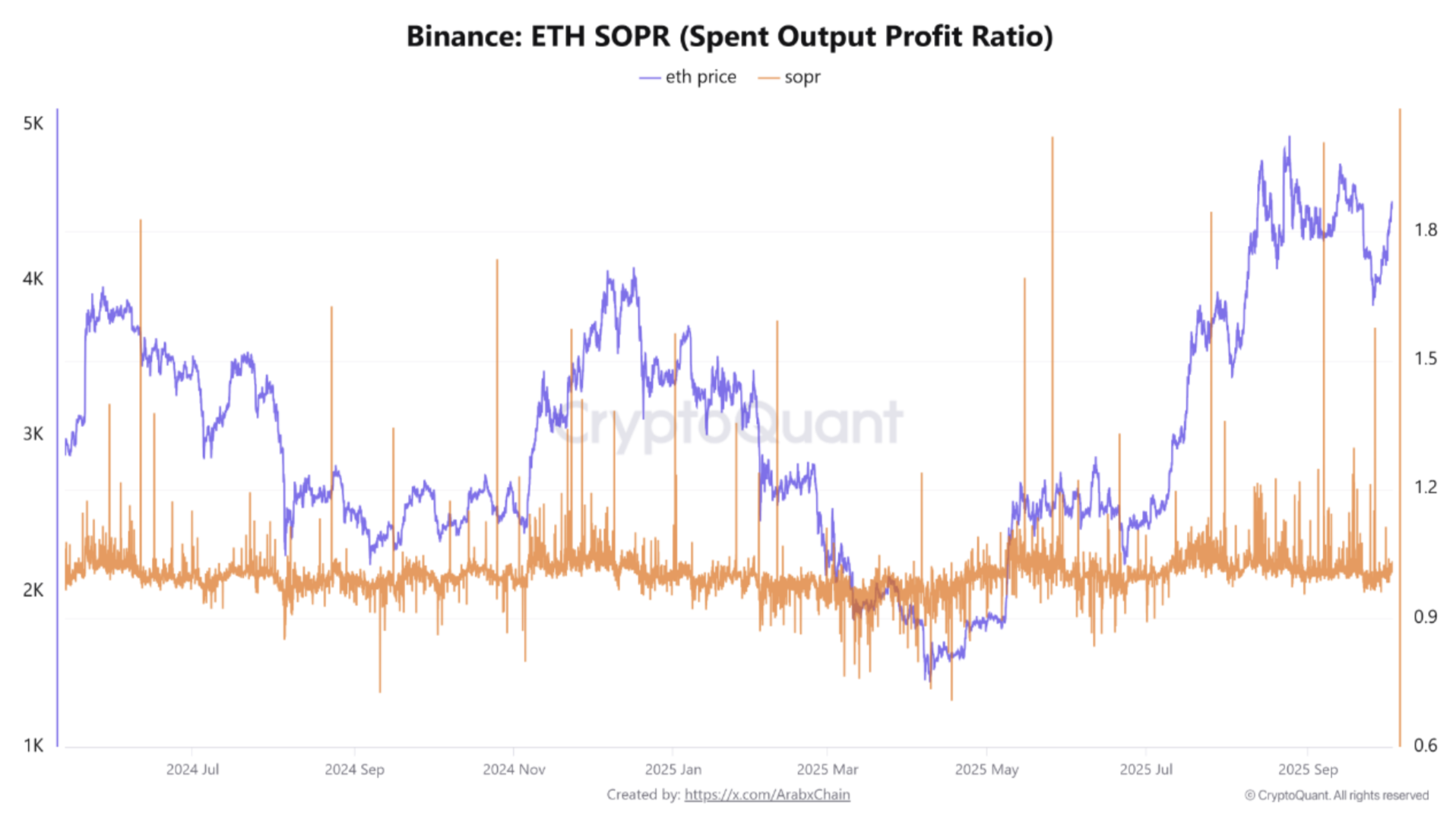

At the same time, ETH’s Spent Output Profit Ratio (SOPR) remained volatile around 1.0, with multiple spikes above one and a singular outlier, shown in the chart below. It suggests that short-term inflows are generating enough demand to meet the supply.

In simple words, any price decline is quickly reversed as long as the ETH SOPR remains above 1.0. The chart shows a local bottom created in late September near $3,800 – $3,900.

This local bottom was soon followed by a gradual rebound to $4,500. However, the reversal did not occur at once. Instead, it occurred in multiple stages, with short price corrections that did not go below previous lows.

For most of this period, the SOPR hovered between 0.98 and 1.03, a neutral range that suggests a rotation in position instead of a broad market sell-off. Although some flash highs surged above 1.0, these profit-taking bursts were quickly absorbed by the strong demand for ETH.

Currently, Ethereum is showing signs of reaccumulation. As long as any pullback keeps the SOPR at or above 1.0 and the support level at $4,000 is not breached, ETH could benefit from a continued upside scenario. Arab Chain added:

A sustained break above 4.5K would consolidate demand momentum and open the way for gradually higher targets, while a break below 4.0K with SOPR

ETH Reserves On Exchange Continue To Dwindle

Besides ETH’s bullish momentum that may propel it to $5,000, the digital asset’s reserves on crypto exchanges continue to decline. Recent analysis found that an increasing number of new ETH investors are withdrawing ETH for self-custody or staking.

Related Reading

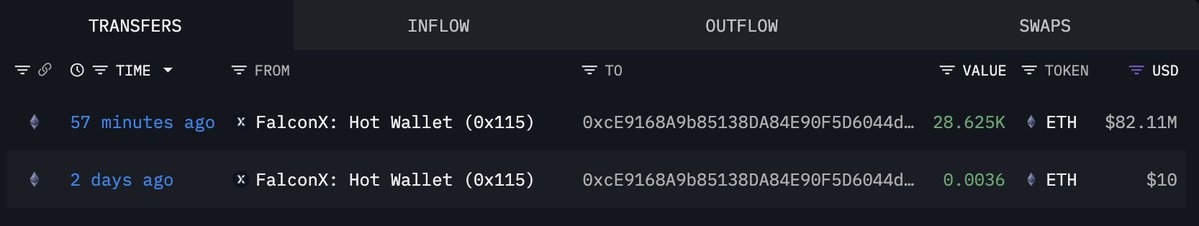

ETH whale behavior also points toward a potential upcoming price rally for the cryptocurrency. Recently, ETH whales scooped as much as $1.73 billion worth of ETH, sending exchange balances to a nine-year low.

From a technical standpoint, Ethereum’s Relative Strength Index (RSI) recently gave a rare bullish signal, suggesting a potential price appreciation to $8,000. At press time, ETH trades at $4,471, up 2.6% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.