Here is the rewritten content in a well-organized HTML format with all tags properly closed:

Ethereum Price Analysis: The Risks of Falling if it Loses this Key Support Level

The Ethereum price has been highly volatile lately, moving between the $2,600 and $2,300 range. However, amidst this, a prominent crypto market expert has highlighted a key support level, falling below which could trigger a further selloff in the ETH market, potentially dragging its price down.

Ethereum Price At Risk Of Further Decline

In a recent analysis, shared on X, renowned crypto expert Ali Martinez identifies $2,300 as a crucial support level for the Ethereum price. He notes that more than 2.4 million addresses have purchased 5.6 million ETH at this level.

Having said that, he predicts that if Ether falls below this level, it could trigger a selloff, as investors might choose to minimize their losses. In other words, Martinez issues a stark warning that falling below the $2.3K level could lead to a further dip in ETH price.

Another Analysis Highlights Similar Concerns

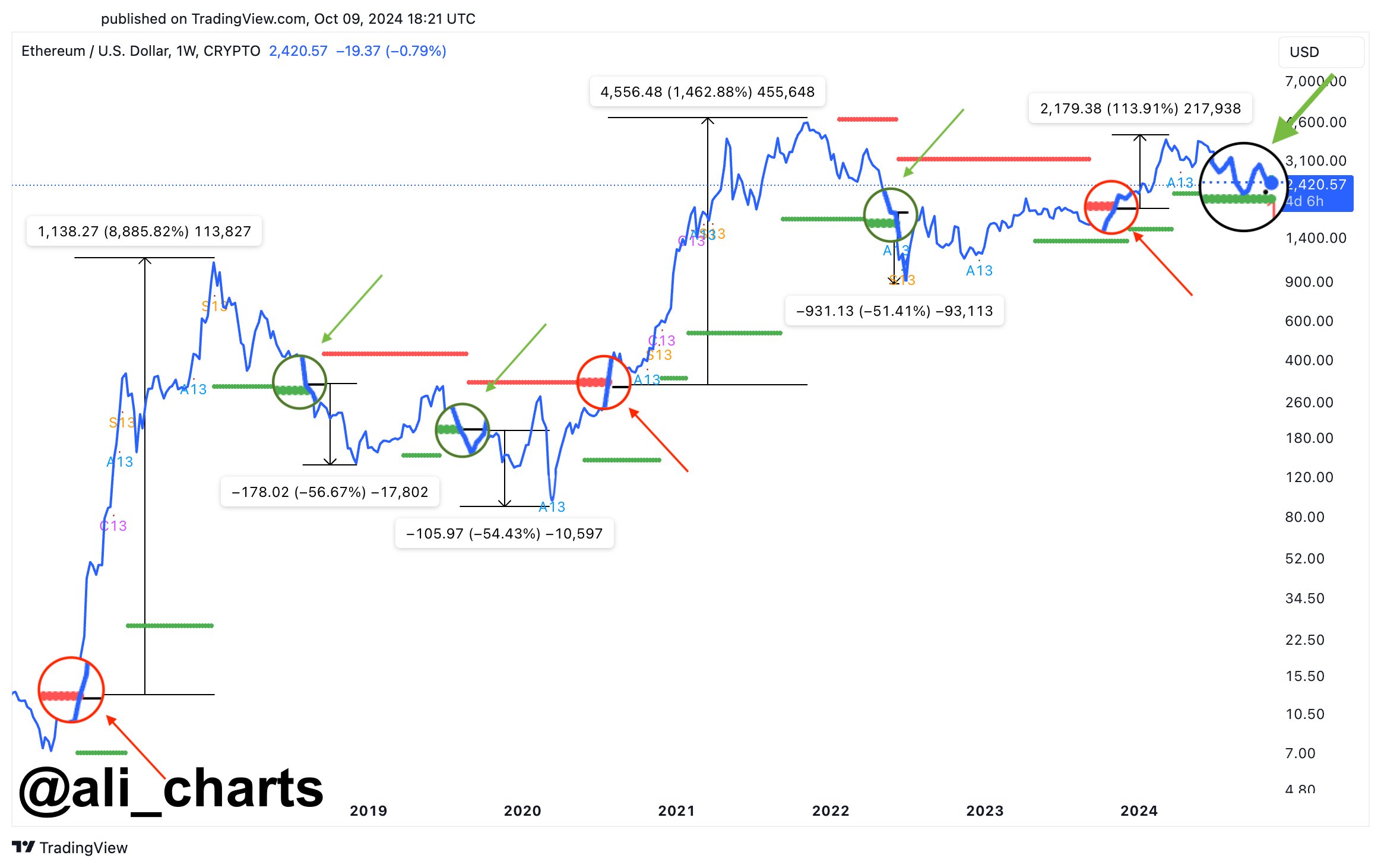

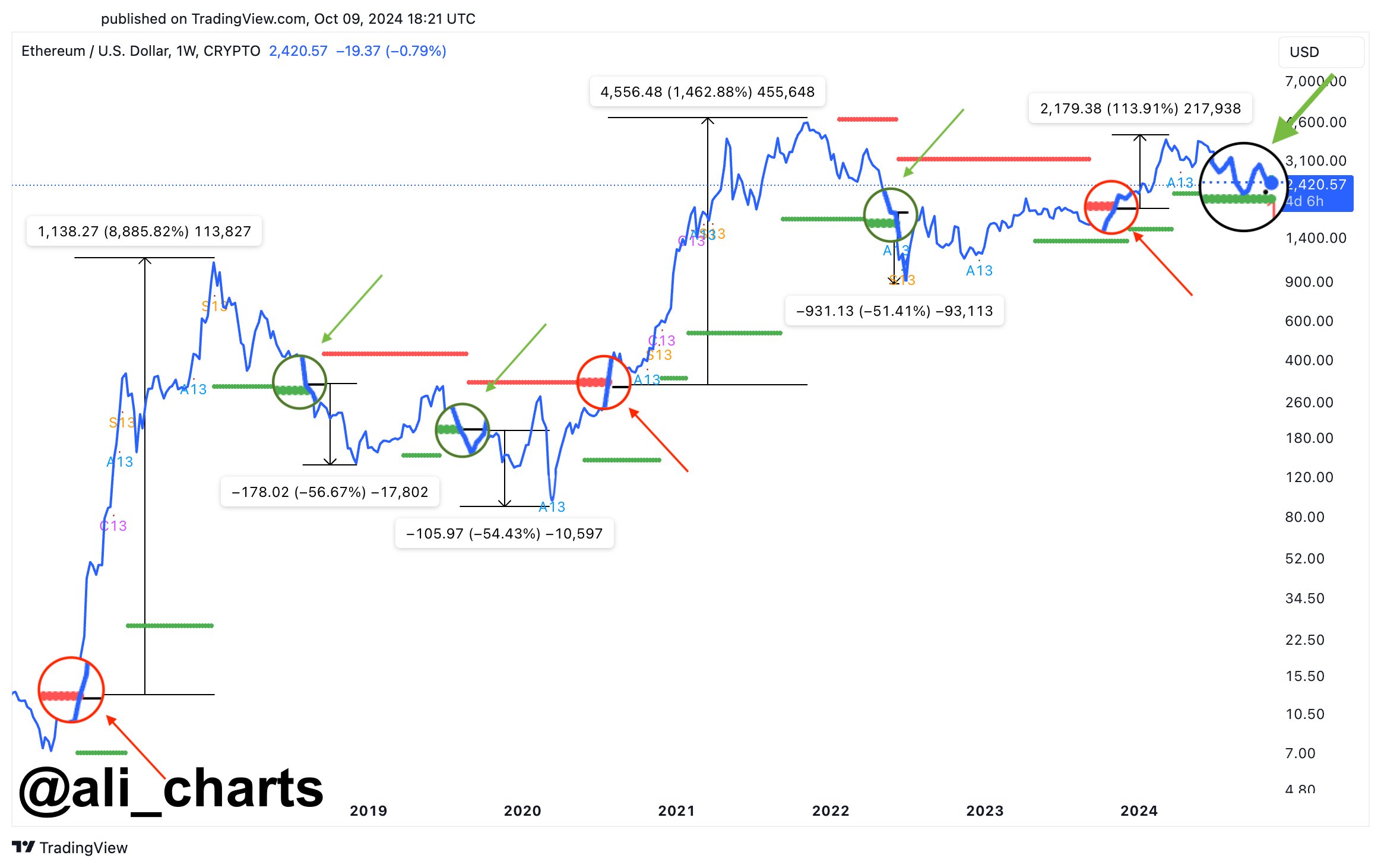

In another analysis, Martinez notes that Ether tends to see a strong correlation whenever it breaks below its TD setup support trendline. Considering past patterns, the average of such drops is around 53%, which could cause trouble for the crypto. In this analysis, he notes that if the second-largest crypto by market cap loses the $2,250 support, a significant price drop may follow.

Bulls Remain Optimistic

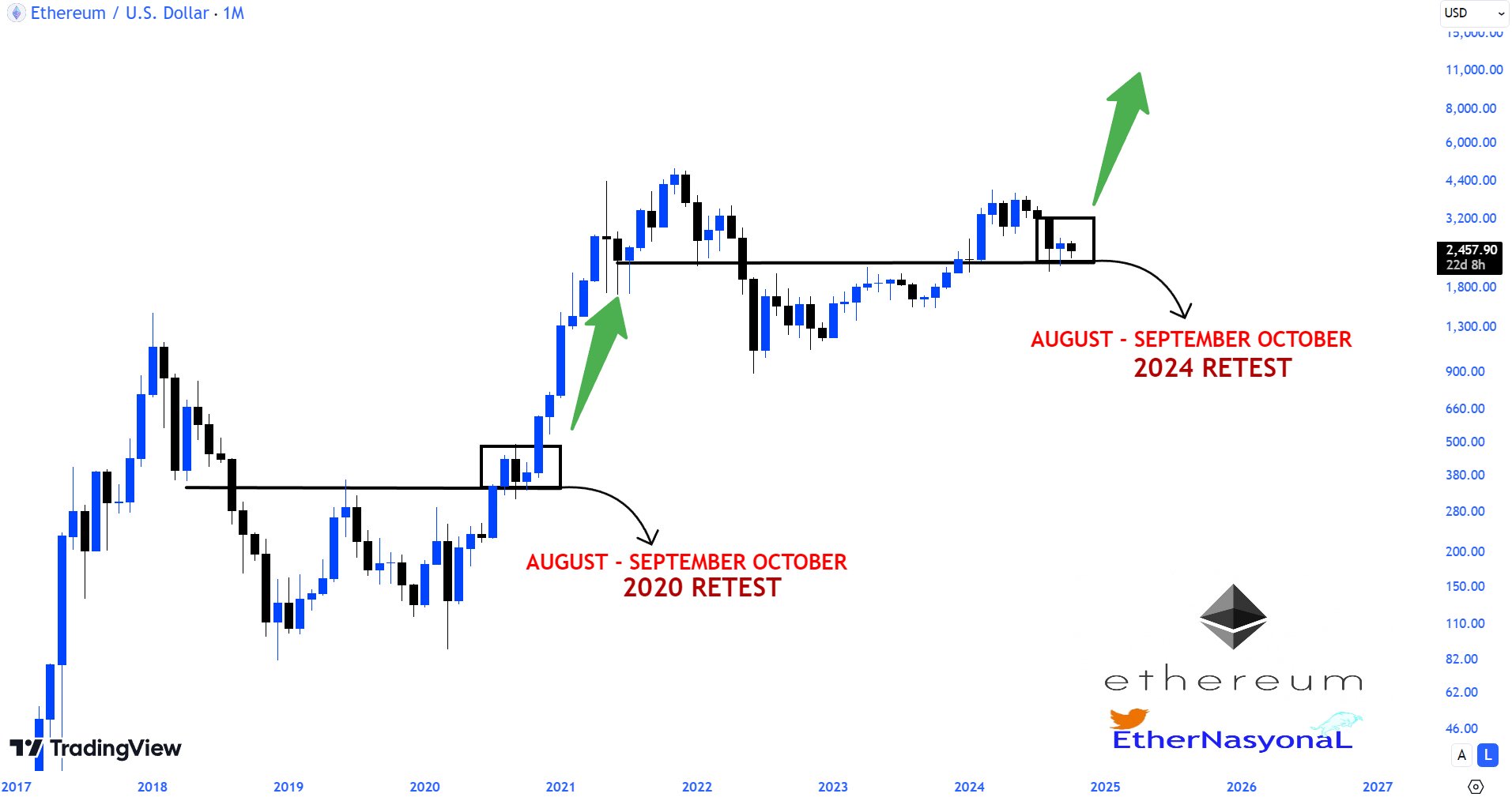

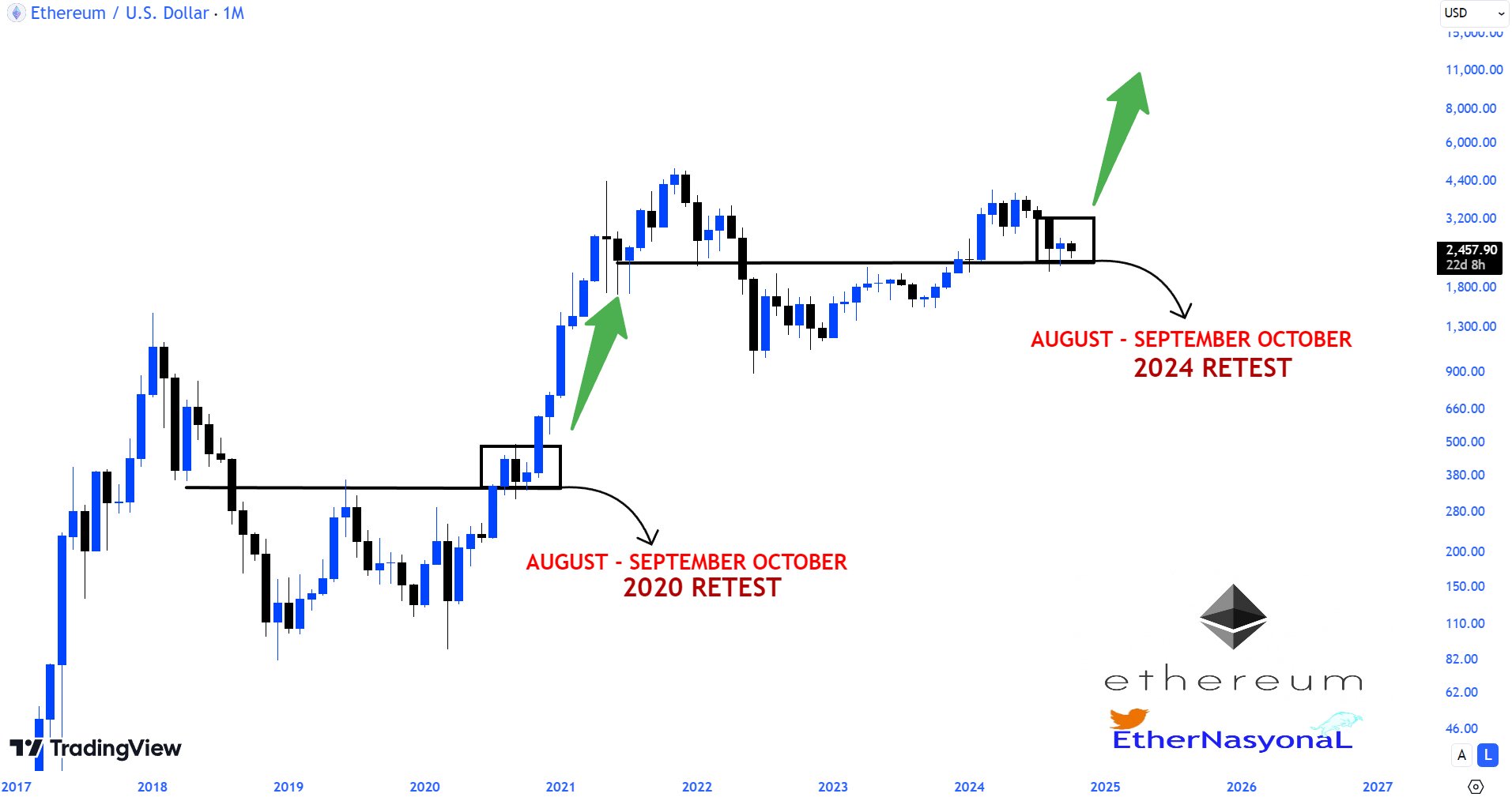

However, despite these concerns, some analysts have remained bullish on the crypto’s long-term potential. A popular crypto analyst, known as EᴛʜᴇʀNᴀꜱʏᴏɴᴀL on X, suggests that Ethereum is now at the final stage of its accumulation process, readying for a major bull run in 2025. He has cited historical trends to support his comments.

What’s Next for ETH Price?

The Ethereum price has been highly volatile over the past few days, as evidenced by its recent performance. In addition, the slowing US Spot Ether ETF inflows have also sparked concerns over the shifting interest of market participants from ETH to other top altcoins.

However, despite this, many in the crypto market remain bullish on the second-largest crypto by market cap. Historical data indicates that the crypto market tends to showcase a positive performance in the final quarter of the year. Besides, the upcoming US Presidential Election is also likely to boost the ETH price in the coming days.

Conclusion

In conclusion, the Ethereum price is at a critical juncture, with a key support level at $2,300. If it falls below this level, it could trigger a further selloff, which could drag its price down. However, some analysts remain optimistic about the crypto’s long-term potential, citing historical trends and patterns.

FAQs

- What is the current market situation for Ethereum?

The Ethereum price is currently highly volatile, moving between $2,600 and $2,300. - What is the key support level for the Ethereum price?

The key support level is $2,300, which could trigger a further selloff if broken. - What are the potential implications of falling below this level?

Falling below $2,300 could lead to a further dip in the ETH price. - Are there any analysts who remain optimistic about the crypto’s long-term potential?

Yes, some analysts believe that Ethereum is at the final stage of its accumulation process, readying for a major bull run in 2025. - What factors could impact the Ethereum price in the coming days?

The US Presidential Election and historical trends could both impact the ETH price in the coming days.