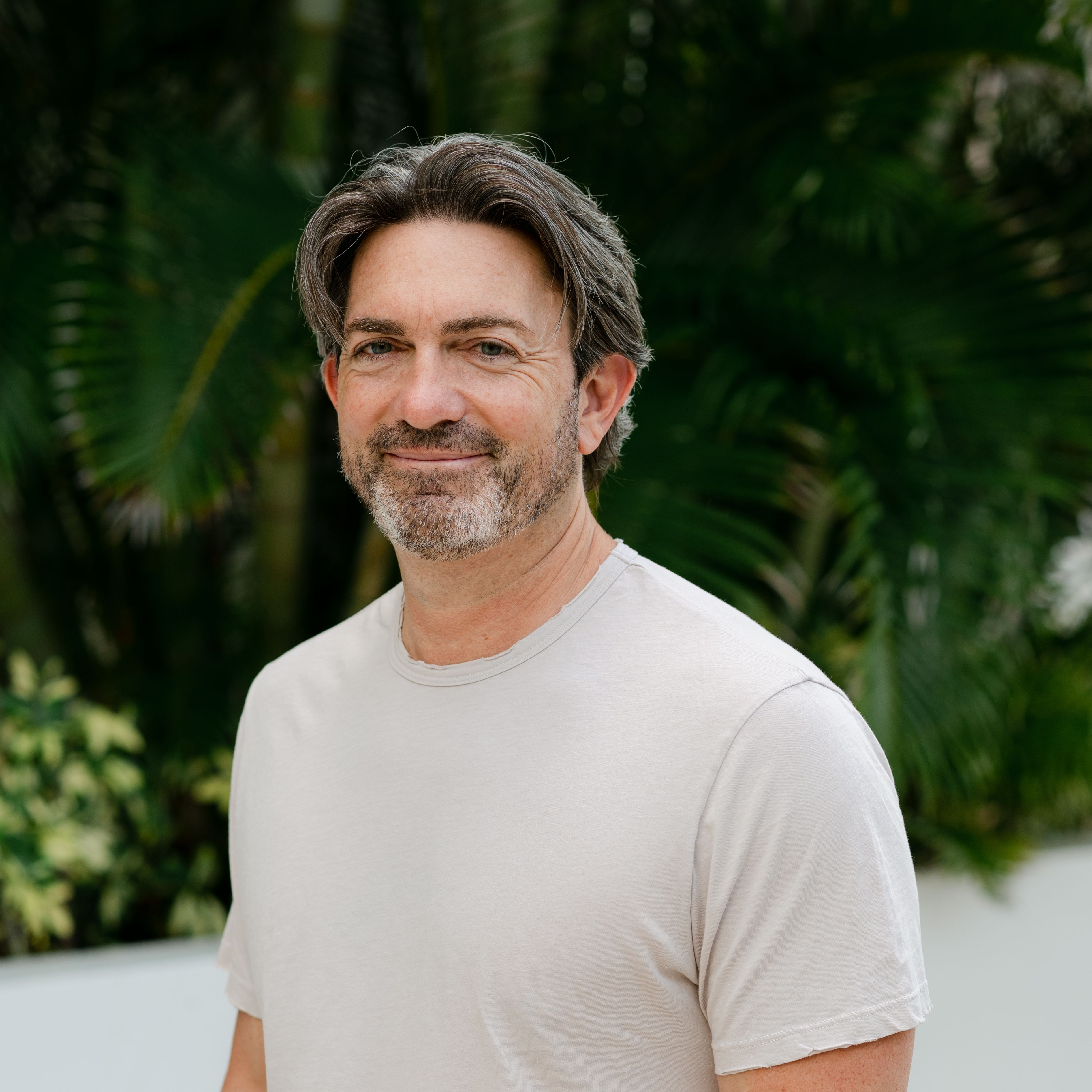

Lorien Gabel: Building the Future of Staking

Early Days of Figment

Lorien Gabel has spent decades building internet infrastructure companies, from ISPs to cloud security firms. In 2018, recognizing the transformative potential of proof-of-stake networks, he co-founded Figment, which has since become one of the world’s largest independent staking providers. The company offers technology and services that enable users to stake their tokens without having to use a centralized exchange or custodian.

Scaling Figment

Today, the company manages $15 billion in assets and serves over 500 institutional clients. While employee count isn’t always a meaningful metric, Figment has about 130 employees and expects to reach 150 by year-end. Asia is the company’s next big expansion focus, with the opening of a Singapore office last year and plans to add Japan, Hong Kong, and other key markets.

Challenges in Asia

The company faces challenges in Asia, including navigating vastly different economies and regulatory landscapes. "Asia isn’t one market – it’s a collection of vastly different economies and regulatory landscapes," Gabel notes. "We’ve always been compliance-focused, working only with institutional clients rather than retail users. But in Asia, compliance varies widely by country. Unlike the U.S., where you primarily navigate SEC and CFTC rules, each Asian market has its own regulators and policies."

Education and Customer Demand

Education is another challenge in Asia, as many investors are unfamiliar with staking. "In many Asian markets, staking is not well-defined and is sometimes misconstrued as DeFi lending," Gabel explains. "We spend a lot of time at conferences, client meetings, and media interviews explaining what staking is and why institutions should consider it over riskier yield-generating alternatives."

Staking Trends and Innovations

Some of the most exciting trends in staking right now include liquid staking and re-staking, with EigenLayer leading the charge globally in these areas and having a strong presence in Asia. Bitcoin staking is another area of interest, with projects like Babylon exploring its potential, though demand remains uncertain. Additionally, Figment is actively supporting BTC staking while closely monitoring new staking models emerging from Asia.

Ensuring Competitive Returns

Figment focuses on providing the highest risk-adjusted staking rewards. "Staking is not the highest-yield activity in crypto, but it’s the safest way to earn yield without counterparty risk," Gabel notes. "We focus on providing the highest risk-adjusted staking rewards. While some providers chase higher returns by cutting corners (e.g., ignoring OFAC compliance or MEV risks), our clients – mainly institutions – prioritize security and compliance."

Conclusion

In conclusion, Figment has established itself as a leading independent staking provider, with a strong focus on security, compliance, and institutional clients. As the company continues to expand into Asia, it will be interesting to see how it navigates the complex regulatory landscape and educates investors on the benefits of staking.

FAQs

Q: What led you to start Figment?

A: We saw a natural alignment between our expertise in network security, cloud infrastructure, and scaling B2B solutions and what proof-of-stake (PoS) could become. If PoS gained traction, we believed our experience in building secure, institutional-grade networks would be invaluable.

Q: How large is Figment now?

A: We currently manage $15 billion in staking assets and serve over 500 institutional clients.

Q: What challenges do you see to Asia’s adoption of staking compared to other regions?

A: Asia isn’t one market – it’s a collection of vastly different economies and regulatory landscapes. We’ve always been compliance-focused, working only with institutional clients rather than retail users. But in Asia, compliance varies widely by country.

Q: How do you decide which tokens to support for staking?

A: We have an evaluation framework that we’ve refined over the past six years. Since we can only support a limited number of new tokens each year, we have to be selective – last year, we added support for 12 or 13, which is quite a lot given the complexity of each integration.

Q: Are there any staking-related trends or innovations in Asia that excite you?

A: Some of the most exciting trends in staking right now include liquid staking and re-staking, with EigenLayer leading the charge globally in these areas and having a strong presence in Asia.