Rewrite the

Ethereum (ETH) is trading at critical levels after a sharp rally from $3,800 to $4,700 in just a few days, marking one of its strongest moves in recent months. The swift rebound highlights renewed strength from bulls, who now appear firmly in control of the market’s short-term direction. As ETH approaches key resistance zones, analysts are closely watching whether the second-largest cryptocurrency can sustain its momentum and confirm a breakout above the current range.

Related Reading

This impressive move is not just driven by market sentiment but also by robust on-chain fundamentals. Institutional participation in Ethereum continues to rise, with inflows from funds and treasuries steadily increasing over the past weeks. Meanwhile, staking activity remains high, suggesting that long-term investors are showing confidence in ETH’s network security and yield potential despite volatility in broader markets.

The combination of growing institutional demand and sustained staking confidence provides a solid foundation for Ethereum’s next phase of growth. If bulls maintain control and price holds above $4,500, analysts believe ETH could be gearing up for another leg higher, potentially entering a new expansion cycle as the broader crypto market follows Bitcoin’s renewed bullish momentum.

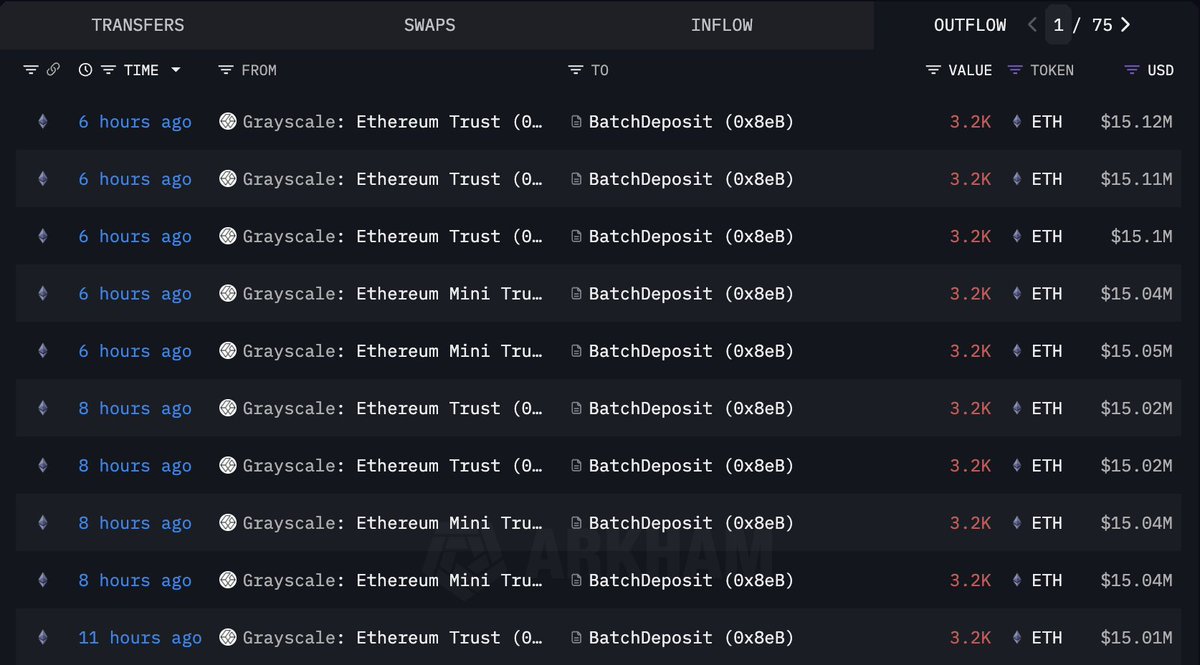

Grayscale Stakes $150M in Ethereum

According to onchain data from Lookonchain, Grayscale (ETHE and ETH ETF) staked 32,000 ETH, worth approximately $150.56 million, earlier today. This move represents one of the largest institutional staking transactions in recent weeks and signals growing confidence among major players in Ethereum’s long-term value proposition. The decision to allocate such a significant amount of ETH to staking underscores the continued institutional belief in Ethereum’s dual role as both a technology platform and a yield-generating asset.

Staking Ethereum locks coins within the network, effectively reducing liquid supply while contributing to network security and stability. When large holders like Grayscale commit such capital, it demonstrates conviction in the sustainability of Ethereum’s staking economy and its role within future financial infrastructure. Analysts interpret this as a strong bullish signal, especially amid rising institutional demand for tokenized assets and DeFi exposure built on the Ethereum network.

Moreover, Grayscale’s move aligns with the broader trend of institutional staking growth, where funds and asset managers increasingly leverage staking yields as an alternative income strategy. This reinforces Ethereum’s position as the backbone of decentralized finance and a key component of institutional crypto portfolios.

Combined with renewed bullish sentiment across the crypto market, Grayscale’s staking decision adds weight to the narrative that Ethereum remains undervalued relative to its fundamental strength and adoption. If momentum sustains, this event could mark the beginning of a new accumulation phase — one driven not by speculation, but by institutional conviction in Ethereum’s evolving economic and technological dominance.

Related Reading

Bulls Regain Momentum Above $4,600

Ethereum is currently trading around $4,688, showing renewed bullish strength after a sharp recovery from the $3,800 region earlier this month. The chart highlights a clear upward structure, with ETH reclaiming both the 50-day and 100-day moving averages, confirming a short-term trend reversal. Buyers have regained control, and the price now approaches the critical resistance zone between $4,700 and $4,800, which previously marked a major rejection area in late August.

A decisive daily close above $4,700 could pave the way for a test of $5,000, potentially leading to a new phase of price discovery if momentum holds. The sustained higher lows since late September further indicate accumulation rather than distribution, suggesting that investors are positioning for continuation rather than taking profits.

Related Reading

From a broader perspective, Ethereum’s recent surge coincides with Bitcoin’s move above all-time highs and growing institutional participation. This correlation, combined with Grayscale’s recent 32,000 ETH stake, reinforces the bullish case for ETH’s medium-term outlook. However, short-term traders should monitor the $4,400 support, as a breakdown below this level could delay further upside. Overall, Ethereum’s technical structure looks strong, with clear momentum and market confidence returning as it eyes another breakout attempt.

Featured image from ChatGPT, chart from TradingView.com

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.