Bitcoin Miner Hut 8 Records $331 Million in Net Income in 2024

Overview

Hut 8, a leading bitcoin mining firm, has announced its financial results for 2024, revealing a net income of $331 million. The company’s success can be attributed to the significant rise in bitcoin’s price over the year.

Reserve and Collateral

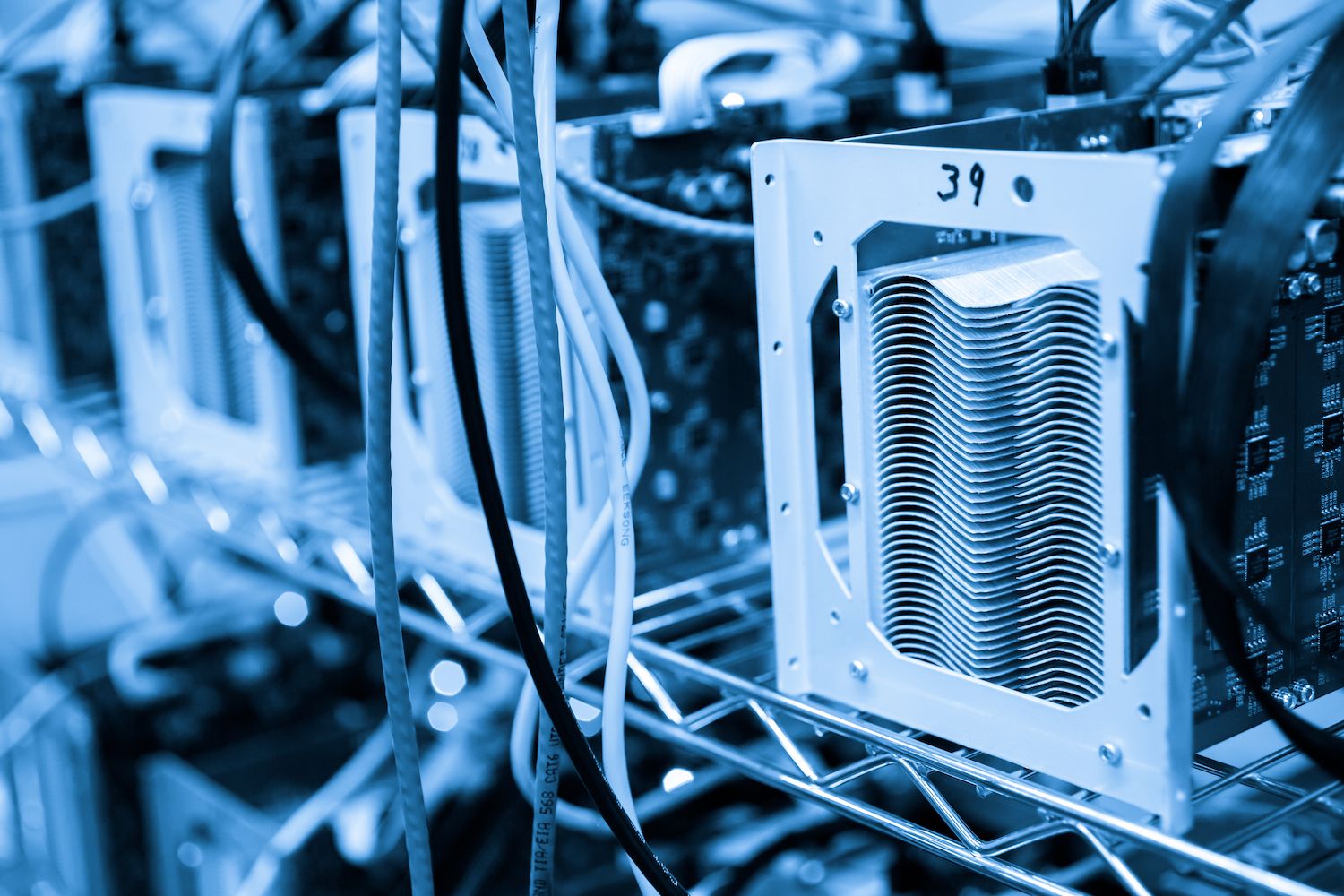

As of the end of 2024, Hut 8 held a reserve of 10,171 bitcoin (BTC), worth approximately $905 million at the time of writing. The majority of this reserve has been pledged as collateral to acquire more ASIC mining machines.

Energy Costs

The company experienced a substantial reduction in energy costs, with fourth-quarter costs per megawatt-hour dropping by 30% from the previous year to $31.63. Hut 8 operated approximately 1,020 MW at the end of December and has over 12,300 MW in the pipeline.

Strategic Partnerships

Hut 8 deepened its relationship with Bitmain, one of the largest bitcoin mining firms in the world. The company secured a colocation deal with Bitmain, expected to generate $125 million in annual revenue, and is also teaming up with the firm to develop a next-generation ASIC miner.

AI Infrastructure Investments

Hut 8 is expanding its AI infrastructure investments. Its subsidiary, Highrise AI, signed a five-year customer agreement for GPU-as-a-Service. The company also closed a $150 million strategic investment from Coatue to support AI development.

Financial Performance

As a result of its strong performance, Hut 8’s stock is down 7.25% on the day, bringing its valuation to $1.5 billion.

Conclusion

Hut 8’s impressive financial results are a testament to its ability to adapt to the rapidly evolving bitcoin mining landscape. The company’s strategic partnerships, reduced energy costs, and AI infrastructure investments have positioned it for continued success in the years to come.

FAQs

Q: What was Hut 8’s net income in 2024?

A: Hut 8 reported a net income of $331 million in 2024.

Q: What is the company’s current bitcoin reserve?

A: As of the end of 2024, Hut 8 held a reserve of 10,171 bitcoin (BTC), worth approximately $905 million at the time of writing.

Q: What is the company’s plan for its bitcoin reserve?

A: The majority of Hut 8’s bitcoin reserve has been pledged as collateral to acquire more ASIC mining machines.

Q: How has Hut 8 reduced its energy costs?

A: The company experienced a 30% reduction in energy costs per megawatt-hour in the fourth quarter, dropping to $31.63.

Q: What are Hut 8’s plans for its AI infrastructure investments?

A: The company is expanding its AI infrastructure investments through its subsidiary, Highrise AI, and has signed a five-year customer agreement for GPU-as-a-Service. Hut 8 has also received a $150 million strategic investment from Coatue to support AI development.