TL;DR

- Solana (SOL) tanked by 15% daily amid market-wide panic from the global trade war, with analysts predicting a potential drop to as low as $60.

- Earlier this month, Solana witnessed a major token unlock and whale sell-offs, adding to the selling pressure.

- The asset’s price collapse comes less than three months after its all-time high of almost $290, registered shortly before Donald Trump’s inauguration as the 47th President of the United States.

How Worse Can It Get?

Solana (SOL) is among the worst-affected cryptocurrencies following the latest crash of the digital asset market. Its price briefly collapsed below $100 for the first time since February 2024 before slightly rebounding to the current $101 (per CoinGecko’s data). The asset’s major pullback comes less than three months after its all-time high of almost $290, registered shortly before Donald Trump’s inauguration as the 47th President of the United States. The surge back then was partially fueled by the frenzy surrounding some Trump-themed meme coins, which are based on Solana’s blockchain.

Ironically, the POTUS, or more specifically, the trade war he declared to the rest of the world, appears to be the main factor behind the recent bloodbath in the crypto market and SOL’s crash. Several renowned analysts noted the asset’s plunge, predicting further pain for the bulls in the short term. Ali Martinez believes SOL’s dive below $114 could be followed by a slump to as low as $60. This would represent a roughly 40% decline from the current valuation. Another person, using the X moniker Crypto_Jobs, assumed that Solana could find a "key bottom level" at approximately $68-$70.

The Retreat of the Whales

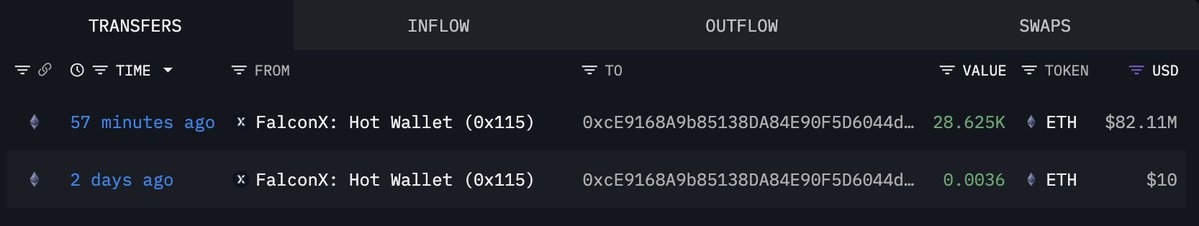

Earlier this month, a total of $200 million worth of Solana tokens were unlocked, which, according to Arkham Intelligence, marked "the largest single-day unlock of staked SOL until 2028." Prior to the event, some big investors unstaked and offloaded millions of assets. Those developments are typically considered bearish in the short term since they increase Solana’s circulating supply, which currently stands at over 515 million tokens. The whales’ actions could also spark panic in the community, prompting smaller investors to follow suit and further amplify the selling pressure.

SOL’s recent price decline coincides with a gradual decrease in the total value locked (TVL) in the ecosystem and its DEX volume. Those developments generally signal low user engagement, diminishing traders’ confidence, and lower liquidity. It is essential to note that Solana’s TVL is measured in USD, meaning that if the price of the underlying token drops, the metric automatically goes down even if the same amount of SOL stays locked. DefiLlama’s data shows that the indicator hit an ATH of almost $12 billion at the end of January, while currently, it is less than $6 billion.

Conclusion

Solana’s recent price collapse and the subsequent predictions of further pain for the bulls in the short term are significant concerns for investors. The asset’s circulating supply has increased, and the whales’ actions have sparked panic in the community, prompting smaller investors to follow suit and further amplify the selling pressure. The retreat of the whales and the decrease in TVL and DEX volume are also contributing factors to Solana’s decline.

FAQs

Q: What caused Solana’s recent price collapse?

A: The trade war declared by Donald Trump appears to be the main factor behind the recent bloodbath in the crypto market and Solana’s crash.

Q: How much has Solana’s price fallen?

A: Solana’s price has fallen by 15% daily amid market-wide panic from the global trade war, with analysts predicting a potential drop to as low as $60.

Q: What is the current circulating supply of Solana tokens?

A: Solana’s circulating supply currently stands at over 515 million tokens.

Q: What is the total value locked (TVL) in the Solana ecosystem?

A: Solana’s TVL is less than $6 billion, a significant decrease from its ATH of almost $12 billion at the end of January.

Q: What are the implications of the whales’ actions on Solana’s price?

A: The whales’ actions have sparked panic in the community, prompting smaller investors to follow suit and further amplify the selling pressure.