Rewrite the

The crypto market faced a violent downturn, with Ethereum breaking below the $3,100 level while Bitcoin lost the critical $100,000 mark, triggering widespread liquidation and fear-driven selling. Panic quickly rippled across the market, and sentiment flipped sharply bearish as traders rushed to reduce exposure, price targets vanished from social media, and risk assets saw a cascade of exits. In moments like these, emotions often outweigh fundamentals — and this week was a clear reminder of that dynamic.

Related Reading

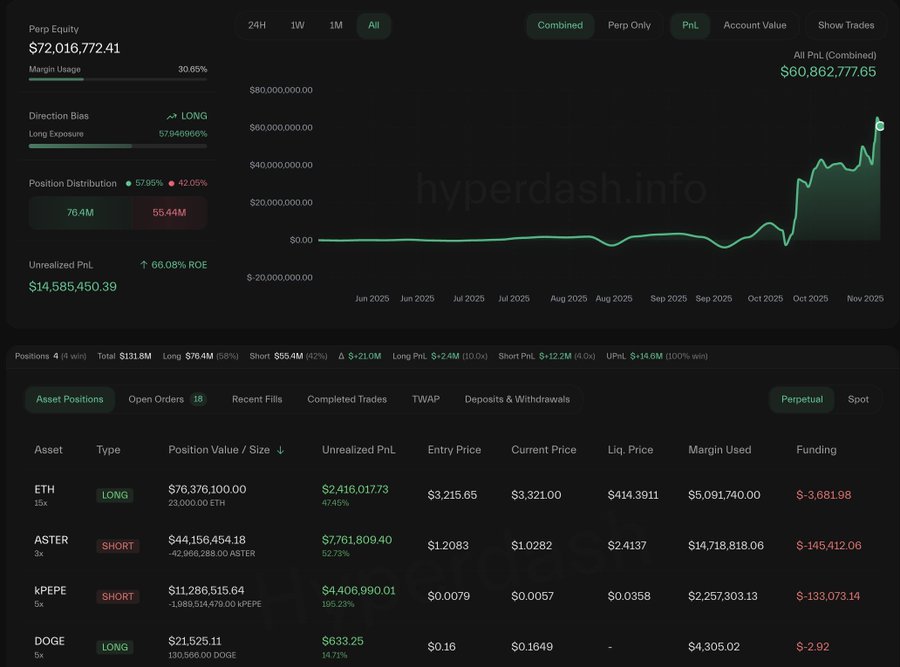

However, even in periods of sharp fear, not all market participants behave the same. Some notable players have begun shifting their stance, hinting that strategic positioning may already be underway beneath the panic. Among them is the well-known Anti-CZ Whale — a trader who gained attention after aggressively shorting ASTER immediately following Changpeng Zhao’s public post announcing he bought ASTER. That trade paid off massively as ASTER surged briefly and then retraced sharply, delivering this whale tens of millions in unrealized profit.

Now, in a notable shift, this trader has flipped from shorting Ethereum to going long, signaling renewed conviction despite the market’s emotional breakdown. As fear peaks, sophisticated players may already be preparing for the next phase — raising the question: is this capitulation… or opportunity?

Whale Rotates Into ETH Long as Market Panic Peaks

According to Lookonchain, the well-known Anti-CZ Whale has executed a notable portfolio shift, flipping from shorting Ethereum to taking a long position worth 32,802 ETH (~$109 million). Now, the whale is maintaining a 58.27M ASTER short (~$59.7M), signaling conviction that ASTER’s weakness may continue despite recent volatility.

Alongside this, the whale holds a 1.99B kPEPE short (~$11.3M), a bet against speculative memecoin flows during uncertainty. Meanwhile, a small 130,566 DOGE long (~$21.5K) appears more symbolic than directional, likely serving as a hedge or sentiment gauge rather than a major conviction play.

The standout move is clearly the ETH long, signaling the whale views Ethereum’s drop below $3,100 as oversold rather than structurally bearish. Taking such a position during peak fear suggests an expectation of recovery once forced liquidations cool and liquidity stabilizes. While broader sentiment remains fragile, this shift implies sophisticated capital may already be positioning for an eventual rebound — reinforcing ETH’s role as a core asset even amid aggressive market stress.

Related Reading

ETH Price Technical Outlook: Testing Key Support as Panic Selling Eases

Ethereum is attempting to stabilize after a steep breakdown below the $3,500 region, with price now reacting around the $3,300 zone. This level aligns closely with the 200-day moving average (red line), making it a critical support area for bulls to defend. The recent candle structure shows heavy volatility and high sell-side volume, confirming panic-driven liquidations as the primary force behind the move — rather than a fundamental shift in trend.

The aggressive flush followed a series of lower highs throughout October, signaling weakening momentum before the breakdown. The 50-day and 100-day moving averages (blue and green) are trending down and currently overhead, adding pressure and reinforcing the short-term bearish structure. A recovery above the 50-day MA would be an early sign of strength, but Ethereum must reclaim the $3,500 zone to regain bullish control.

Related Reading

Volume has spiked dramatically, suggesting capitulation behavior — often near cycle pivot points. The wick near $3,150 hints that buyers stepped in aggressively at lows, consistent with accumulation dynamics observed among sophisticated traders. If ETH holds above the 200-day MA and builds a base here, it could set up a relief rally. A sustained break below $3,150, however, risks further downside toward $2,900 as liquidity pockets remain thin below current levels.

Featured image from ChatGPT, chart from TradingView.com

in well organized HTML format with all tags properly closed. Create appropriate headings and subheadings to organize the content. Ensure the rewritten content is approximately 1500 words. Do not include the title and images. please do not add any introductory text in start and any Note in the end explaining about what you have done or how you done it .i am directly publishing the output as article so please only give me rewritten content. At the end of the content, include a “Conclusion” section and a well-formatted “FAQs” section.