Yield Generation Strategy for Dogecoin Holdings

Canadian Investment Firm Adapts MicroStrategy’s Bitcoin Reserve Strategy with Dogecoin

A Canadian investment firm, Spirit Blockchain Capital, has revealed plans to earn yield on its Dogecoin (DOGE) coins, with future ambitions to potentially offer products based on other major cryptocurrencies as investors look for new ways to get higher returns on their tokens.

Spirit Blockchain Capital, a publicly traded company, said in a statement that it intends to leverage its Dogecoin holdings through the new yield-generating strategy. The company stated that the move will enable it to deliver value to its shareholders, in addition to expanding its treasury efficiency and enhancing the decentralized financial product adoption.

Yield Generation Strategy for Other Cryptocurrencies

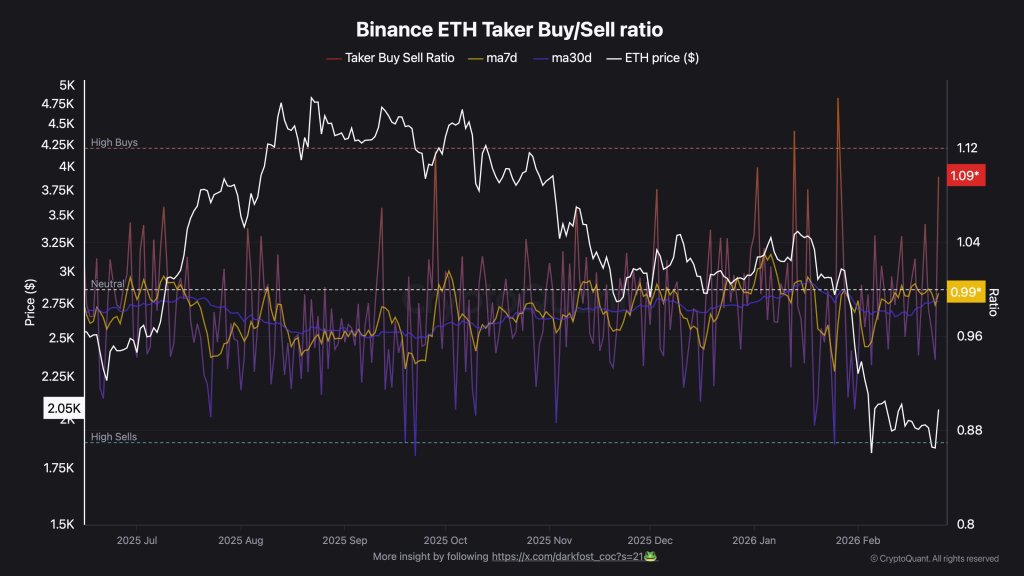

The initiative will serve as the bedrock for the company to launch potential yield-bearing strategies for other assets such as Bitcoin, Ethereum, Tether, and Solana in the future, according to Spirit CEO Lewis Bateman.

“We aim to unlock a previously untapped revenue stream while simultaneously positioning ourselves as a market leader in yield generation for not only Dogecoin, but the broader digital asset space,” Bateman said.

Unclear Details on Yield Generation

However, the company did not provide clear details on how exactly it plans to generate yield on its DOGE treasury, and did not respond to Decrypt’s requests for comment. Spirit Blockchain Capital did not announce an exact date for its yield-bearing strategy’s rollout.

Background on Spirit Blockchain Capital

The company’s announcement comes a few months after it acquired Dogecoin Holdings, a firm that is amassing DOGE as a treasury reserve asset. Spirit previously declined to disclose the size of its Dogecoin treasury to Decrypt, citing regulatory guidelines for its acquisition.

Yield-Bearing Financial Instruments

Yield-bearing financial instruments such as stablecoins have gained steam during this latest crypto market rally, with several major companies rolling out new tokens in recent months to meet sky-high investor demand.

Crypto investors can also earn yield on assets through such measures as staking—or locking up assets within a proof-of-stake network to earn interest-like token rewards—or pledging assets to crypto lending services.

Conclusion

Spirit Blockchain Capital’s yield generation strategy for Dogecoin and potential future yield-bearing strategies for other cryptocurrencies may provide a new avenue for investors to earn higher returns on their tokens. However, the company’s lack of clarity on its yield generation plans and the absence of a specific rollout date may raise concerns among investors.

FAQs

- What is Spirit Blockchain Capital’s yield generation strategy for Dogecoin? The company plans to leverage its Dogecoin holdings through a new yield-generating strategy, but did not provide clear details on how it will generate yield.

- Will Spirit Blockchain Capital offer yield-bearing strategies for other cryptocurrencies? Yes, the company plans to launch potential yield-bearing strategies for other assets such as Bitcoin, Ethereum, Tether, and Solana in the future.

- When will Spirit Blockchain Capital’s yield-bearing strategy be rolled out? The company did not announce a specific date for its yield-bearing strategy’s rollout.

- How will Spirit Blockchain Capital generate yield on its DOGE treasury? The company did not provide clear details on its yield generation plans.