SEC Drops Case Against Token Metrics CEO Ian Balina

Background

Ian Balina, CEO of Token Metrics, has been involved in a three-year legal battle with the US Securities and Exchange Commission (SEC) over allegations of violating US securities laws. The charges stemmed from a September 2022 order, which claimed that Balina failed to disclose compensation received while promoting the Sparkster (SPRK) initial coin offering (ICO).

Update: SEC Drops Case Against Balina

According to a recent tweet by Balina, the SEC has dropped its case against him. This development comes as a relief to Balina, who has consistently maintained that the charges were unfounded and unjust.

The Charges

The SEC’s original complaint alleged that Balina received a 30% bonus on his $5 million investment in SPRK tokens but failed to disclose this consideration when promoting the tokens to his substantial social media following. The regulator claimed that this failure to disclose was a violation of securities laws.

Ruling on SPRK Tokens

In May 2024, a judge ruled that SPRK tokens qualified as securities under the SEC’s purview. This ruling had significant implications for the case against Balina, as it meant that the SEC had jurisdiction over the tokens and Balina’s promotion of them.

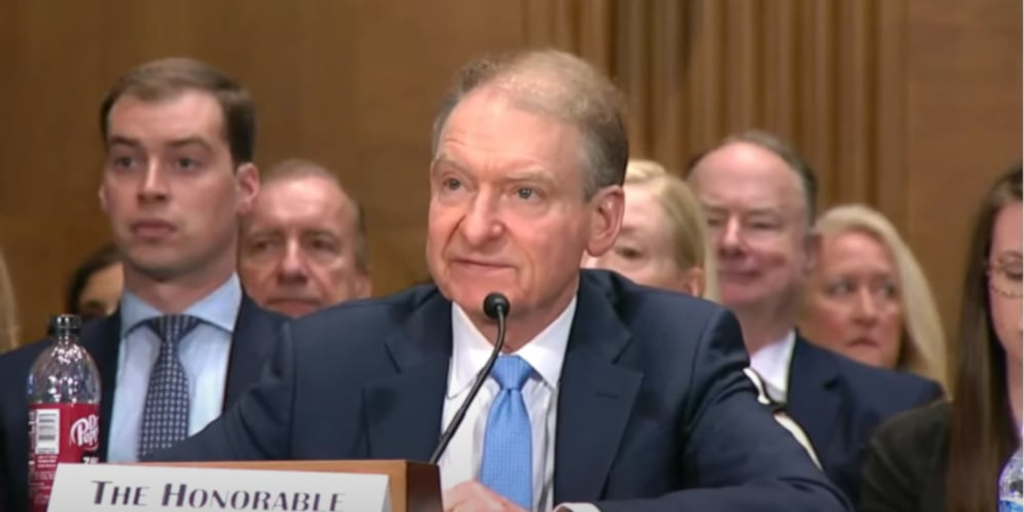

SEC’s Shift in Enforcement

The SEC’s decision to drop the case against Balina may be part of a larger shift in the regulator’s enforcement approach. Since President Trump appointed Mark Uyeda as acting SEC Chair following Gary Gensler’s January departure, the SEC has dismissed several cases against crypto companies, including Binance, Coinbase, OpenSea, Robinhood, Uniswap, Gemini, and Kraken, among others.

Context

The SEC’s decision to drop the case against Balina has sparked widespread debate about the regulator’s approach to crypto regulation. Some have questioned the fairness of the original charges and the SEC’s motivations for pursuing the case. Others have expressed concerns about the potential implications for the crypto industry as a whole.

Conclusion

The SEC’s decision to drop the case against Ian Balina marks a significant development in the ongoing debate about crypto regulation. As the industry continues to evolve, it is essential to strike a balance between protecting investors and promoting innovation. The SEC’s shift in enforcement approach may signal a more nuanced approach to regulating the crypto space, but only time will tell.

FAQs

Q: What were the original charges against Ian Balina?

A: The SEC accused Balina of failing to disclose compensation received while promoting the Sparkster (SPRK) initial coin offering (ICO).

Q: What was the outcome of the case against Balina?

A: The SEC has dropped its case against Balina, with the CEO tweeting that the charges have been "dropped."

Q: What is the significance of the SEC’s decision?

A: The decision may signal a shift in the SEC’s enforcement approach, with potential implications for the crypto industry as a whole.

Q: How might this affect the crypto industry?

A: The SEC’s decision could have far-reaching implications for the crypto industry, potentially leading to a more nuanced approach to regulation and increased clarity for investors and companies alike.

![Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW] Crypto Recovery Pump Incoming!! [DUMP NEARLY OVER – ACT NOW]](https://i.ytimg.com/vi/MrMeVsgZJPU/maxresdefault.jpg)