Here is the rewritten content in HTML format:

U.S. Commodity Futures Trading Commission’s Legal Campaign Against Prediction Market Platforms

Agency to Hold Roundtable Meeting to Discuss Regulation and Oversight of Prediction Markets

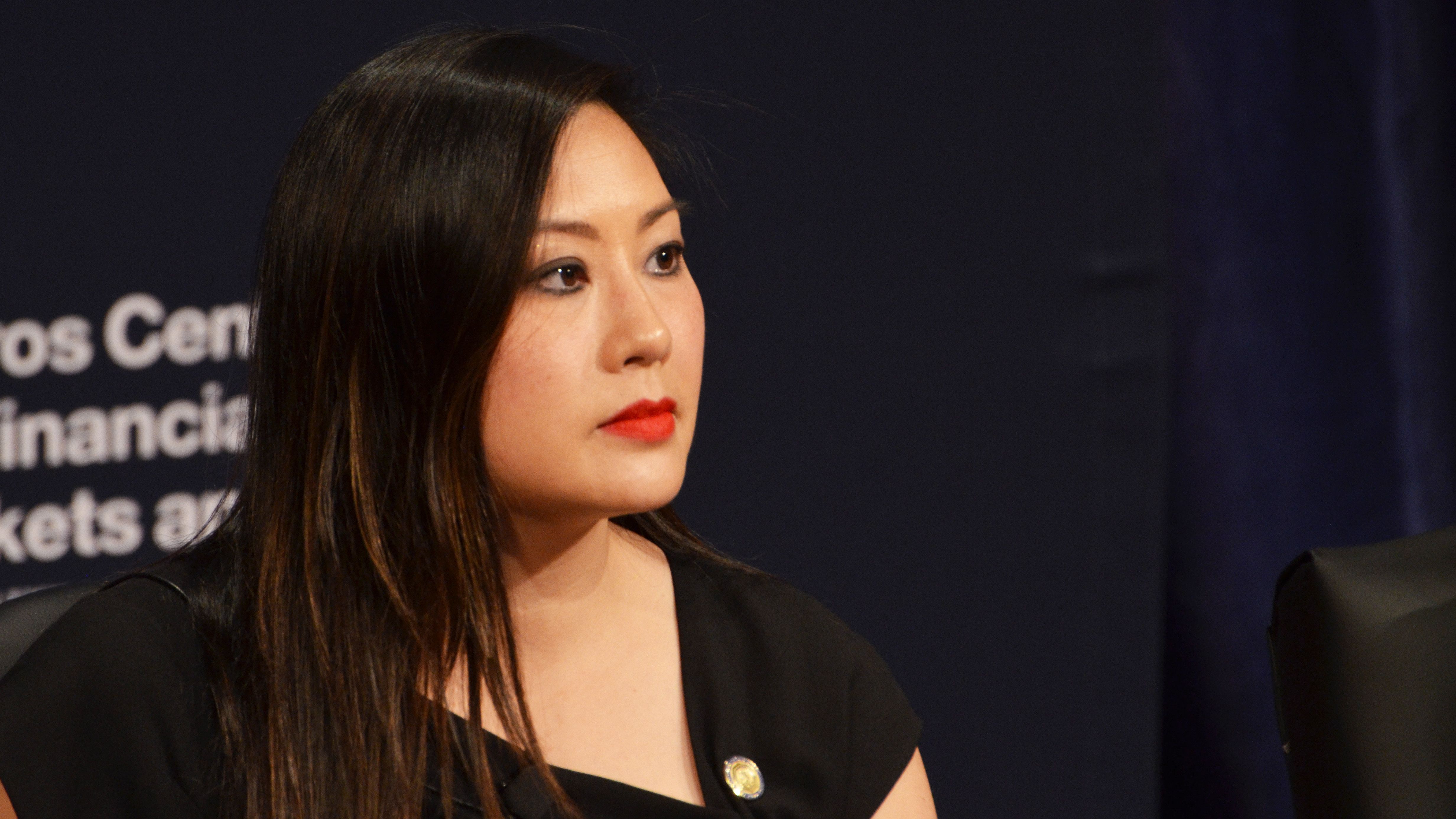

The U.S. Commodity Futures Trading Commission’s (CFTC) legal campaign against prediction market platforms such as Polymarket and Kalshi cannot be shut down, according to Caroline Pham, the acting agency chairman put in place by President Donald Trump.

Pham said the agency will gather experts for a roundtable meeting, probably next month, to build a case for how the commission ought to approach regulation and oversight of firms that offer betting on event contracts. She noted that despite her continued objections in recent years to former Chairman Rostin Behnam’s enforcement stance against prediction markets — including wagers made on sporting events and U.S. political outcomes — the agency moved too far on its path to easily reverse it.

“Unfortunately, the undue delay and anti-innovation policies of the past several years have severely restricted the CFTC’s ability to pivot to common-sense regulation of prediction markets,” Pham said. “The current commission interpretations regarding event contracts are a sinkhole of legal uncertainty and an inappropriate constraint on the new administration.”

Setting up the roundtable is a “necessary first step in order to establish a holistic regulatory framework that will both foster thriving prediction markets and protect retail customers from binary options fraud such as deceptive and abusive marketing and sales practices,” Pham said.

The CFTC lost an initial court case against Kalshi when a U.S. federal judge ruled late last year that the agency couldn’t stop the firm from listing election contracts. However, the agency pursued an appeal with a higher court, and Kalshi argued in that new legal dispute that only Congress can halt election betting.

CFTC Fines Crypto Betting Service Polymarket $1.4M for Unregistered Swaps

The CFTC had taken a position through rules, orders, and enforcement work that such political betting isn’t permitted under derivatives laws and that the agency doesn’t have the ability to police manipulation of those markets — basically arguing that it would have to be an elections cop. With only days remaining in his chairmanship, Behnam’s agency was seeking information about Polymarket’s customers from crypto exchange Coinbase.

In a sharp contrast to Behnam’s resistance, Pham called prediction markets “an important new frontier in harnessing the power of markets to assess sentiment to determine probabilities that can bring truth to the Information Age.” She added the agency needs to “break with its past hostility.”

Pham is running the agency in the absence of Trump naming a permanent nominee to seek Senate confirmation to take over. So far, the president has only picked a head for its cousin regulator, the Securities and Exchange Commission. Such confirmations can take months, so whether or not Pham becomes a frontrunner for the permanent job, she’ll have time to accomplish some policy goals at the CFTC.

Conclusion

The CFTC’s legal campaign against prediction market platforms such as Polymarket and Kalshi is ongoing, with the agency seeking to establish a new regulatory framework for the industry. The agency’s acting chairman, Caroline Pham, has emphasized the need for a more holistic approach to regulation, one that balances the need to protect consumers with the need to encourage innovation in the industry.

FAQs

Q: What is the CFTC’s position on prediction markets?

A: The CFTC has historically been opposed to prediction markets, arguing that they are subject to manipulation and pose a risk to investors.

Q: What is the current status of the CFTC’s legal campaign against prediction market platforms?

A: The CFTC is currently pursuing an appeal in a federal court case against Kalshi, a prediction market platform that lists election contracts.

Q: What is the CFTC’s goal for the upcoming roundtable meeting?

A: The CFTC is seeking to gather experts to build a case for how the commission ought to approach regulation and oversight of firms that offer betting on event contracts.

Q: What is the current state of the CFTC’s regulatory framework for prediction markets?

A: The CFTC’s current framework is seen as overly restrictive by many in the industry, and the agency is seeking to establish a more balanced approach to regulation.

Q: Who is acting as the CFTC’s chairman?

A: Caroline Pham, who was put in place by President Donald Trump, is currently acting as the CFTC’s chairman.