Here is the rewritten content in well-organized HTML format:

US Spot-Listed Bitcoin (BTC) Exchange-Traded Funds (ETFs) Suffer Second-Biggest Outflows of the Year

US Spot-Listed Bitcoin (BTC) Exchange-Traded Funds (ETFs) Experience Second-Biggest Outflows of the Year

According to Farside data, US spot-listed bitcoin (BTC) exchange-traded funds (ETFs) experienced the second-biggest outflows of the year on Monday, with a net outflow of $516.4 million.

Growing Discomfort with Bitcoin

The withdrawals reflect a growing discomfort with the largest cryptocurrency, which has traded in a narrow price range between $94,000 and $100,000 for most of this month.

Bitcoin Breaks Out of Three-Month Channel

On Tuesday, bitcoin broke out of its three-month channel, falling below $90,000 and sliding to as low as $88,250.

Cash-and-Carry Trade

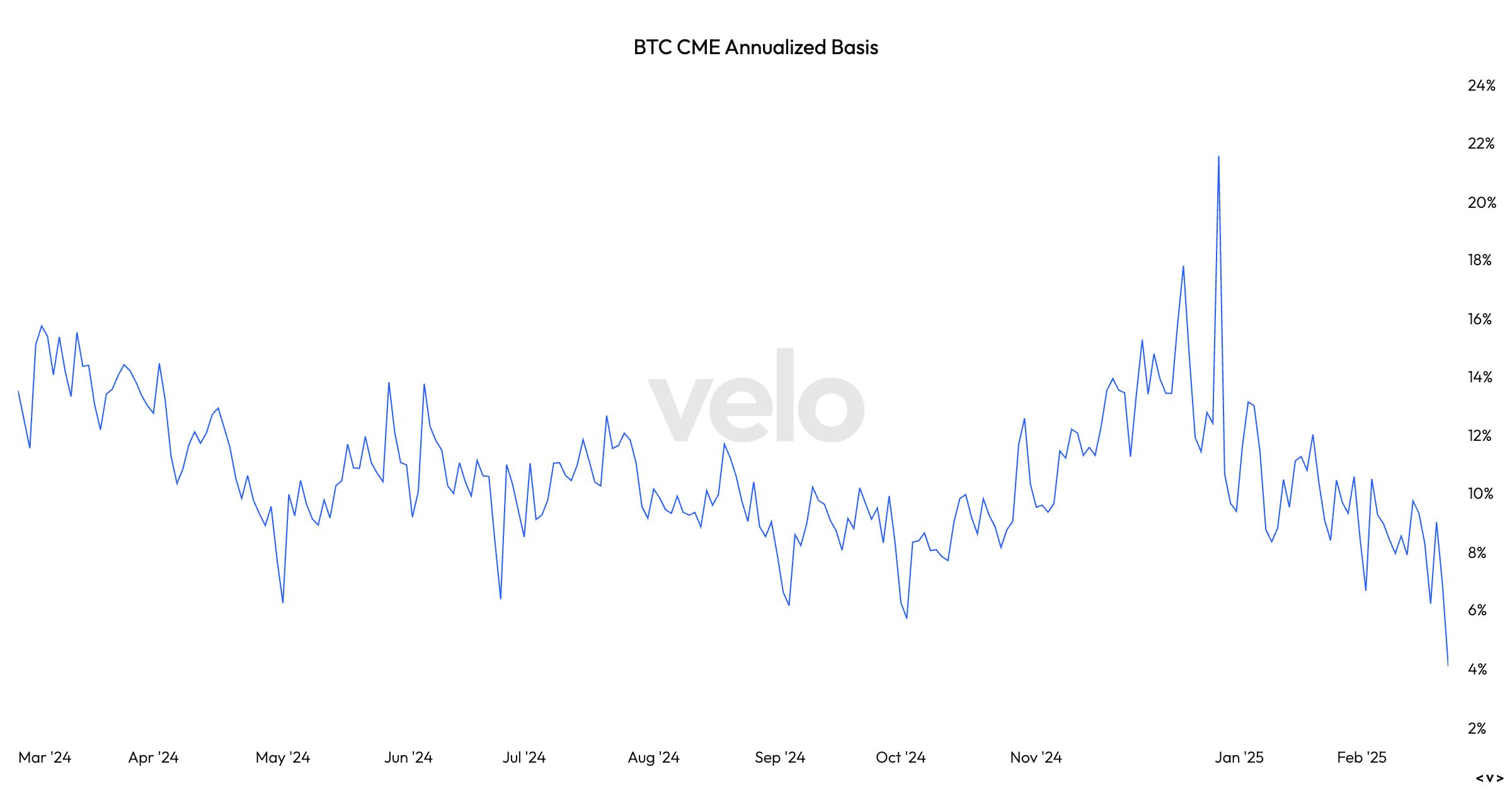

According to Velo data, the bitcoin CME annualized basis, which is the difference between the spot price and futures, has dropped to 4%. This is the lowest since the ETFs started trading in January 2024. This is also known as the cash-and-carry trade, which is a market-neutral strategy that seeks to profit from the mispricing between the two markets.

This strategy involves taking a long position in the spot market and a short position in the futures market. Velo data shows a one-month futures forward contract. Investors collect a premium between the spread of the spot and futures pricing until the futures contract expiry date closes.

Basis Trade Unravels

At the current level, the basis trade is less than the so-called risk-free rate, the yield on the U.S. 10-year Treasury of 5%. The difference may persuade investors to close their positions in favor of the greater return. That could see further outflows from the ETFs. Because this is a neutral strategy, investors will also have to close their short position in the futures market.

Arthur Hayes, the co-founder of Bitmex, alludes to the basis trade unravelling in a post on X.

“Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short-term US treasuries,” he wrote. “If that basis drops as bitcoin falls, then these funds will sell IBIT and buy back CME futures. These funds are in profit, and given basis is close to UST yields they will unwind during US hours and realise their profit. $70,000 I see you mofo!”

Conclusion

The recent outflows from US spot-listed bitcoin (BTC) exchange-traded funds (ETFs) reflect a growing discomfort with the largest cryptocurrency, which has traded in a narrow price range between $94,000 and $100,000 for most of this month. The basis trade, which involves taking a long position in the spot market and a short position in the futures market, is expected to unravel, leading to further outflows from the ETFs.

FAQs

Q: What is the basis trade?

A: The basis trade is a market-neutral strategy that seeks to profit from the mispricing between the spot and futures markets. It involves taking a long position in the spot market and a short position in the futures market.

Q: What is the cash-and-carry trade?

A: The cash-and-carry trade is a market-neutral strategy that seeks to profit from the mispricing between the spot and futures markets. It is a type of basis trade.

Q: What is the risk-free rate?

A: The risk-free rate is the yield on the U.S. 10-year Treasury. It is used as a benchmark for evaluating the profitability of the basis trade.

Q: Who is Arthur Hayes?

A: Arthur Hayes is the co-founder of Bitmex, a cryptocurrency exchange. He is known for his expertise in the cryptocurrency market and has been involved in various high-profile projects and initiatives.

Q: What is the significance of the basis trade unraveling?

A: The basis trade unraveling could lead to further outflows from the ETFs, as investors close their positions in favor of the greater return.