States’ Quest for Cryptocurrency Reserves: A Dynamic Process

In recent months, several U.S. states have been actively exploring the possibility of investing in cryptocurrencies, including bitcoin (BTC). The trend gained momentum following the 2024 Bitcoin conference in Nashville, Tennessee, and has since continued to gain traction, with some states making significant progress toward passing bills that could tie their financial health to digital assets markets.

However, the journey has not been without its challenges. So far, five states – Pennsylvania, Wyoming, Montana, South Dakota, and North Dakota – have fallen short of their goals, with their legislative efforts to put public money into crypto ultimately floundering. On the other hand, Utah remains a single vote away from passing a bill that would allow the investment of up to 5% of certain public accounts in digital assets, while Texas has reportedly advanced a bill to its state Senate.

The U.S. Congress and President Donald Trump have also made noise about establishing a federal strategic digital assets reserve, with the idea of a public campaign stemming from the Bitcoin 2024 stage in Nashville, Tennessee. Trump has spoken broadly in favor of the notion, which has also been more aggressively advocated by MicroStrategy’s Michael Saylor and pitched by Senator Cynthia Lummis, the Wyoming Republican who heads the crypto subcommittee of the Senate Banking Committee.

The market value of the asset most of these efforts are talking about – bitcoin (BTC) – has slipped considerably from its post-election euphoria-driven high of $106,000 to around $86,000. This decline has been coupled with a high-profile exchange hack at Bybit, which reportedly made off with more crypto than thieves have ever previously snatched in one outing. These setbacks may have dampened the goodwill of state government enthusiasts.

"States have some breathing room to assess and contemplate a way forward," said Johnny Garcia, a managing director at VeChain Foundation, who has been following state actions. "My view is that states have some breathing room to assess and contemplate a way forward."

In Montana and North Dakota, their legislatures considered the idea of state-level crypto reserves but ultimately voted to reject the bills. Both legislatures saw the bills fail at the committee level. Pennsylvania, Wyoming, Montana, South Dakota, and North Dakota have all experienced defeats in their legislative efforts to put public money into crypto.

In contrast, Utah’s legislation to allow the investment of up to 5% of certain public accounts in digital assets has cleared the state house and a senate committee, with consideration by the entire senate forthcoming. However, nothing is guaranteed in the limited windows most states give to their legislative activity.

"This is a dynamic process," said Dennis Porter, CEO of the Satoshi Action Fund, which has pushed for states to embrace bitcoin reserves. "Although Utah seems best positioned to finalize its bill first, nothing is guaranteed. It’s a dynamic process."

Porter believes the campaign in the states is leaning on them as the "laboratory of democracy." He posted on social media site X (formerly Twitter) that most of the bills will fail, which is "normal" for the process, which his group will continue pursuing each year.

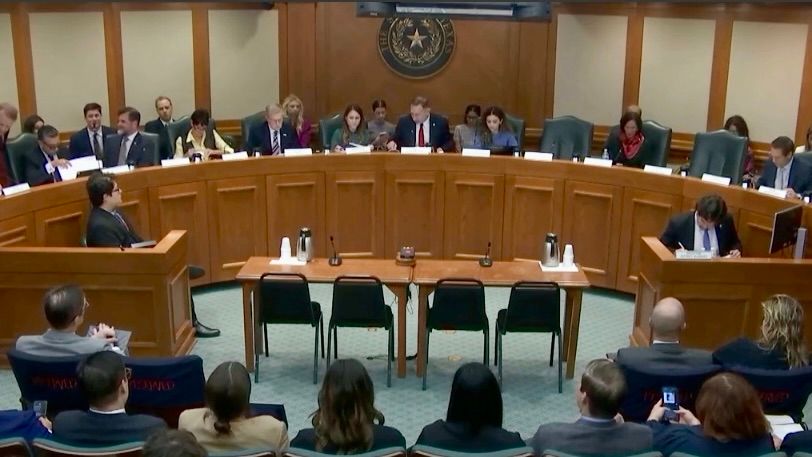

Texas, a major bitcoin mining hub, has reportedly become the latest state legislature to move a crypto reserve bill out of committee. However, the states have pursued a wide variety of digital assets initiatives, making it difficult to pin down a common effort. Some states are also moving on other aspects of crypto involvement, such as Indiana’s house-passed bill weighing blockchain for government efficiency and Arizona’s advancing a technical bill through its house that would keep unclaimed property in crypto form, rather than converting it to cash – an outcome that would involve managing it in a state fund.

While North Dakota’s effort to set up a reserve failed, the state house also approved a separate resolution that encourages its treasurer to invest certain state funds in digital assets. This resolution is now in the hands of the state senate.

Garcia predicted that "many of these states will likely authorize digital assets as part of their state pension and investment options before moving toward more aggressive digital asset reserves."

Conclusion

The pursuit of cryptocurrency reserves by U.S. states is a dynamic and ongoing process, with some states making significant progress while others have fallen short of their goals. As the market value of bitcoin (BTC) continues to fluctuate, it remains to be seen which states will ultimately succeed in their efforts to invest in digital assets.

FAQs

Q: What is the current state of the pursuit of cryptocurrency reserves by U.S. states?

A: Several U.S. states are actively exploring the possibility of investing in cryptocurrencies, including bitcoin (BTC). Some states have made significant progress, while others have faced setbacks.

Q: Which states have fallen short of their goals?

A: Pennsylvania, Wyoming, Montana, South Dakota, and North Dakota have all experienced defeats in their legislative efforts to put public money into crypto.

Q: Which state is best positioned to finalize its bill on crypto reserves?

A: Utah’s legislation to allow the investment of up to 5% of certain public accounts in digital assets has cleared the state house and a senate committee, with consideration by the entire senate forthcoming.

Q: What is the market value of bitcoin (BTC)?

A: The market value of bitcoin (BTC) has slipped from its post-election euphoria-driven high of $106,000 to around $86,000.